Britain's hidden army of under-employed

More hours mean lower benefit bills, higher tax takes and rising wages. David Blanchflower explains how falling jobless figures conceal a problem at the heart of the economy

The labour market has been absent as an issue from the election campaign. Falling unemployment numbers may have given the mistaken impression that all is well.

But figures from Eurostat, the EU’s statistics agency, and our own analysis, show that underemployment remains a lingering blight on the UK economy. There are also good reasons to believe that the labour market will not be a source of upward pressure on inflation any time soon.

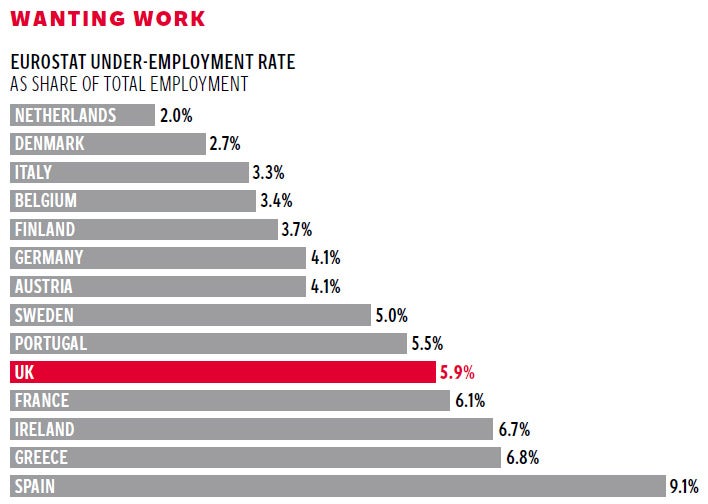

Take the figures from Eurostat. New data show the rate of underemployment in the UK in 2014 was worse than in the rest of the EU other than in five high-unemployment countries.

So much for the jobs miracle. These figures measure the number of part-timers who want more hours. In 2014, more than one fifth of part-time workers in the EU, equivalent to 4.5 per cent of total employment, wanted longer hours and were available to do so at the going wage rate.

Their incomes are lower than they would like because their employer is unable or unwilling to offer them a longer working week. So their living standards are lower than they would want, and many of these workers will be claiming in-work benefits due to their low earnings. And low incomes mean that tax payments are lower than they would be if working time was not rationed.

The data show that there is a large reservoir of under-used labour in Europe, willing to work more hours at the going wage rate and therefore unlikely to exert upward pressure on wages. This reservoir of labour exists in addition to the unemployed. Both form part of the “reserve army” of labour, as are the so-called “hidden unemployed” who have left the workforce. They are neither employed nor unemployed, but would take a job if one was available at an acceptable wage. The combination of unemployment, underemployment and hidden unemployment is keeping wages down in the UK and across Europe and the United States. In turn, the lack of wage pressure is contributing to record low rates of price inflation in the UK and across the European Union.

Two thirds of under-employed part-time workers on this measure are women; indeed the majority are women in most EU countries, including the UK. Just less than 1.8 million of these part-time workers were in the UK in 2014. Together they comprise 5.9 per cent of total employment (top graph). In addition, 27 per cent of these under-employed workers in the UK are aged 25 or under, compared with only 15 per cent for the EU as a whole. Young British workers are particularly constrained by the lack of opportunity to work more hours.

The number of part-time under-employed workers in the UK, using this measure, fell slowly from 1.88 million in the first quarter of 2014 to 1.75 million in Q4 2014. Over the same period, unemployment fell from 2.17 million to 1.80 million. So there are only 50,000 fewer under-employed workers in the UK than there are unemployed workers. This is hardly a success story. This statistic suggests the UK economy is a very long way from full employment and – surely – is part of the explanation of why wage growth remains low while unemployment is now relatively low.

There are a couple of other ways to measure underemployment in the UK. The Eurostat measure focuses on how many part-time workers want to work longer hours. The ONS publishes another, smaller, measure which is the number of part-time workers who want full-time jobs, which produces a lower number of about 1.35 million under-employed workers. This has also fallen more slowly than the unemployment rate, falling from a maximum of 1.46 million. I and my colleague David Bell at Stirling University have constructed a more comprehensive and sophisticated measure, based on how many more (or less) hours workers would like to supply at the going wage rate, which we publish quarterly. We can then establish how many “worker equivalents” these extra hours comprise and construct an underemployment rate that is comparable with the standard unemployment rate.

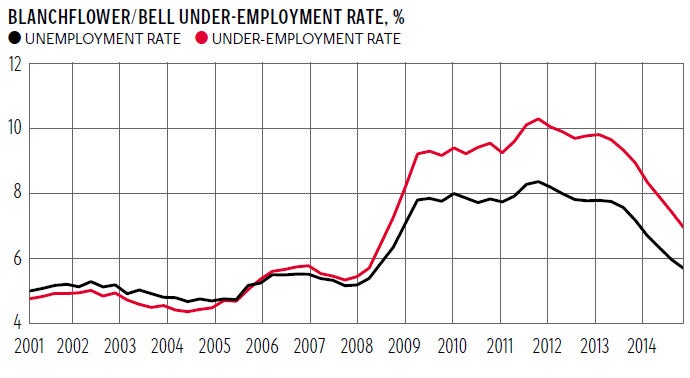

Our estimates of underemployment take a broader perspective than either the EU or ONS statistics, by recognising that full-time as well as part-time workers might wish to work additional hours. We also allow for the finding that some workers, particularly those aged over 50, would prefer to work shorter hours. Our latest estimates, for the final quarter of 2014 – presented here for the first time – show that the seasonally adjusted rate of underemployment in the UK was 7 per cent, well above the unemployment rate of 5.7 per cent.

This gap between the unemployment and underemployment rate did not exist before the start of the Great Recession, when demand for more hours was almost exactly offset by the desire to work fewer hours (bottom graph).

Our analysis can also show how underemployment varies among different groups in the UK labour market. It is especially high among the young. Our estimates put the seasonally adjusted underemployment rate among those aged under 25 at 23.8 per cent in the last quarter of 2014, more than 7 percentage points above their unemployment rate and 3.4 times the equivalent rate for all workers.

As with the Eurostat measure, women are much more likely to be under-employed than men. The gap between the female underemployment and unemployment rates is more than 2 percentage points, while for men it is only 0.9. Women and the young find it more difficult than prime age men to match with jobs that offer them the hours they desire.

Historically, explanations of wage determination typically relied on unemployment to measure excess labour supply. These models typically ignored the role of underemployment in moderating wage growth.

Our view is that underemployment has played a vital role in constraining money wages in the UK economy since the beginning of the recession and is part of the reason why the historic explanations have performed so poorly. All hail the “long-term economic plan”.

David Blanchflower is a professor of economics at Dartmouth College and a former member of the Bank of England’s Monetary Policy Committee. David Bell is a professor of economics at the University of Stirling

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks