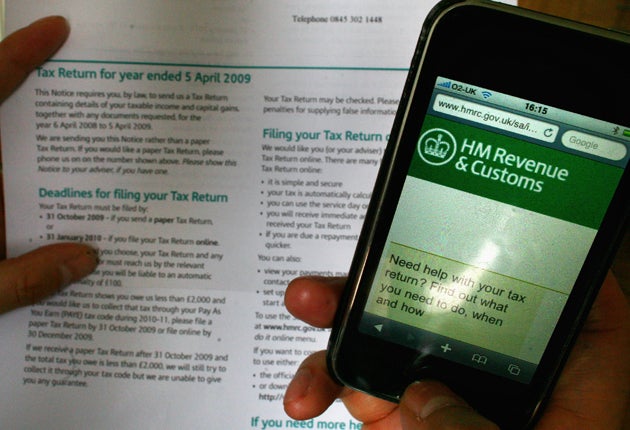

The tax deadline is almost upon us, but don't panic if you have yet to file your return online

Just over a fortnight is left before the self-assessment deadline when all online tax returns must be filed along with any money owed. Taxpayers must return their forms by 31 January to avoid contributing to the estimated £503m in fines for late returns and errors set to be handed to the taxman this year, according to professional advice website Unbiased.co.uk.

If you are new to filing online, you'll have even less time to file your return as you must first register on the HMRC website for self-assessment online. This is so that a personal identification number can be sent to you in the post, but it can take up to seven days to arrive so you must register as soon as possible to give you enough time to collect your PIN and file your return on time. Failing to return your form by the deadline will incur an initial charge of £100, but if you still haven't returned the form by 31 July, another £100 penalty will be slapped on, after which HMRC is able to apply a fee of as much as £60 a day.

Self-assessment forms are renowned for being complicated so what help is there out there for taxpayers?

Tools and calculators

For those with relatively straightforward tax affairs, HMRC's own online tax return service should suffice and won't cost a penny. There is plenty of helpful advice and as well as comprehensive guides on both the HMRC's website (hmrc.gov.uk) and Direct Gov (direct.gov.uk).

"For the majority of relatively straightforward tax affairs, they should be able to do it themselves. The HMRC software is absolutely fine; it's easy to use with lots of links to help sheets," says Anita Monteith, a tax spokeswoman for the Institute of Chartered Accountants in England and Wales.

For anyone struggling to cope with the number crunching, free tools and calculators are available online. At taxcentral.co.uk, for example, there is a tax code checker, a VAT calculator and a pension relief calculator. Which? also has its own tax calculator (which.co.uk/advice/which-tax-calculator/index.jsp).

If you're part of the iPhone clan, useful applications, such as the income tax and self-assessment calculator from nXtreme (59p), allow you to enter your salary, dividend, bank savings interest and any other income for a clear and fast tax calculation, with a detailed breakdown of that calculation to help with the self-assessment forms.

Computer software

Beyond the free HMRC software and various tools and calculators, commercial software packages are available too, from the likes of TaxCalc, Sage Taxation and Ftax. Basic packages cost from about £25 and are designed to make light work of completing the self-assessment tax return. However, be warned that if your tax affairs are more complex, you may need a more comprehensive package.

"Self-employed people or those with small businesses are likely to have more complex affairs and also have more allowances available to them, so they need to ensure they are using a more elaborate package to cover all of this," says Helen Lacey from Which?, the consumer organisation.

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

TaxCalc is one of the UK's most popular software applications and has a range of products for individuals, partnerships, trusts and companies. TaxCalc actually offers a wider range of forms than the HMRC online service and, as well as more general taxation advice with each box. It also allows you to import data from previous years, assuming you used TaxCalc software before, to avoid having to repeat static information such as your contact details. The TaxCalc 2009 Personal 6 costs £29.99.

Visit the HMRC website for a list of commercial software suppliers that are compatible with its online service.

Accountants

Business owners and anyone earning their income from various sources such as shares or property are more likely to need a helping hand from a professional. A qualified tax adviser is better equipped to spot mistakes and make the most of your allowances by getting as many tax deductions as possible for your tax expenses. Accountant costs can vary widely but is likely to set you back at least £100 an hour.

Look for an accountant who has been accredited by a professional body such as the Association of Chartered Certified Accountants (ACCA). Make sure you get a quote first as most accountants will be able to have a quick look at your books and know roughly how long it will take them to complete your self-assessment.

"When tax affairs start getting more complicated you will usually find that accountants quickly earn their fees and save you the money that they charge," says Ms Monteith.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks