Online advice to run your finances

Personal financial pointers may soon be too pricey for many, but plenty of help is at hand via the internet

Financial advice is poised to undergo a transformation. In a few weeks' time, financial advisers will no longer be allowed to gather commissions, and will have to levy fees instead.

The Retail Distribution Review (RDR) as it's called, could price many people out of face-to-face financial advice. The RDR has worthy intentions – it will see commission-based financial advice banned in a bid to reduce mis-selling and will also force independent financial advisers (IFAs) to be qualified to much higher standards. However, upfront payments – perhaps running into four figures – will be a big deterrent, particularly for investors with smaller portfolios who are often the very people who most need help. This will leave an important gap to fill.

Fortunately, many sites and web tools are springing up to bridge that gap, but where should you start and what do you need to watch out for?

Investment advice

Reputable fund platforms such as Fidelity FundsNetwork and Hargreaves Lansdown already provide detailed information for investors, but today, Bestinvest has launched its new Free Investment Report Service & Tool (bestinvest.co.uk).

This is designed to help people manage their existing investments and analyse their portfolios in four key areas: exposure to risk (using market benchmarks and Bestinvest's own models); asset allocation (to see how balanced it is); quality and performance (using fund ratings given by the Bestinvest research team); and annual costs.

"Much has been written about the expected explosion in 'DIY' investing, but traditional, no frills, execution-only services, focused primarily on fund selection and reducing transaction costs, do not offer a magic bullet for servicing those investors who are expected to be orphaned from the advice market," says Jason Hollands, the managing director at Bestinvest.

"These investors will need access to educational material, rigorous research and user-friendly guidance tools to help them navigate the investment maze."

Post RDR, a web-based, simplified advice service such as Money on Toast, from IFA firm CPN Investment Management, could also prove popular. You can access basic advice and product recommendations for free, but cross-selling is how these sites make money so they do earn a fee if you go on to buy anything through the site. Of course, there is no obligation to do this and if you want to talk to a human instead, you can book a 20-minute virtual appointment via Skype with a qualified adviser for a reasonable £35 a pop.

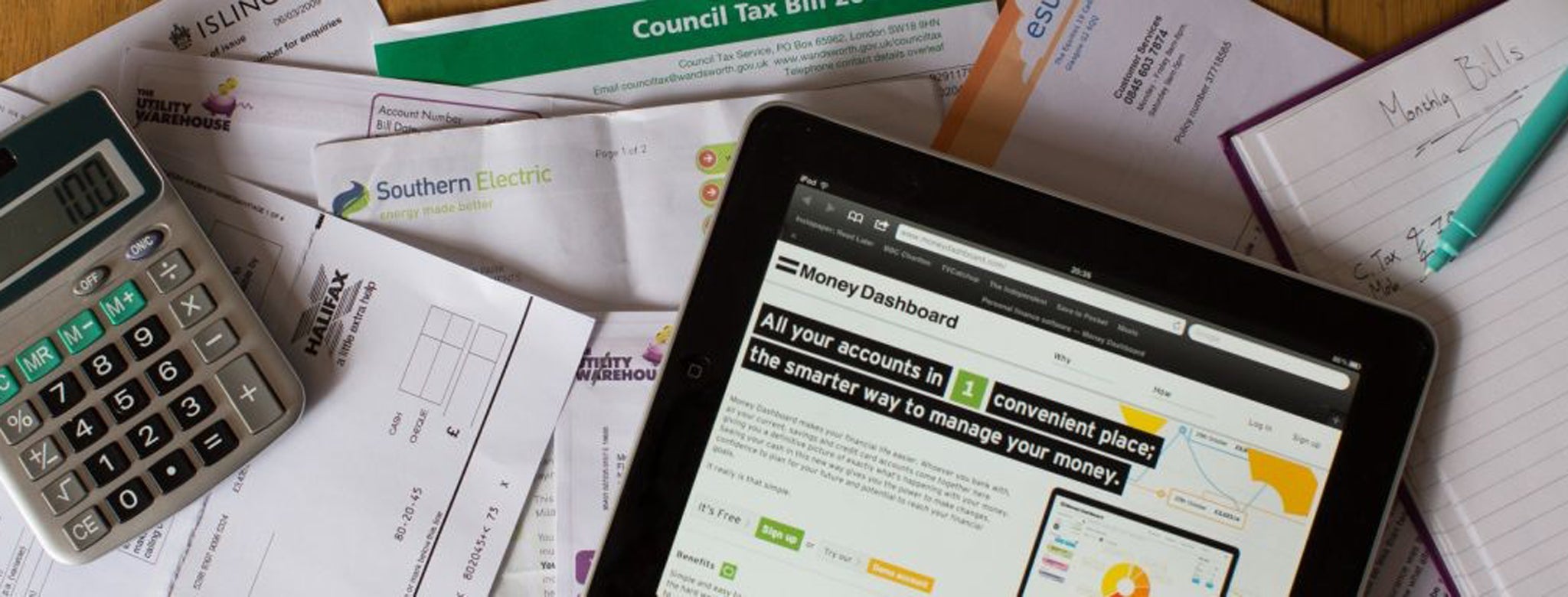

Account pooling

Getting an overall picture of your financial health is a big step in clever financial planning.

An aggregator site such as Moneydashboard.com makes this easy, providing a snapshot of all your online current savings and credit-card transactions in one place so that you can track your finances in real time.

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

After your first log in, the past three months' worth of statements are automatically loaded and you can start analysing your habits immediately using clever tools such as the "intelligent tagging" function to group your spending into categories.

Other useful features include the "future planner" for personalising financial goals, charts to see your spending habits at a glance and what Money Dashboard called a "clear cash" figure to see what spare money you have available from your current account after any planned outgoings have been accounted for. It can also use your past spending patterns to predict future outgoings and potential savings so you can budget realistically for the future.

You may be nervous about having all your details in one place and you should tread carefully when using software that isn't approved by your bank. You could even come unstuck if you need to make a refund claim for fraud because banks view aggregator sites as third parties. Ultimately, however, your account numbers and passwords aren't actually stored on their servers and as this is a read-only service, you can't actually withdraw or transfer any money.

Competitors include First Direct and Egg. However, First Direct's Internet Banking Plus cannot be used with Macs and only Egg customers can use its Money Manager service.

Lovemoney.com also offers "money track", which uses your bank statements to create an automatic budget. As with Money Dashboard, you cannot yet include your investments so you don't get a full picture of your finances, but you can access your online bank and credit-card accounts in one place, along with an analysis of your spending habits.

Financial planning tools

Sites such as MoneyVista.com are advanced financial planning tools.

You can quickly upload details about your income, expenses, debt, protection and investments and this information is then used to create an instant, personalised plan.

The "savings watch" tool is a big selling point here because it tracks your savings accounts and sends you alerts when your bank drops interest rates, or when a product paying a higher rate becomes available.

Otherwise, the more information you provide, the more interesting it gets. If you enter details about your house, for example, it will calculate how much the property will be worth by the time you die. You can even compare your budget to others to see how your spending habits stack up.

MoneyVista originally cost £8 a month but this fee has been dropped for a limited period so it's a good time to give it a test run.

One for the children

Financial education should start early, and if you want to prepare your children for their future, financial or otherwise, you invariably need to think digital – there's little use teaching them about systems they won't be using when they become adults.

With pktmny.com parents can set up an account for their child (aged eight to 16) and arrange to pay in their weekly or monthly pocket money. Your child gets a bit of independence and can use a contactless, prepaid VISA debit card to spend that money, but as the parent, you can set strict parameters.

The fees are a bit of a sting: you pay a one-off £5 to join and an ongoing £1 monthly membership per child, with ATM charges on top at 50p in the UK and £2 abroad.

This aside, you do have ultimate control and can decide how much is spent in a single transaction and per week, as well as whether the card can be used in cash machines, or on the internet. Your child can also create savings goals and wish lists, with relatives and friends able make occasional payments to help them reach their targets.

Independent Partners: Search our directory to find Independent Financial Advisers (IFAs) who have been rated and reviewed by their clients. Find out more

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks