The birth of a new age of corporate landlordism?

Institutional money is flowing into the private rental market. But is it good for tenants? And could rent controls spoil the party?

For many years Britain has been a haven for one-man band landlords and wealthy investors who let out a handful of their flats – but who are sometimes hard to get hold of when leaky pipes need repairing or pests exterminated. But could this be changing? There is a rapidly rising breed of landlords that are professional institutions rather than individuals. And more people could soon be paying their monthly rent over to a pension fund or even a listed house builder.

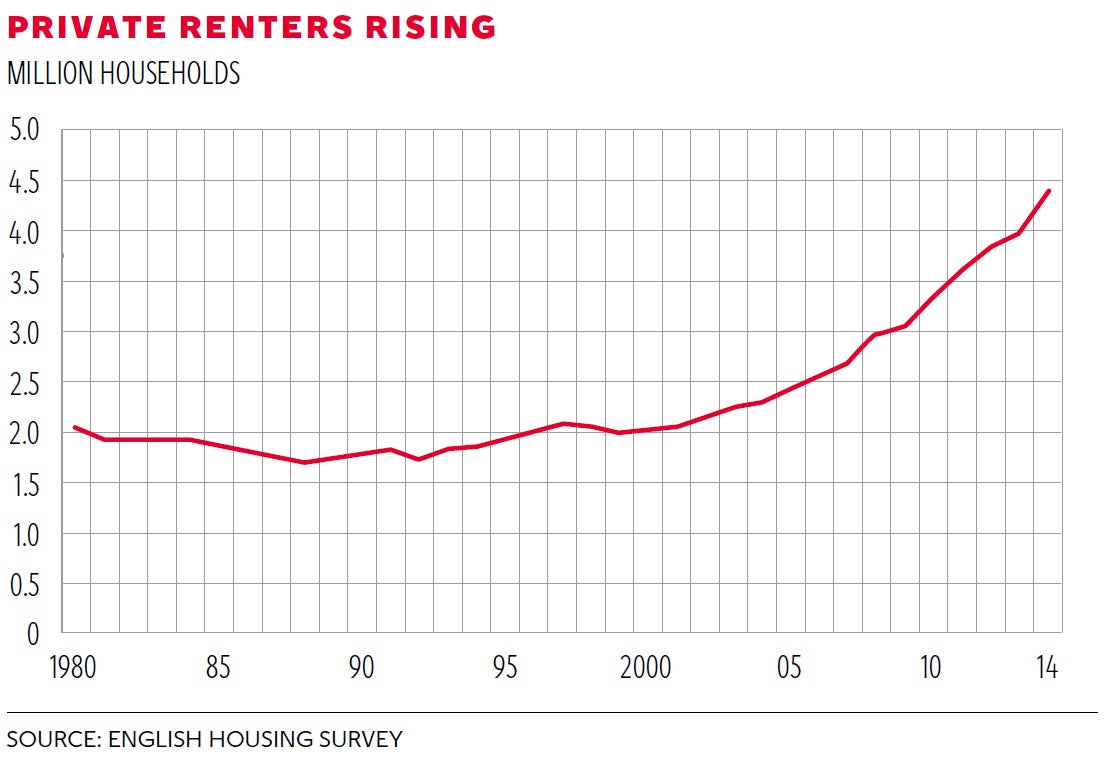

The rise of the corporate landlord follows an explosion in private renting in Britain. Numbers have more than doubled since 1980, to about 4.5 million in 2014. Property agent Savills estimates that rental demand will rise by a further 1.2 million households by the end of 2019.

The market is still dominated by small landlords. But large investors are increasingly getting involved. This week saw Kennedy Wilson Europe Real Estate, a property investor, make its UK debut in the private rental market. And last week the housebuilder Crest Nicholson announced that it had teamed with a mainstream UK investment institution, M&G Real Estate, on a private rented development.

Here we look more closely at the wave of money trying to capitalise on the booming rental market – and consider the wider implications.

Landlord benefits...

Better Renting for Britain, a campaign group made up of developers, housing associations and pension funds, estimates that there is about £30bn of private sector money waiting to be funnelled into building some 150,000 homes for the rental sector. The group argues that the private sector can help to ease the national housing shortage as well as delivering strong financial returns for investors.

“The private rented sector offers pension funds and other institutions stable, long-term returns to match the pensions they are paying out” says Melanie Leech, the chief executive of the British Property Federation. “These institutions invest savers’ money for up to 30 years and so are not interested in speculative gain. They need income rather than capital growth, and the private rented sector will deliver long-term returns that grow with earnings.”

Her view is shared by M&G and Crest Nicholson, which will deliver 97 apartments at the Bath Riverside regeneration scheme in Bath city centre. Chris Tinker, executive board member for Crest, says the sector provides an alternative revenue stream to its core sales business. He adds that it allows the company to progress more quickly with major projects so that they get into use faster through a mix of home owners and tenants. Ultimately it “secures an improved return on capital employed”.

The level of demand for rented property remains very high, according to M&G’s head of residential investment, Alex Greaves. M&G, which bought a portfolio of 534 flats from the Berkeley Group in 2013, has occupancy levels of up to 99 per cent.

Good for tenants?

Corporate landlords could bring more professionalism, some argue. “Standards of private accommodation will rise with more institutional investment” says M&G’s Mr Greaves. He says there is a parallel with how student accommodation has improved as a result of major institutional investment. “The old Young Ones-style student house with overgrown gardens and unscrupulous landlords” has completely changed, he says.

Kennedy Wilson, which bought the debt of two residential towers in Ilford, east London, intends to rebrand the properties as a “professionally managed” rental operation.

Meanwhile, the Better Renting for Britain campaign believes an American-style rental market – where single companies own large portfolios of homes – could bolster standards, offering better value and greater transparency.

In an open letter to the next government, the group said: “We want to create more professionally managed rented housing, purposefully designed and built with the long-term occupier in mind.”

Government interference

But if the next government intervenes in the rental market, this kind of investment could be deterred, the industry warns. The Labour leader, Ed Miliband, has pledged to end excessive rent rises and has called for longer, securer tenancies. Mr Greaves says this would be “clearly unwelcome to a number of investors and make them uncomfortable”. Mr Tinker warns that it could undermine the viability of some regeneration schemes in their early stages.

The Association of Residential Letting Agents is also concerned. It says it wants to see more institutional investment in the private rental market but admits that “such regular and dramatic changes in law, such as those proposed by Labour, mean that institutions are wary about investing in the UK’s private rental sector for the long term”. The acid test of this new era of corporate landlordism could come after the next election in the shape of a rent-capping Labour Government.

Key investors: Ready to rent

M&G Real Estate

Has existing and pipeline stock of more than 700 homes. It is understood talks are under way to increase that to 1,000.

Legal & General

Planning to invest £1bn in the sector after signing a £25m deal in February to build and rent out 300 flats in London.

Essential Living

Wants to build 5,000 flats by 2023. Backing from the Build to Rent fund and Royal Bank of Scotland means it can make a start on 300 homes.

Aviva Investors

The company’s head of specialist real estate funds said last year that Aviva wanted to invest in at least 2,500 private rented-sector homes.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks