Hamish McRae: Don't worry about bad figures – chances are they're wrong

Economic Life: The first thing to say is we have been doing quite a lot better than has been reported

It's the morning after – and it was not much of a party the night before. The more one crawls over the great wodge of economic and financial information that came out with the Budget, the clearer it becomes that the key to getting the country's finances back on to a sustainable basis will be growth. It is the only way out. It is incredibly hard to cut the deficit if the economy is growing at less than 2 per cent a year and we have been struggling to achieve that since the recession struck. So what are the prospects for growth?

Well, the first thing to say is that we have been doing quite a lot better than has been reported.

There are been substantial upward revisions to the growth numbers initially recorded, as highlighted by the Office for Budget Responsibility (OBR).

On page 20 of its new report it says: "In January 2011, the ONS [Office for National Statistics] published its first out-turn estimate for growth in 2010. Thanks to the unexpected 0.5 per cent fall in GDP in the fourth quarter, its initial estimate was just 1.4 per cent, lower than all 36 outside forecasts made at that time. But now, following a series of upward revisions, the current ONS estimate for growth in 2010 is 2.1 per cent – higher than every outside forecast made at the end of 2010 and all but two of those made at the start of 2010."

So 1.4 per cent turned out to be 2.1 per cent. Readers with good memories may recall than when that 0.5 per cent, fourth-quarter fall in GDP was published I wrote in these columns that the figure was wrong – much to the annoyance of the ONS, who rang to object. Well, now we are beginning to learn what really happened. I expect the 2011 growth figure, officially recorded as 0.8 per cent, to be wrong too and when all the numbers are revised it will eventually be seen to be around 1.3 per cent – not great but not quite so bad as it seems.

So you see, all this earnest debate about the slow pull out of recession is based on figures that turn out to be wrong. What is happening to growth is undoubtedly disappointing, but it is not as dire as the relentless comment would suggest.

Will it pick up? The OBR forecasts 0.8 per cent this year, 2 per cent next, rising to 3 per cent in 2015 and 2016.

Take this year first: intuitively, that 0.8 per cent feels a bit too low but whether it is will depend on two main factors both beyond out control – Europe and oil.

The eurozone as a whole has gone back into recession and it is hard to see it pulling out strongly given all the austerity being piled on to its weaker economies, including two big ones, Spain and Italy.

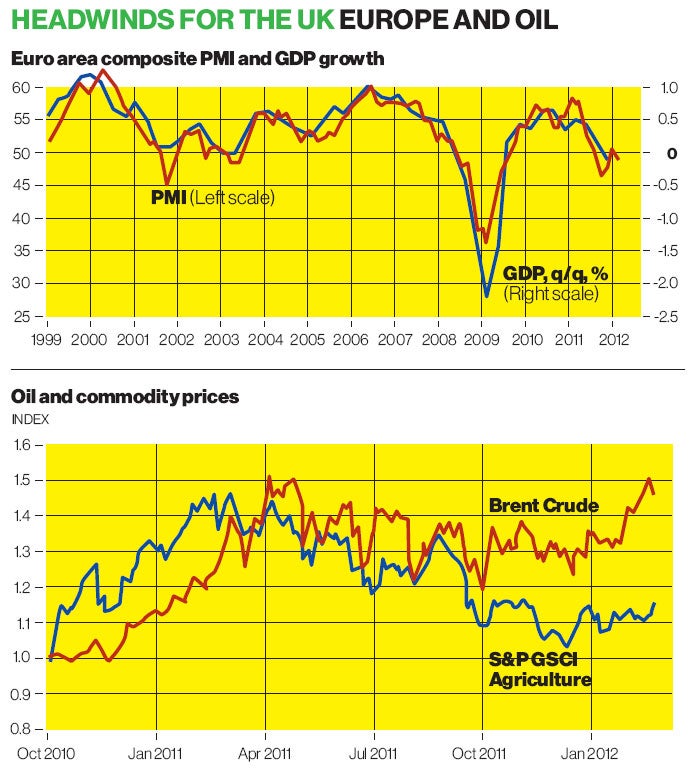

The very latest data has gone negative for two months. The top graph shows how this indicator gives a feeling for what might happen to GDP – Credit Suisse notes that this is consistent with a flat GDP, or a small minus, in the first quarter and that is probably right. The European economy is not falling off a cliff, or at least the evidence at the moment says it is not; but it may well shrink during the calendar year, as the OBR expects it to do.

The question then is whether a shrinking European economy could bring about a shrinking UK one. The answer is not necessarily, for exports to the eurozone have been falling steadily as a proportion of the total and are now smaller than exports to North America and Asia/Australasia. We are being quite successful in diversifying away from the European market. Our biggest single market remains the US and the recovery there, phew, is at last taking hold. But Europe will to some extent be a drag on the UK economy.

The other worry is oil. In dollar terms oil is not quite at its previous peak (see bottom graph) but in sterling terms it is just about there. Were it to shoot up to say, $200 a barrel, perfectly plausible were there disruption to supplies from the Middle East, the developed world might well be pushed into a double dip.

Fortunately, commodity prices in general, and food prices (see graph) have not risen as much as they did at the peak of the boom, so the inflationary impact is more muted now than then. Fortunately too, other energy prices, notably natural gas, have not come up as fast as oil this time. But an economy such as the UK's cannot hope to grow much until it gets inflation down and that will only happen if energy prices are stable or, better, fall.

Those are the two main potential negative surprises. Are there any which are potentially positive? The only obvious one would be lower-than-expected inflation. It is tantalising.

The UK has had decent nominal growth – in money terms that is – but because inflation has been so way above target, higher prices have absorbed all of people's additional purchasing power.

This is not the place to go into the debate as to why we have higher inflation than the eurozone or the US, or to savage the Bank of England's monetary committee for its insouciance to repeated overshoots. My point is simply that if we can get rising prices under control that will mean more money in people's budgets to spend on other things.

Consumers are reportedly more cheerful than they have been for a year, notwithstanding the bad retail sales figures yesterday. Since consumer spending accounts for two-thirds of final demand, even a modest revival would have a disproportionate impact on growth. It would also help tax receipts, and the Government desperately needs those.

My guess, when the final figures are eventually known, will be that growth in 2012 will turn out to be somewhere between 1 per cent and 1.5 per cent. That would not be very good, but it would not be dreadful, and if in the months ahead there are some discouraging GDP numbers, console yourself with this: they will probably be wrong.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks