George Osborne misses borrowing target by £1.8bn: in charts

Public sector borrowing in 2015-16 was £1.8bn more than the Chancellor's official forecaster predicted only last month.

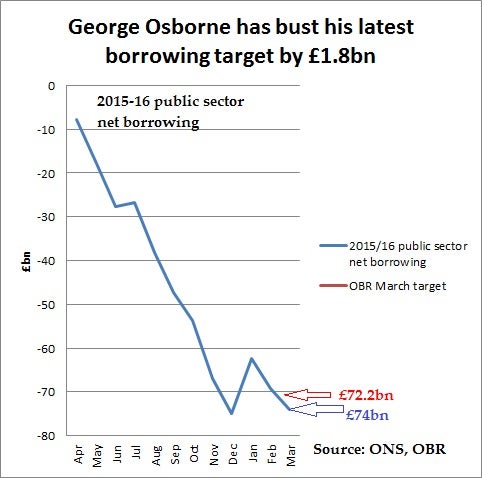

George Osborne has bust his 2015-16 borrowing target set by the Office for Budget Responsibility only one month ago. Borrowing in 2015-16 came in at £74bn according to the Office for National Statistics this morning. That’s £1.8bn higher than the £72.2bn the OBR forecast in March's Budget:

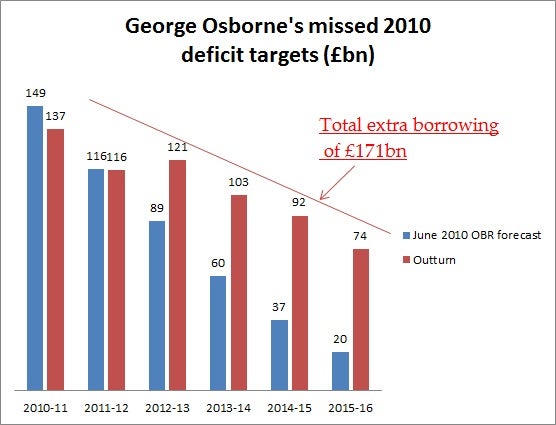

It is another missed target for George Osborne who famously pledged back in 2010 when he became Chancellor to wipe out the structural deficit by 2015 and slash overall borrowing to just £37bn. Borrowing in the final financial year of the Parliament was, in fact, £92bn.

But today’s figures are, nevertheless, something of a vindication for the Chancellor and the OBR.

The £4.8bn borrowing in March the final month of the financial year, reported by the ONS was lower than the £6bn forecast by City of London economists and so represents something of an upside surprise. In other words, the Chancellor has missed his latest target by a smaller margin than many expected.

And as the OBR frequently points out, the ONS often revises its full year public sector borrowing figures as more data comes in. The average historic revision within 12 months is £3.5bn according to the OBR, which means that as the months go by it may well emerge that the Chancellor has hit his 2015-16 target after all.

But, of course, no historic revisions will ever save the Chancellor's original 2010 targets:

The cumulative borrowing overshoot relative to those 2010 forecasts now stands at £171bn.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks