Julian Knight: Your country needs you to spend, spend, spend. Don't

Your country needs you to spend when you should be saving.

Saving for what? Towards paying back those debts that most of us acquired over the past two decades of living beyond our means. I will explain why later.

When I think back on the past couple of years it really is rather amazing that we have got away with as much as we have. Iceland fell at the first puff of wind; Ireland's reckoning has now arrived, and Spain's looks on the cards. Yet in Britain, which has some of the highest personal debt levels in the world, and a public finance system wrecked by Gordon Brown and almost completely reliant on financial services, we are still able to borrow money at only a slightly higher rate of interest than the Germans – now restored to their rightful position as the gold standard in fiscal prudence and economic good sense. Unemployment is climbing again, but is nowhere near as bad as it could have been. As for the public sector cuts – despite the hysterical coverage in some quarters – their effect on the wider economy may prove transitory and, frankly, rather small.

The economy itself is growing at twice the level it was expected to and, despite the VAT rise in January, I can see this trend continuing into the summer.

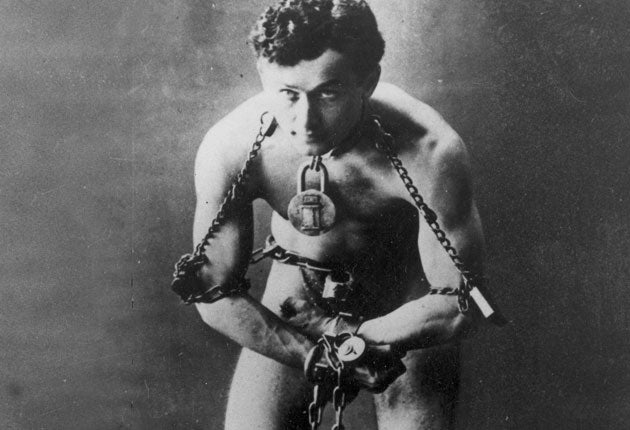

If the economy is like Houdini performing one of his tricks, to date we have done little more than loosen the handcuffs; we have still to loosen the chains and escape the sack before the flame burns through the rope we're dangling from. I'd have given our chances of reaching this point without mishap as 50:50; but, from here on in, the odds of pulling off the whole trick are narrower still.

Inflation – rather than deflation, as so many mistakenly feared until quite recently – could spoil everything. The retail price index currently stands at around 5 per cent (best forget the CPI measure as this is irrelevant to anyone's real expenditure). Fears of job losses are keeping a cap on wage demands to such an extent that we haven't quite had a 1970s-style wage- price spiral. However, inflation is getting to such a point that it is eroding other assets and values. For instance, if I earn 0.5 per cent on my savings and don't receive a pay rise, yet inflation rises at 5 per cent, I am getting poorer very quickly. This erosion of assets and savings can only go on so long before an attempt (which has no guarantee of working) is made to squeeze this out of the system. The only method the Bank of England has to do this is higher interest rates, which is where all this economics starts to hit you and should dictate your thinking over the next year.

The Bank of England's financial stability report warned last week that seven million Britons are suffering "latent distress", in that they are close to the financial precipice. Any substantial rise in interest rates may either make them unable to meet their repayments or unable to move (because they couldn't possibly borrow to fund a new purchase because of the changed lending criteria that came in after the credit crunch).

What should they do? The only rational thing is to cut right back on spending, try to expand income as much as possible, and hurry to pay down debts, whether mortgage or otherwise; or, at the very least, build up a war chest against potential job loss and the economic shock of higher rates.

But this is the last thing policymakers want you to do. They want you to keep spending through the VAT rise and well into 2012. And what happens then? Well, you'll be on your own. They're just hoping the economy will be robust enough when the lenders start repossessing homes. "Your country needs you." My advice would be to ignore this call.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks