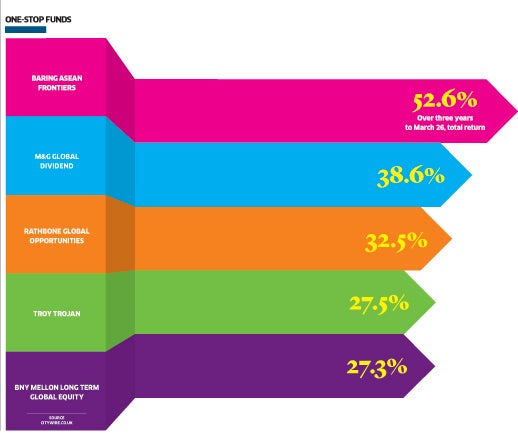

The only stock ISA you'll ever need

Finding a home for your tax-free allowance before Friday's deadline can be a nightmare. Emma Dunkley asked experts to nominate one core fund

Looming deadlines can often cause panic, but when it comes to your ISA allowance and the endless investments on offer, it's hardly surprising if you're overwhelmed by choice.

But with the ISA deadline at midnight on Friday, there's still time to make a considered judgement on where to invest, rather than just leaving it in cash earning very little interest.

And it's worth taking heed of the deadline in order to maximise the amount of hard-earned money you protect from the tax-man, rather than watch it swiftly and needlessly being taken away from you.

So where should you lock away your cash and put it to work? To make it simpler, we asked the experts to nominate the one core fund you'll ever need, where you can invest your money, sit tight for years and watch it grow.

Although you should, ultimately, look to spread your money, these are stalwart funds you could look to buy before the deadline, in the view you can build up other investments around them later.

With up to £11,280 to invest in a stocks and shares ISA, the experts reveal their top fund picks.

Rathbone Global Opportunities

Tipped by a few experts, this fund is a great choice for the long term. Its manager, James Thomson, has delivered a solid performance over a number of years. Mr Thomson has a flexible approach and aims to invest in tomorrow's success stories . Rather than focus on the UK, he has the flexibility to buy companies in terms of size, type and geography, although he chooses only between 40 and 60 of the best stocks. He looks for undiscovered growth stories and those companies that show a "star quality" other investors have yet to discover.

But he is also careful about risk. "He won't own companies that don't have any profits right now, because these companies get the rug pulled from underneath them in an economic crisis," says Rob Burdett at F&C Investments. "He also has no direct exposure to the emerging markets at the moment – which is good, because they're lagging behind.

"He prefers the strong governance and controls of developed-market companies that can access the growth of the emerging countries, but without being based there."

Since taking on the fund in 2003, Mr Thomson has returned a whopping 193 per cent. "He's a genuinely good custodian of your money," Mr Burdett adds.

Troy Trojan

"If you're starting up and looking to build a diversified portfolio, then a great fund to buy and hold, and treat as your core investment, is the Troy Trojan fund," says Adrian Lowcock of Hargreaves Lansdown.

The fund, managed by the respected Sebastian Lyon, puts your money to work in a range of different investments, including equities, gold, index-linked bonds as well as cash, meaning it's inherently diversified.

"He buys large, growth companies, where there is repeat demand, driven by habit or necessity," says Mr Lowcock. "He also buys bonds and gold to help protect you against inflation and he has the flexibility to invest defensively during the tough times. This is a fund that can grow and effectively work in all environments."

Although Mr Lowcock says the fund is not going to "shoot the lights out" and be the best performer if markets suddenly soar, it will likely still do well and can, importantly, protect you when markets are falling.

"The fund can withstand the peaks and troughs – so you're not going to get the best of a bull market, but it can shelter you when markets are going down, to smooth out performance over the long term," he adds.

M&G Global Dividend

"If you're looking for one main fund, it really can't just be UK-based," says Darius McDermott, the managing director at Chelsea Financial Services. "You want to spread out your money – and your currency exposure – globally."

Mr McDermott proposes the M&G Global Dividend fund managed by Stuart Rhodes. "This fund has an income, which if reinvested can compound over time and significantly boost your overall returns," he says.

The fund aims to deliver a dividend that is higher than the average, investing around the globe.

In order to perform well in both the good economic times and the bad, Mr Rhodes selects stocks with different dividend-paying characteristics. He also looks for companies with at least 10 years of dividend growth.

"So because it's a global fund, it offers a mix of currencies and companies and an investment process that targets total return," Mr McDermott says. "The fund is reaching its fifth anniversary and it's been a roaring success, because of the manager and his passion for the investment process."

BNY Mellon Long-Term Global Equity

While many people believe the economic balance of power is shifting from the old developed markets such as the UK, Europe and America to the new emerging markets of Asia and Latin America, it is still important to keep some of your money in the developed world, says James Bateman, a fund of funds manager at Fidelity.

"Global equity funds allow you to access a number of developed markets, as well as having a limited exposure to the emerging markets, in one solution," he says. "The BNY Mellon Long Term Global Equity fund is one that particularly stands out."

The fund is invested in 40 to 60 of the management's best picks and is focused on achieving solid, long-term returns, says Mr Bateman. "The investment process is driven by detailed research on companies, looking for those that can sustain and grow their profits, have solid market and competitive positions, strong financials, low debt and high rates of wealth generation."

It's also ideal for the long term, as the managers look to invest for extended periods.

Baring Asean Frontiers

For those looking to take on a bit more risk and happy to invest for 10 years or more – with the stomach for a few ups and downs along the way – the Baring Asean Frontiers fund offers an exciting growth story.

David Coombs, a fund of funds manager at Rathbone Unit Trust Management, says the Association of Southeast Asian Nations (Asean) is similar to the EU but without a single currency – and it is opening up for more business.

"There are several well-documented growth drivers … but the most compelling is the agreement that will be in place in 2015, to allow goods to travel freely, cross-border," says Mr Coombs.

The fund, which invests in between 60 and 80 stocks, is managed by Soo Hai Lim and his team, based in the area.

"Asean demonstrates the potential for strong economic growth over the coming years, with much room for the investment theme to proliferate," Mr Coombs says.

Emma Dunkley is a reporter at citywire.co.uk

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments