Plug into currents and beat savings accounts

It's hard to be a saver, but some great interest rates can be found where you least expect them. By Chiara Cavaglieri and Julian Knight

These are strange financial times. Inflation is above target yet mortgage rates are at near record lows. The economy is sluggish but the stockmarket is going through a bull run. And here, perhaps, is the strangest phenomena of all: you can now get a higher rate of return on your current-account cash than you can with a standard-savings account.

There is major competition in the current-account space with new rules introduced to ensure seven-day switching but next to none in the savings space, so if you're looking to make your money work hard, getting the right account can be highly rewarding.

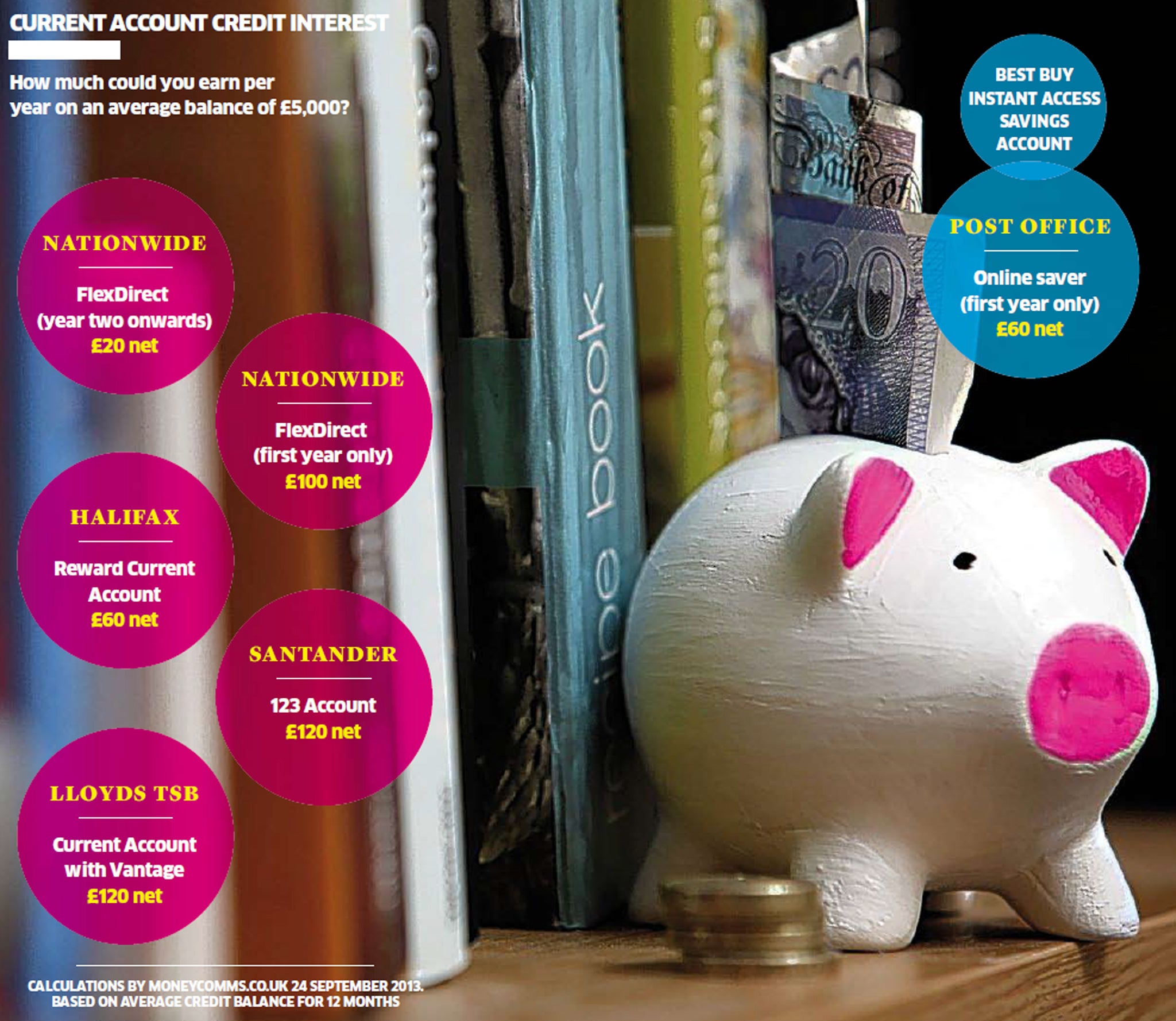

Not only are there cash incentives and other perks, but several current accounts are offering market-leading interest rates on in-credit balances. In fact, the average no-notice savings account is paying a paltry 0.67 per cent, according to Moneyfacts.co.uk, while the average current-account credit interest is a far more appealing 1.19 per cent.

Anna Bowes, director of Savings-Champion.co.uk says: "Savvy savers will utilise all the weapons in their armoury from cash Isas (individual savings accounts) to high-interest current accounts and regular savings accounts, in order to cream as much extra interest as possible. Saving in the current environment isn't easy and being complacent can cost you dearly, so it's worth juggling your money and considering the best-paying accounts you can find."

Nationwide's FlexDirect current account, for example, pays an impressive 5 per cent on balances up to £2,500 in year one, falling to 1 per cent thereafter. You must pay in at least £1,000 per month to be eligible, and if you can't pay in the required £1,000 you won't receive any interest that month (calculated on the last day of the month and paid the next day, minus any tax). The current best buy for instant-access savings – the Post Office Online Saver – pays a mere 1.50 per cent AER, which doesn't even come close to protecting suffering savers against inflation.

The Lloyds Classic Account with Vantage is one of few accounts to start paying interest on balances as low as £1 – balances up to £1,000 earn 1.5 per cent interest, rising to 2 per cent on £1,000 to £3,000 with the full 3 per cent payable on balances of £3,000 to £5,000. Interest rates apply to the whole balance so if you have £4,000 in your account you earn 3 per cent on the lot.

Again, if you go into the red at all you miss out on interest for that entire month, although there is a £10 overdraft buffer with both this and the Nationwide account.

It isn't very likely that you would be able to maintain a balance of over £5,000 for an entire year, but in theory you could earn £150 in interest per year (before tax) with the Lloyds account. Similarly, the maximum potential pay out with Nationwide (5 per cent on £2,500) would still be a very attractive £125.

Santander's 123 account is another contender. It does carry a monthly fee of £2, but it offers tiered rates starting at 1 per cent on balances from £1,000, 2 per cent on £2,000 to £3,000 and 3 per cent on balances between £3,000 and £20,000. Interest is calculated daily so if your balance falls below £1,000 on any given day of the month you don't earn any interest for that day.

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

"Nationwide BS gets plaudits for its 5 per cent rate, but remember this is only for the first year. Santander 123 is the winner for balances over £5k as it's the only one paying credit interest at this level," says Andrew Hagger, personal finance analyst at MoneyComms.co.uk.

The 123 account goes one better offering monthly cashback (again ranging from 1 to 3 per cent and paid directly into your account) on your direct-debit bills for mortgage payments, council tax, utilities and TV/broadband packages. You need to set up at least two direct debits and you must pay in at least £500 every month to be eligible, but you can share the account with a partner and put both your salaries in.

The Halifax Reward current account will even give you an impressive £100 switching incentive and an ongoing £5 per month as long as you pay in at least £750 a month and use your account to pay for two direct debits (the £5 reward is only available if you remain in credit).

From the end of September, online Halifax bank customers will also be able to earn up to 15 per cent cashback on spending in various stores including Morrisons, Argos and Homebase under its Cashback Extras scheme.

There are current accounts that give you access to headline-grabbing savings accounts including the First Direct 1st Account. Not only do you get a £125 bonus for switching (you must pay in at least £1,000 per month) and a bank with an outstanding customer-service record, but as a current-account customer you can access their Regular Saver paying an appealing 6 per cent. You are restricted to saving £25 to £300 per month but this can still add up – if you put the maximum £300 per month for the whole year you would earn around £117 (£93 net).

All of these perks are appealing of course, but there is not one bank account that suits everybody. If you regularly rely on an overdraft, in-credit interest rates are of little relevance so concentrate on fees and charges as any rewards will easily be cancelled out if you get stung by overdraft charges.

"These accounts have been tailored for customers who stay in credit and therefore overdrafts charges tend to be higher cost than those specifically designed for those who dip in and out of their overdraft. Customers should also note if they do dip into their overdraft there may be a clause that they could be stripped of their credit interest," says Charlotte Nelson of MoneyFacts.co.uk.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks