Julian Knight: Don’t forget ‘Old Europe’ if looking for investment growth

While the emerging Bric countries are still attractive, Germany, France and Switzerland still have their place

Two out of three independent financial advisers now think that their clients ought to invest more in countries such as China, India, Brazil, Russia and the other emerging economies, according to research from Barings. Hallelujah!

The IFA community finally wakes up to the fact that there is a fundamental shift in wealth and power from west to east and it’s best if they pin their clients to the winningside for once. The idea that clients should have about 5 per cent of their portfolios (this is the percentage that many IFAs have used when advising clients) in the powerhouses of the emerging economies has been a bad call for a long time – try double or triple that and you’re nearer the mark.

These markets are more likely to suffer setbacks but the growth and demographic story is so compelling. And privately some IFAs admit it. One of the country’s leading investment IFAs told me recently that he was putting half of his personal new investments into ETFs investing in stock markets in the big emerging economies. That’s a lot more than 5 per cent. Of course, many investors are risk adverse, and at the back of their mind is the big question of political instability; hence IFAs, when drawing up their clients’ portfolios, not only have to ask how they can best make money long term but also what the client will actually swallow. It’s a lot easier sell to advise putting 10 grand in Neil Woodford’s giant Invesco UK equity income fund than, say, a Malaysian ETF.

But there is something nagging in the back of my mind. Whenever I hear IFAs pushing a particular investment area I tend to look for the exit. They do have a history of jumping on a bandwagon just as it comes to a shuddering halt – technology, pharmaceuticals, commercial property funds, guaranteed income bonds, just to name four areas where the today’s must-have has turned into tomorrow’s must-rid.

So although I am an unashamed fan of emerging markets, I can’t help but think that you need an effective hedge if you’re to increase your exposure right now. And the hedge comes for me in the most unloved of equity sectors – Europe, or Old Europe, according to Donald Rumsfeld’s infamous putdown. I know we still have the Pigs (Portugal, Ireland, Greece and Spain) and untold liabilities to sovereign debt squirrelled away in the balance sheets of many of Europe’s biggest banks. There is also the issue of demographics; with Italy, for instance, fast becoming a country of pensioners.

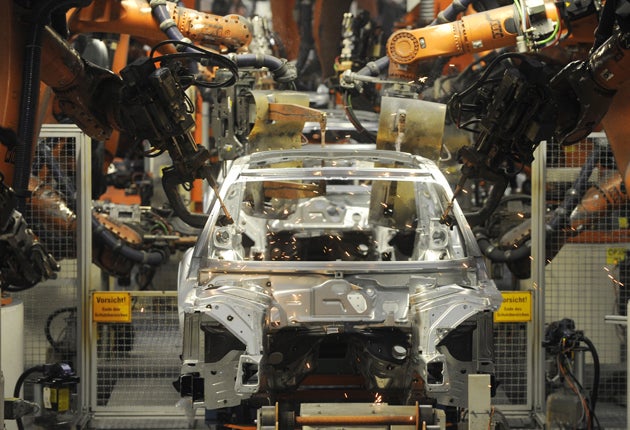

But Europe, unlike the UK, isn’t largely about banking and services, they still produce stuff. Take Germany, for instance. It is one of the few countries in the world that can claim to have fair balance of payments with China as it produces fantastic manufacturing machines for export. They, the French, Swiss and Italians have more than their fair share of high-end prestige brands that make money. And European firms once shy of paying dividends – all a bit too Anglo-Saxon, don’t you know – are doing so increasingly.

Europe is not, of course, a great growth story. In fact, in City speak it could be referred to as a “sunset” continent (in the same way TV and papers are supposedly sunset industries) but it’s got a lot more going for it than many investors and IFAs have given it credit for over the past few years. Perhaps post-euro crisis it’s time to look again to balance out your more exotic eastern foray.

2007 and all that

Three years ago this week, investment bank BNP Paribas admitted to its investors a “complete evaporation of liquidity”. It may have escaped many at the time but it was the clearest sign yet that the credit crunch was under way. We all knew a month later, of course, when queues were forming outside Northern Rock. The next 15 months brought us to the very brink of something akin or perhaps worse than the Great Depression. It’s been bad but not that bad. But with the banks seemingly returning to profit – although a little edgily with the part-nationalised ones – surely it’s time to draw a line under all this. Not as far as many private investors are concerned.

The “casino” operations still continue; the bonuses are as big as ever; state finances in much of the world are in crisis coping with the recession, and heaven help us if the double dip occurs. Outside of this, investors’ attitudes to banking shares are still unsure. According to TD Waterhouse, three of the four most bought shares are Lloyds, RBS and Barclays, yet these same banks are the top three sells also. It’s been this way ever since the dark days of early 2009. Confidence has returned but it’s clearly still fragile.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks