David Blanchflower: The inflation nutters are on the march again – and they are as wrong as ever

Martin Weale voted for rate rises in 2011 but his predictions of rising inflation did not materialise

So two external members of the Bank of England’s Monetary Policy Committee (MPC), Martin Weale and Ian McCafferty – whom I call the irrelevant minority (IM), having been one myself throughout much of 2008 – ludicrously voted for a rate rise at the 7 August meeting. The remaining seven voted to sit pat, arguing, sensibly, that any rate rise would be dangerous.

This is what the seven said: “It was possible that, given the strength of the headwinds faced by the economy, even the current extraordinarily low level of Bank rate was not providing a great deal of stimulus to activity. A premature tightening in monetary policy might leave the economy vulnerable to shocks, with the effectiveness of any further necessary stimulus being limited by the effective lower bound on Bank rate. In addition, increases in Bank rate well ahead of any pick-up in wage and income growth risked increasing the vulnerability of highly indebted households. Finally, an unexpected increase in Bank rate might cause sterling to appreciate further, bearing down on inflation and further impeding UK economic rebalancing.”

It is hard to disagree with any of that. But the IM did, arguing: “These members noted that the continuing rapid fall in unemployment alongside survey evidence of tightening in the labour market created a prospect that wage growth would pick up. They noted that it was possible that wages were lagging developments in the labour market to some extent. If that were true, wages might not start to rise until spare capacity in the labour market were fully used up. Since monetary policy, too, could be expected to operate only with a lag, it was desirable to anticipate labour market pressures by raising Bank rate in advance of them.”

The vote for a rate rise was apparently because inflation is set to rise because wage inflation is going to rise, even though it is moving fast in the opposite direction. The claim is that even though there hasn’t been any wage inflation for years, believe us, it is about to spiral out of control. They also seem to have forgotten that there is a secondary objective of ensuring growth and employment. The remit of the MPC, as set out by the Chancellor in a letter dated 19 March 2014, is to “maintain price stability” and “subject to that, to support the economic policy of Her Majesty’s Government, including its objectives for growth and employment”. The IM appears to have lost the plot.

Since the August 7-2 vote, there has been a lot of data pertaining to where the economy is headed, and none of it looks terribly promising for the IM view. Inflation and real wages are falling, not rising. The oil price is plunging. Brent crude at the time of writing was $100, down from around $108 at the end of July. We also had data from the Office for National Statistics (ONS) on the consumer prices index, which unexpectedly fell to 1.6 per cent in July, from 1.9 per cent in June. Falls in clothing prices provided the largest contribution to the fall in the rate. The ONS produced other estimates showing that both annual output producer price inflation and input prices fell in the year to July. Factory gate prices fell 0.1 per cent between June and July. Total input prices fell 1.6 per cent between June and July, compared with a fall of 0.9 per cent between May and June.

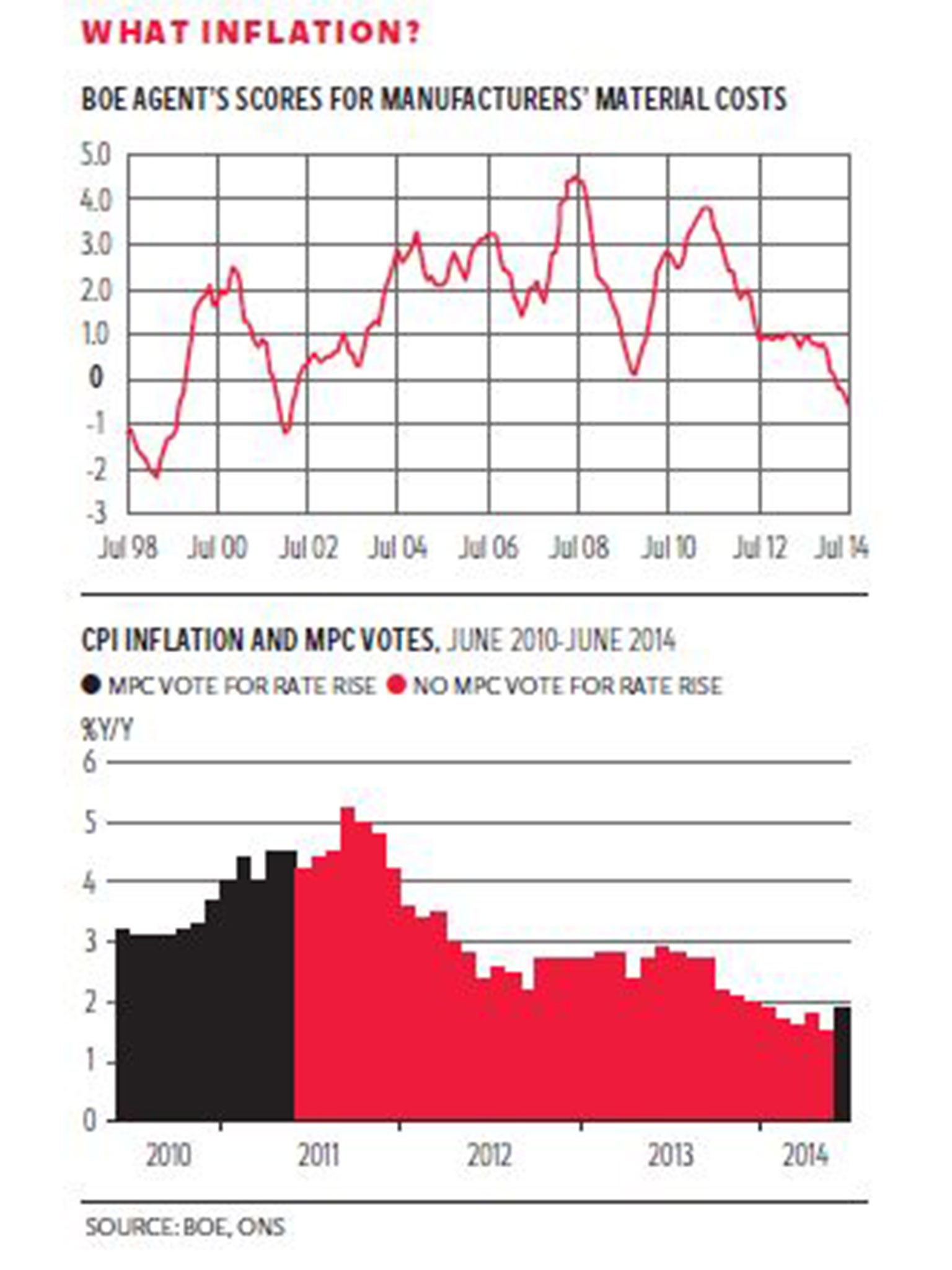

The overall price of materials and fuels bought by UK manufacturers for processing fell 7.3 per cent in the year to July, compared with a fall of 4.5 per cent in the year to June. The Bank’s regional agencies published data on material costs faced by manufacturers, which are plotted in the first chart. These costs are sharply down. The agencies report that materials cost inflation has “remained negative”.

On 13 August the ONS published the latest data on wage growth, which showed that average weekly earnings in June had gone negative: minus 0.2 per cent on the year, down from 1.9 per cent in March. Regular pay growth excluding bonuses had fallen to 0.6 per cent, down from 1.3 per cent in March. Finally, the ONS published new data on the earnings of the self-employed, which are excluded from the calculations for average weekly earnings, and they were a real shocker.

We should note that even though the average earnings of the self-employed are above those of employees because of high earnings at the top of the distribution, the typical self-employed worker earns less than the typical employee. The self-employed can have negative earnings as they can make losses. In 2013 prices, the real median weekly income of the self-employed in 2006-7 was £301. In 2011-12 it was £236, while in 2012-13 it had fallen to a shocking £207. So real self-employed earnings are down by 31 per cent since 2007 and by 12 per cent over the last year for which the data is available. This suggests that the figure for average weekly earnings is a seriously upward-biased estimate of what has happened to real earnings in the UK, as that is down by only 8.4 per cent since May 2010.

This isn’t the first time that Mr Weale has dissented on rates. He voted for 25 basis point rate rises seven months in a row from January 2011 to July 2011, along with Spencer Dale, who voted for a similar rise six months in a row from February 2011 to July 2011, while Andrew Sentance voted 12 times in a row from June 2010 through July 2011, with the last four of these votes for a 50-basis-point rise.

The second chart, which shows inflation along with the months when there were votes for rate rises, demonstrates how mistaken these votes were. Their predictions of rising inflation were wrong.

In the minutes of the February 2011 meeting, the three inflation nutters argued that a rate rise was necessary because “the upside risks to the medium-term inflation outlook from global inflationary pressures... outweighed the downside risks to inflation associated with uncertainty about the strength of the recovery and the possibility of persistent spare capacity”.

Fortunately, the other members of the MPC didn’t go along with them; there were no rate rises and inflation tumbled a few months later.

Wrong then and wrong now.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks