Wealth Check: 'I want to buy property and land in the future'

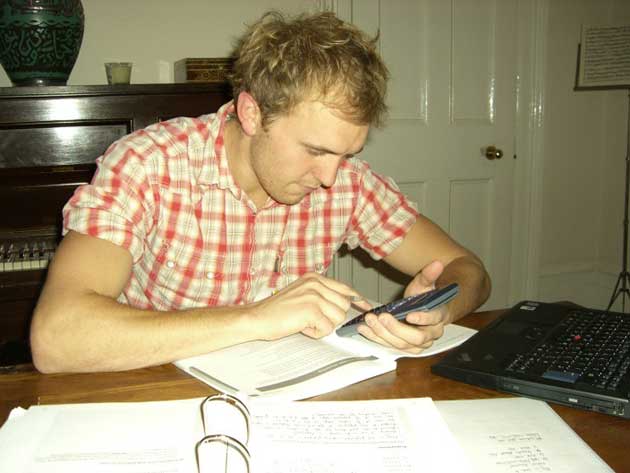

Jono Darby is a 25-year-old graduate accountant living near Regent's Park in north-west London. He recently completed an engineering degree at Loughborough University, and started a job three weeks ago in assurance, working towards a career in chartered accountancy.

His ambition is to buy a property in London within the next three years, and a large property with land in the future. He has a high amount of student debt but his earnings outweigh his monthly spending, and he pays a competitive rent price of £130 per week for a normally expensive area of London. Jono is concerned that his spending is consistently within an overdraft facility, and he wants to start saving spare cash for emergencies.

Case notes

Jono Darby, 25, north-west London

Income: £29,000 a year including benefits and pension

Monthly spending: £625 on rent, £400-£500 on food and drink

Savings: £40 split between an ISA and building-society account

Pension: Jono contributes £600 a year, which his employer matches

Property: None, but plans to buy within three years

Debts: Student loan £13,400, credit-card £840, overdraft £750

Protection: none

We asked three financial advisers to take a look at his situation: Kevin Tooze from Equity Partners UK Ltd, Raj Shah from Simpli Group, and Nick McBreen, who is an independent financial adviser.

Student debt

Jono has a student loan of approximately £13,400, with an interest rate of 4 per cent, as well as a credit-card balance of £840, with an interest charge of 1.02 per cent per month. He is also £750 overdrawn on an interest-free graduate account.

Tooze says Jono's first priority should be to reduce his debts. He suggests that Jono should reduce or temporarily cease his pension contributions, which are £600 per year, and use the money to pay down his debt. Shah says Jono should try to pay £100 per month into either his overdraft or credit-card debt, and then, when these debts have been paid in full, turn his interest to payment of his student loan.

Savings

All three advisers agree that Jono should start saving more of his income, and consider cutting back on his monthly spending. They also say that he should set up an emergency fund to which he has easy access, to deal with unexpected financial needs. Like many recent graduates, Jono has very little money in savings, and Shah says he should look into paying a regular amount into a cash ISA – about £300 per month. In the longer run, this could be used as a deposit on a first property.

Shah says that Jono should aim to build up between three and six months of his net income for his emergency fund. "It's essential that he gets into the habit of saving, and gets used to budgeting so that, as his salary increases with his career progression, it won't cause that much of a dent in his monthly outgoings," he says.

McBreen says that the best approach for Jono is to aim to accumulate around £3,000 in an ISA as a financial safety-net. "Online accounts offer the best headline rates, and funds can be moved around easily," he says. "Easy-access accounts are great, but Jono needs to be tough enough with himself not to raid the pot for holidays and nights out."

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

Tooze is most concerned about Jono's spending on food and drink. He says that £400-£500 per month is excessive, and considers it to be a reasonable budget for a family of three or four people. He suggests that Jono reduces this outgoing by cooking meals himself and shopping more sensibly for food. "With several years of tight control, Jono could find himself in a strong position in a short time, but he needs seriously to consider the cost of living in London – he is spreading himself too thinly."

Investment

Jono is considering making medium-risk investments in the future, and wants to find a balance between risk and return. McBreen suggests that he drip-feed any surplus income into regular unit trusts with the aim of capital growth. The first step would be to get quality advice from a fee-based independent financial adviser, which will clarify Jono's objectives. "In the current climate, with global equity markets in meltdown mode, there are some real opportunities for investors."

Jono would ideally like to retire at 50 with a good level of financial security. Shah says that he should find out what the maximum pension contribution from his employer is, and aim to put in as much as possible to receive this maximum benefit: "It is vital that this figure is increased and reviewed annually to ensure that he doesn't get a nasty surprise come retirement."

Protection

Jono has no protection, other than what is provided by his employer, and McBreen says critical illness cover and permanent health insurance are worth considering. He says that Jono also needs to clarify exactly what income protection is available from his employer as part of his pension-scheme membership.

Shah says that Jono may be able to get an income protection plan for as little as £16 per month, which would protect his salary if he was unable to work due to ill-health, or if he was made redundant.

For a free financial check-up, write to Wealth Check, The Independent, 191 Marsh Wall, London E14 9RS; or email cash@independent.co.uk

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks