A shot in the dark: gas and electricity customers frazzled by overcooked bills

As if the soaring charges weren't enough, thousands of households are suffering as a result of massive miscalculations of their usage. Madeline Thomas reports

You may well be aware that energy prices are rising, but if you pay by direct debit, the size of the increase when the bill arrives could still jolt you with the force of an electric shock.

Four of the biggest energy suppliers have already announced double-digit price rises this year and the others are expected to follow shortly.

British Gas and Scottish Power have announced increases, of around 15 per cent, while npower's prices are rising by 17.2 and 12.7 per cent respectively for gas and electricity. EDF Energy has also upped its rates, by 12.9 and 7.9 per cent.

But Energywatch, the consumer watchdog, says that potentially tens of thousands of customers who pay by direct debit should brace themselves for rises of at least double these amounts as the size of their payments is reassessed.

"There have been four big price increases in the last two years [two for gas, two for electricity] and each has come in double digits," says Energywatch spokes-man Karl Brookes. "If you are still paying the same amount now as two years ago [by direct debit], you will be hundreds of pounds in arrears."

The problem for people who pay by direct debit is that the price rises are rarely passed on at the time they are announced. A supplier will assess a customer's usage against their payments at six-monthly intervals, based on the anniversary of when they opened their account. Meter readings only have to be taken every two years, and if there is no accurate usage figure, a supplier will guess.

They can – and do – get it wrong, and customers who have paid steadily over the years assuming everything is OK can face a shock when increases suddenly catch up with them.

Mr Brookes adds: "Some [companies] are exacting a penalty from those who are overpaying and are actually in credit – by putting up the direct debits by more than they need.

"Every time we go to Ofgem [the industry regulator], we are told it isn't an industry-wide issue. The Energy Retail Association [which represents Britain's suppliers] will say that out of 200 million bills, accidents will sometimes happen. If this was any other industry, people would be up in arms, but somehow, with energy, we're expected to put up with it. Suppliers are doing what the market will bear."

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

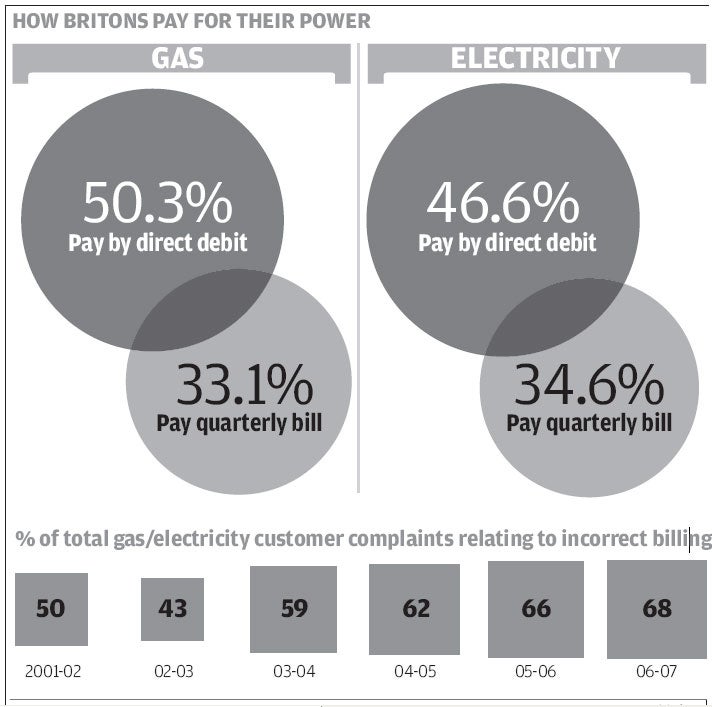

Organisations such as Energywatch receive more complaints about direct debits and inaccurate billing than anything else. At Energywatch, they represent around 70 per cent of the total.

A survey by uSwitch.com, the price-comparison site, last autumn found that 8.2 million customers had been billed incorrectly by their energy company in the previous two years, while 10.4 million customers had unknowingly owed money to their suppliers following inaccurate direct debit estimates.

The fallout from this has added a staggering £1.4bn to customer bills.

But Beverly Harrington, spokeswoman for npower, says that most direct debit customers understand how their accounts work and are generally happy with the services they receive. She adds that last November the firm received just a handful of complaints about inaccurate direct debits from its 4.15 million customers. In addition, direct debit customers across the industry pay less for their gas and electricity than standard quarterly bill payers because of the built-in discounts.

However, with a fresh round of energy price rises on the horizon and thousands of customers in line to have the amount of money they pay by direct debit reassessed, the cries of protest are probably set to get louder.

"We are told we live in the most competitive market in Europe for energy," says Mr Brookes at Energywatch. "but when you go up to the average customer, their experiences differ from that."

If they get your bill wrong...

Anyone unhappy with an increase in the amount they pay by direct debit, or a charge for gas or electricity arrears, should first try to resolve the matter by contacting their supplier. If it is not resolved within a "reasonable" time – no more than a month – they should contact Energywatch on 08459 060708, or through its website, www.energywatch.org.uk, where a complaints form can be filled out online.

Energywatch took up 720,000 disputes last year, securing around £7m in compensation.

'If you pay by direct debit, you think everything is OK'

Mother-of-two Andrea Owen, 35, from Twickenham, said she nearly had a heart attack when she got her November bill from Powergen (since renamed E.ON). Following a meter reading in August, the company said that, based on its estimates, it was increasing her monthly direct debit from £134.50 to £322. It also said the account was £308.17 in deficit.

"I don't usually take much notice of my bills as if you're paying by direct debit and you've had a recent meter reading, you assume everything's taken care of," says Andrea. "It was only because it was such a huge jump that I thought something must be wrong."

At issue was the Owens' electricity bill. The supplier had estimated that charges for the winter quarter would be £831.49.

Andrea phoned to complain. At first, she was told it was too late; payment instructions had already gone through the system.

But then she took her own meter reading, gave it to the firm over the phone, and a revised bill arrived. It said estimated electricity use for the quarter would be £315.45, giving the Owens a credit balance of £184.91. But their monthly bills havestill risen, this timeto £142.

E.ON spokesman Nick Sandham said the high bill was due to a meter misread. The direct debit has still gone up, despite their account being in credit, because of predicted winter fuel usage – though this will be checked again later this month.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks