Coronavirus: What is a stock market correction – and should we be worried?

What does a correction actually mean? And why does it matter?

Stock markets in America and Europe have now entered official “correction” territory due to coronavirus fears.

After a slight respite on Wednesday stock indexes across the world on Thursday continued their downward lurch as news emerged of more cases of Covid-19 infections outside China.

Japan announced today that it will shut every school in the country next Monday, affecting 13 million pupils, in order to contain the disease’s spread.

But what does a stock market correction actually mean?

And why does it matter to ordinary people?

What is a correction?

It’s simply where shares are trading more than 10 per cent below their recent peak in value.

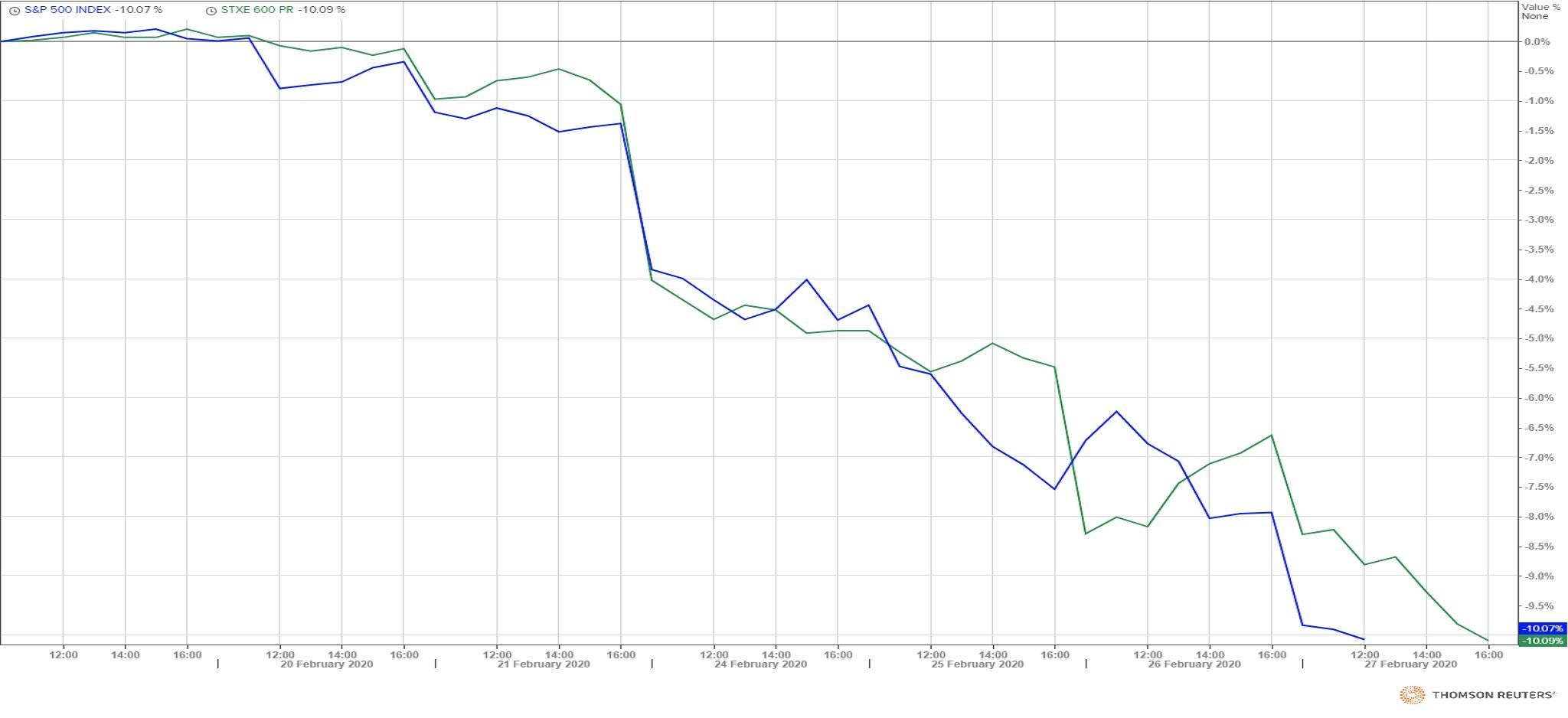

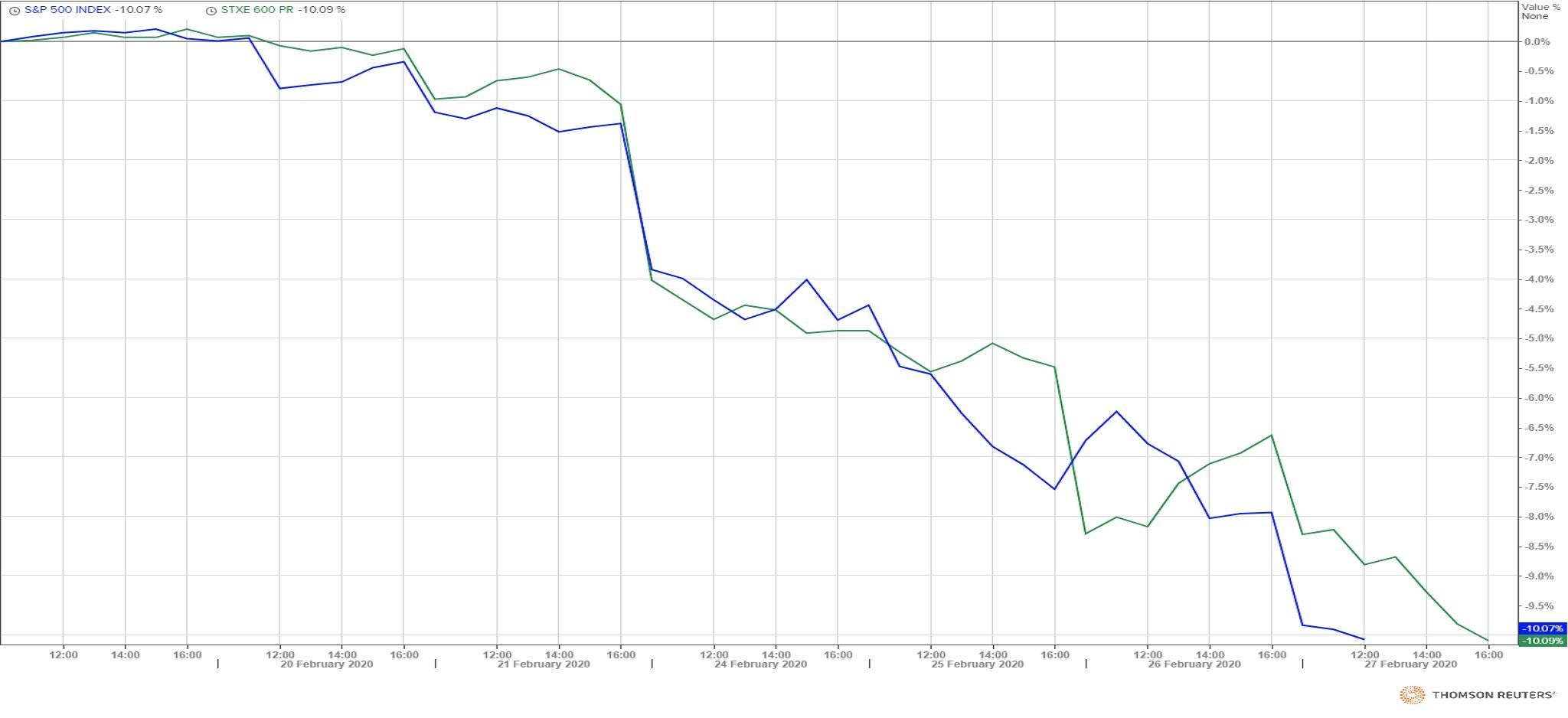

On Thursday afternoon both the S&P index of the 500 largest US companies and its (rough) European equivalent the STOXX 600 were down over 10 per cent on where they were a week ago.

Why are shares falling?

Because traders have woken up to the potential global economic impact of the Covid-19 outbreak.

If growth stalls and company supply chains are disrupted by measures by governments to contain the virus that will be bad for company profits – and a hit to company profits translates into lower share prices.

Why does a correction matter?

The 10 per cent figure itself is rather arbitrary.

Nothing magical happens after a stock index falls by a tenth.

But it’s a round number and that can be important in the psychology of traders.

It may give rise to a further cycle of fearful selling.

It could presage a 20 per cent decline in values, the definition of a “bear market”.

More broadly, falling share prices matter in that many of us are invested in stock markets through our pension or other saving schemes.

So when markets fall, we are worse off.

It’s estimated that more than $3 trillion of value has been lost from listed companies across the world this week.

However, providing we are not about to retire tomorrow we shareholders are only worse off on paper. Shares in the long term have tended to rise.

Any other reason to be relaxed amid the market mayhem?

Some analysts argue that major stock sell offs and corrections can be healthy if they bring an overheated market down to earth.

“Stocks have moved upwards for many months without a significant correction — and there is a compelling argument to make that a correction is overdue,” says Kristina Hooper of Invesco.

Some also maintain that corrections are a welcome opportunity for level-headed and long-term investors to buy undervalued shares in good, profitable, companies.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks