Julian Knight: Commission - The root of another mis-selling scandal

The sale of unregulated products to the general public shows, once again, that abuse is still rife

Financial advisers should not be selling unregulated collective investment schemes (Ucis) to the public, so says the Financial Services Authority.

It adds that it has uncovered "high levels" of unsuitable advice being given and warned that ordinary investors are being exposed to significant risk of heavy losses.

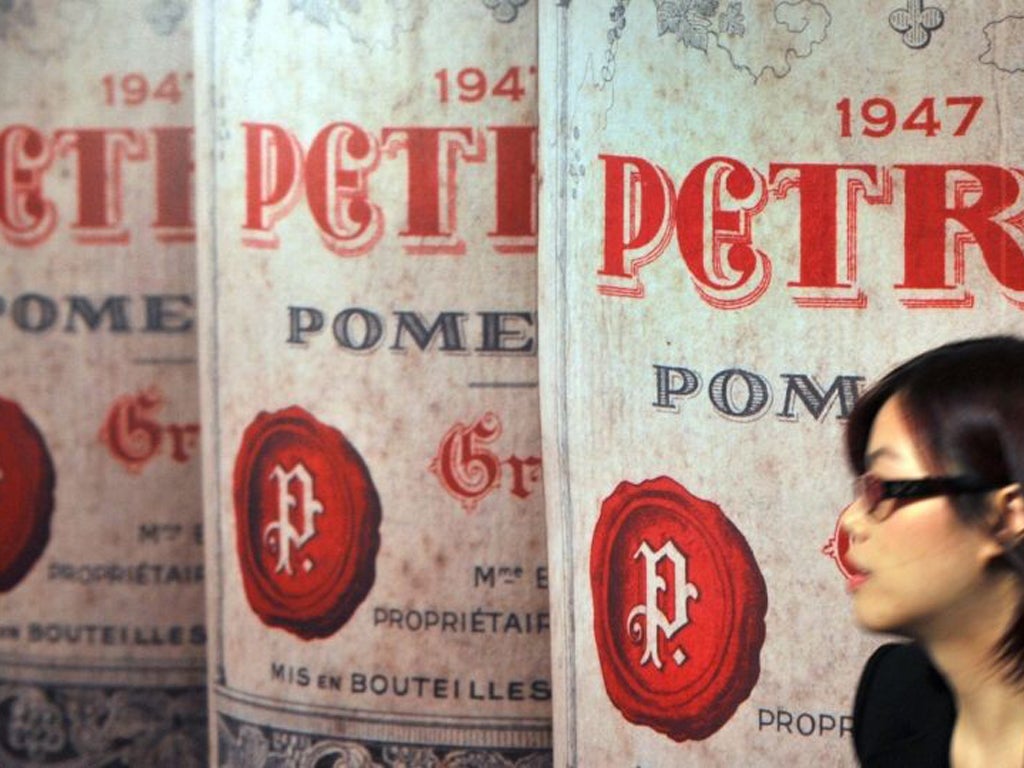

Now there is a place for some Ucis. If you have plenty of money, so can bear any losses and would like to add a little spice to your portfolio, then perhaps a Ucis, offering you access to fine wines for instance, could be OK.

That legitimate reason for Ucis is why, presumably, the FSA sat on the sidelines for so long. But advisers it seems couldn't resist flogging these investments more and more widely to people who really shouldn't be taking the risk.

Notable examples of abuse include clients being advised to borrow money to invest in one of these schemes or pensioners put into "bonds" (the most misused word in financial services) which they can't get back for several years, if ever.

As a result, the FSA is stepping in and asks anyone who has been mis-sold to contact the Financial Ombudsman Service.

The Ucis mis-selling that is unearthed won't be as massive as PPI, but the impact on individual lives will be far greater. I shudder to think of some of the individual horror stories which will emerge from this over the coming months and years.

Yet again, though, as with nearly every previous episode of mis-selling, the root cause is the paying of commission by providers to people who are meant to be acting in the best interests of investors.

Fortunately, this practice of commission payments is coming to an end by the end of the year end but too late for those wrongly pedalled Ucis.

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

Icelandic lesson

Six out of 10 Icelanders believe in the existence of elves. But don't let that make you think for a second that they are a nation of fools.

Iceland, having suffered a potentially catastrophic bust, returned to full employment last week, with its economy growing very nicely, thank you.

What's the lesson from Iceland for George Osborne, Ed Balls, et al? Like Canada before it, it shows that if you are going to cut government spending or cope with banking collapse, do it early and do it deep. The same approach would have worked in Ireland if they weren't tethered to the euro, so unable to devalue.

At the time the coalition revealed its spending plans I said, in this column, that I was worried that they weren't going far enough or quick enough. We'd have got the worst over with by now and the replacement of public-sector with private-sector jobs would have been well underway.

Basically, by waiting so long the economy has been overtaken by events – namely the eurozone crisis. The cuts are about to come on-stream just as the economy is sent into a eurozone inspired recession.

In addition, the government debt mountain is much larger than it was two years ago – although yields are at record lows that's more a reflection, like interest rates, of a completely dysfunctional market rather than real confidence – which leaves very little room now for plan B, C or whatever.

We chose the opiate of high government spending for too long. Nearly a year ago, I wrote that I rated our chances around 50-50 of the UK making it through without a 1970s style or worse crisis. I think those chances are now much lower.

Complete denial

"Only a tiny, tiny, tiny, minority of people have a problem". Such was housing minister Grant Shapps' response to last week's Channel 4 Dispatches investigation into the unfair leasehold/freehold system.

Not judging from the tweets and emails I received following my comment on this unjust system last week. I find it incredible that presented with clear evidence from Dispatches, this newspaper, representatives of the nearly all the key players in the industry of the abuses going on, Mr Shapps remains in complete denial. There is, though, a ministerial re-shuffle ahoy.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks