Hamish McRae: Implosion in tax receipts leaves us with debts that could soon top GDP

Economic Life: Higher tax rates are unlikely to bring in additional revenue as people will adjust their behaviour, by retiring earlier, for example

I am worried about tax. Yes, I know most of us are worried about the tax rises to come later this year, whoever wins the election, but actually it is something else. It is the underlying weakness of tax revenue and the implications this has for spending, borrowing and economic growth over the next several years.

This is not a new concern, of course. What sharpens it is the new evidence of a collapse in tax receipts. January is the most important month of the year for income tax and corporation tax. As a result the Government is usually in surplus – even last year it was in surplus. This year it isn't: there was a deficit of more than £4bn. That means that for the financial year as a whole there is virtually no chance of beating the Treasury's £178bn borrowing estimate, and a clear possibility that the Chancellor may miss it.

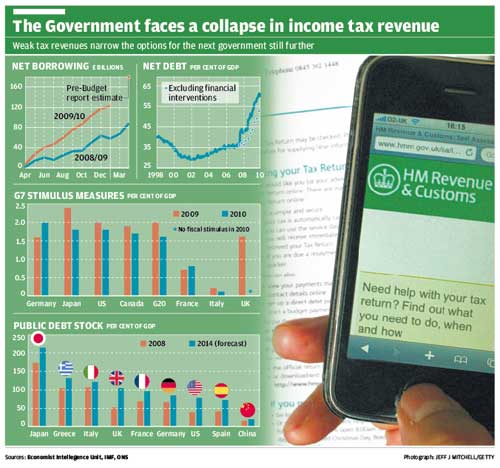

You can see the path to that £178bn number in the first graph, together with the rate of increase in total debt as a percentage of GDP in the second. Note that even without the special support for the banking system, most of which the Chancellor hopes the taxpayer will eventually get back, our national debt would still be soaring.

There is an obvious political significance here in that we still have two months to go in the financial year and thus will have March borrowing figures in late April. That will give us a pretty clear feeling for the overall borrowing for the financial year as a whole, and will, assuming the election is on 6 May, come out in the middle of the campaign. Couple that with some further bad numbers on inflation, and maybe on unemployment, and you could see Labour's position further undermined. But step back from politics and focus on what is actually happening.

The central point here is that not only is spending running well ahead of last year but revenues are falling way short. We all know cuts in spending are coming, the only issue being when. That may not be within our control because the global investors on which we have to rely for funding the deficit may decide for us. That has happened to Greece, and our deficit, as a proportion of national income, looks like being slightly higher than that of Greece. But the even greater threat to public finances is not the spending profile but the revenue profile.

Last month VAT revenue was up £1.4bn on January 2009, thanks to the return of the 17.5 per cent rate. But "taxes on income and wealth", basically income tax and corporation tax, were down from £32.1bn last year to £26.9bn this year. The problem is partly that companies have had a less profitable year, but it also seems that high earners have been hard hit too – despite their having an obvious incentive to bring income forward this financial year rather than be hit by the 50 per cent top tax rate next.

It gets worse. There is evidence that the authorities are holding back reimbursement for overpaid income tax that would normally be paid now. The reason for this may simply be that they have been flooded with repayment requests and been unable to cope, but it may be that they are deliberately trying to make the borrowing figures look less bad than they are really are. Either way, this makes the figures better now at the cost of making them worse in a couple of months' time.

It gets worse still. Next year, with the higher tax rates, you would imagine that income tax revenues would rise. But the judgement of the Institute for Fiscal Studies, based on the admittedly scanty evidence available, was that the higher rate would bring in no net additional revenue, as people would adjust their behaviour in various ways. These include retiring earlier or, for business owners, leaving profits within the business. The weakness of income tax revenues this year suggests that people may be starting already to take such action.

So when will income tax revenues recover? That really depends on the speed at which high earners' income recovers. Remember that the top 1 per cent of earners pay nearly one-quarter of all income tax, while the top 10 per cent pay more than half (53.3 per cent to be precise). So until the top 10 per cent start doing much better, income tax revenues cannot recover. True, other taxes can help a bit and we should certainly expect a 20 per cent or more rate of VAT after the election. But income tax remains the largest single source of revenue for the Government.

Given this, the numbers next year look daunting. I worry that it will simply not be possible for this Chancellor to frame a Budget that is credible at all. As you can see from the third graph, even under present plans the UK is alone among the G7 countries in not giving any further fiscal boost in the coming financial year. Other countries are keeping their right foot on the accelerator pedal. We have to ease off because our deficit is so much worse than theirs.

Now it may be that, at the present level of deficit, the adverse impact on confidence is outweighing the mathematical effect of a larger deficit. In other words, because people in the private sector know that government finances are unsustainable, they are taking action ahead of the coming squeeze. So companies are cutting investment and conserving cash, while we as individuals are trying to repair our savings. The figures confirm this to an extent. Certainly, given the size of the budget deficit, you would have expected a stronger recovery last year than actually took place.

If adverse confidence has been more than offsetting the fiscal boost from the deficit, that would be encouraging because it would mean that post-election fiscal consolidation would boost confidence and therefore help restore growth. There is certainly evidence from around the world that tough fiscal programmes, far from damaging growth, actually create the conditions for increasing it.

Let's hope so because we have no choice. As you can see from the final graph we will have a higher national debt relative to GDP than France, Germany or the US by 2014. Everyone's debts have gone up but our's have gone up faster than anyone else's. According to those estimates from the Economist Intelligence Unit the size of the debt will be more than 100 per cent of GDP by 2014. Back in 2004 it was less than 40 per cent. More of our tax revenues will have to go simply to paying interest on debt and not be available for funding public services. Not good. Not good at all.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments