Hamish McRae: Is the concept of the Brics countries still valid, 15 years after its presentation?

Economic View

And then there were two. One of the extraordinary features of the global economy over the past year has been the downgrading, you might say demise, of two of the Brics.

Russia hit the buffers, initially because of Ukraine but subsequently because of the collapse of the oil price. The World Bank thinks its GDP will fall by nearly 4 per cent this year. Now Brazil also looks like having a year of negative growth, with GDP expected by market economists to fall by about 1 per cent. By contrast both the other two members of the Bric club, China and India, continue to grow at around 6 to 7 per cent, the main question being whether this year may actually see India growing faster than China.

Both economies will recover, for the oil price has probably stabilised and may rebound, and the fundamental strengths of Brazil’s economy will reassert themselves, notwithstanding the mismanagement of the present government. There is quite a bit of “buyers’ remorse” there, following the re-election of President Dilma Rousseff. She started her second term in January, only to be beset by a corruption scandal and a collapse in the currency. But in the past few days there are signs that the government will get to grips with the various problems, even if that means greater unpopularity in the short term.

What seems to me most interesting about all this – and something to reflect on over the holiday weekend – is whether the concept of the Brics has run its course. It was clever of Jim O’Neill, then head of economics at Goldman Sachs, to take a quite crude growth model, apply it to the emerging world and to see where it led. He then had the further genius to coin an expression to encapsulate the four largest emerging economies under the Bric brand and present them as a counterbalance and rival to the G7.

That was nearly 15 years ago. It spawned a Bric summit, or rather a Brics summit, for South Africa was co-opted as a member of the club, even though it did not have a large enough GDP formally to qualify. And, a further example of the power of an idea whose time has come, there is now to be a Brics Development Bank as a rival to the World Bank. Russia, which took over the presidency of the Brics yesterday, committed itself to getting it going this year. Quite how this will fit in with the new China-led development bank, which Britain among others will also join, remains to be seen. If you were cynical, you might think that China is stepping back from the Brics and wants to run the global game of development lending itself.

The big issue, though, it whether the concept of the Brics is still valid. Early last year the projections for growth still looked pretty spot on, with if anything the Brics overtaking the G7 more swiftly than the model predicted. The last recession had that effect, for all the G7 countries went backwards, while China and India barely dipped. Now Russia, in particular, looks likely to underperform for some time, while Brazil has shot down the rankings thanks to the fall of the currency as well as hitting the recessionary wall. What has happened is the exposure of the key inherent weakness of the Bric concept: that the four countries were different in just about every respect, including demography, level of income per head, economic structure, and system of governance.

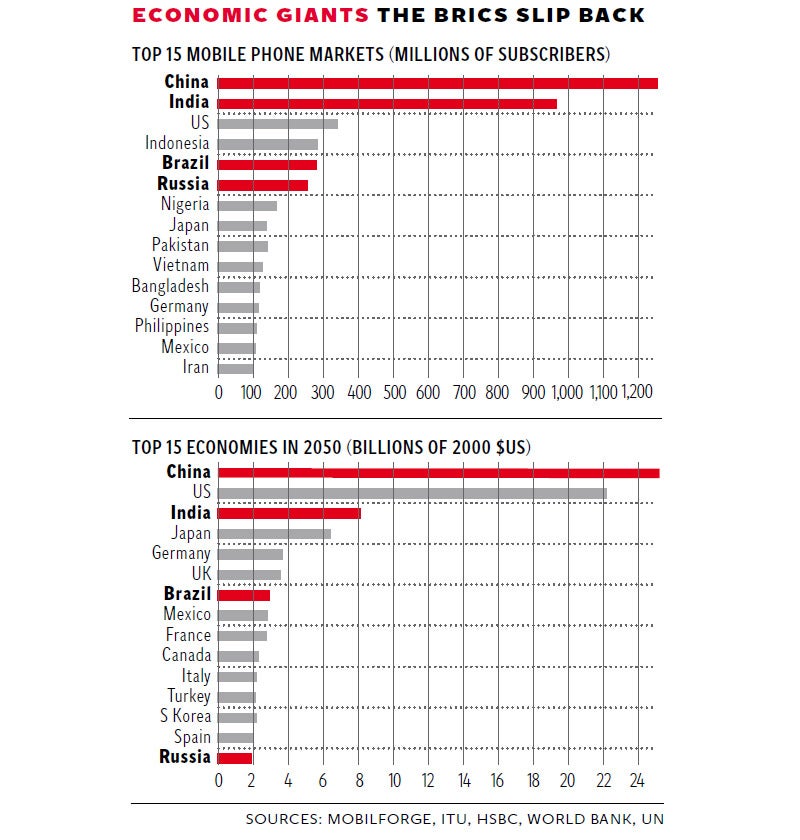

But should we dump the concept altogether? Here are two other windows on economic might, two other ways of looking at the Brics versus the G7. The top graph shows a narrow picture of what is happening now; the bottom, some alterative projections for 2050. The top is a snapshot of the number of people with mobile phones in the different parts of the world, taken earlier this year. As you can see not only China and India utterly dominate the mobile phone market but emerging countries occupy five out of the top six slots. In this particular technology four G7 countries, Italy, the UK, France and Canada do not make the top 15. So as far as mobile telephony is concerned, the Brics and their fellow emerging nations, have taken over, and none of us needs to be reminded of the economic importance of this technology.

The second graph shows the HSBC projections for the world in 2050. They did this three years ago, taking a similar model to Goldman Sachs but tweaking the inputs to produce a rather different, and arguably more credible, outcome. China is the largest economy in the world, but passes the US rather later than Goldman predicted. India is number three behind the US, but much further behind. Brazil grows well, but is still behind the UK in size. Russia did much worse than the Goldman projections showed, while Indonesia does better. Mexico does well, too.

The big point here is that while the emerging world gains ground on the G7 it doesn’t do so as swiftly as Goldman expected. The G7 will still occupy six out of the 10 top places. The UK is still number six. We lose some relevance, of course, but collectively the G7 will still matter a great deal.

Put these two graphs together and a more nuanced picture emerges. The first thing surely is that we should recognise that the emerging world will gain ground vis-à-vis the developed world. There is no question about that. Further, there is no question that in some areas of economic activity, the baton of growth will pass to these countries. But the performance of different parts of the emerging world will be very different, not only in terms of growth, but also in wealth and education. There will be some areas of economic activity where the present developed world won’t matter much. But there will be others – I would put education and scientific research at the top – where the world will still be led by the present developed nations, notably the US.

Seen in this light, the concept of the Brics has been an enormously useful one, because it made us aware of a seismic shift in power. But we need to move on from that, recognising the differences within the emerging world, but also thinking about how the developed world can continue to press forward, supplying leadership and judgement as well as technology.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks