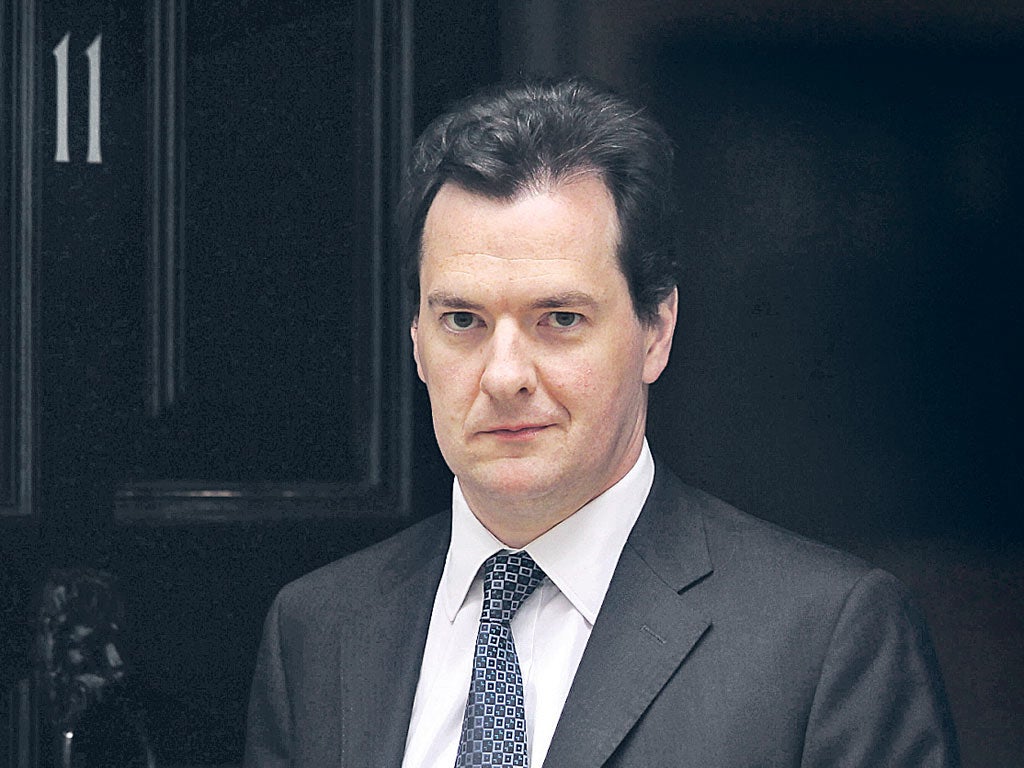

Pension savers face hit from Osborne's plans

The Chancellor's Autumn Statement could contain plans to cut tax relief on pension contributions

Next Tuesday, George Osborne will be making his annual Autumn Statement to the House of Commons. It's a chance to do something positive for economy growth.

But there's unlikely to be any good news, given the current eurozone crisis and risk of a further credit crunch. So what could we see of interest in the statement?

The pensions industry is up in arms about suggestions there may be a reduction in pension contribution tax relief. The financial encouragement to people to save for their retirement currently costs the Government nearly £30bn in lost revenue.

Cutting back the tax relief could give the Government cash that could be used to fund more popular measures that put cash in people's pockets now. A popular move would be to raise the earnings level at which 40 per cent income tax is charged, says PricewaterhouseCoopers tax partner Alex Henderson, who says it could even be increased to £50,000.

"The Chancellor could reason that any detrimental effect of reducing relief on pension saving is more than outweighed by the immediate relief income tax cuts would bring."

Meanwhile, changes to inheritance tax are overdue, says George Bull, senior tax partner at Baker Tilly. "The best thing the Government could do would be to agree what inheritance tax is supposed to achieve and find a way to make it happen," he says.

Blick Rothenberg suggests the level at which the tax becomes due should be raised to £1m from next April. The current nil rate band is £325,000, although a reduced rate – of 36 per cent rather than 40 per cent – is being introduced from 6 April if 10 per cent of an estate is left to charity.

The Building Societies Association wants the current stamp duty holiday for first-time buyers on properties up to £250,000 to be retained. The BSA says reinstating the tax – charged at 1 per cent of the value of a property sold for between £125,001 and £250,000 – will hit homeowners.

However, Osborne could be more inclined to increase the scope of stamp duty, according to Henderson. "Increasing stamp duty on the most expensive properties and widening the stamp duty net would affect the property market," he says. "However, with prime central London property prices continuing to rise substantially, the Chancellor may feel there's scope for the country as a whole to share in this growth."

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

Another way to help first-time buyers could be the reintroduction of tax relief on mortgage interest payments for them, says Lucy Brennan, partner at Saffery Champness. "Debt is not cheap these days, and a tax break like this would give a real incentive to those looking to get a first foot on the ladder."

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks