Hamish McRae: It may only get as bad as the early 1980s – but that was a stinker

Economic Life

At what stage will the mood lighten? The annual Davos forum always provides a snapshot of conventional economic and financial wisdom – what thoughtful people currently feel about the world economy. But it is not a lead indicator, for it exaggerates the mood of the moment rather than telling you how that mood might shift. When times seem good, as they did two years ago, it is euphoric, even bombastic. Last year people were cautious but reasonably positive. Now they are profoundly worried – with good reason.

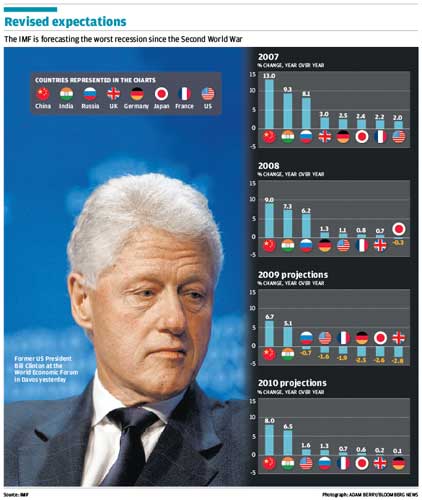

That reason was well captured by the International Monetary Fund's new forecasts for the world economy. Its prediction that the UK would be hardest hit of the major economies ruffled the Government's feathers, but the much bigger message was the massive deterioration in the global outlook this year compared with the previous IMF forecasts. It was in effect saying it had been wrong last October: not a modest slowdown this year, rather the worse recession since the Second World War, and only a very slow recovery in 2010. You can see the main forecasts in the graph, and pretty they are not.

Those of us who long felt that 2009 would indeed be the difficult year and that forecasts of a swift recovery were ridiculous would feel vindicated were it not for the fact that what the IMF is now predicting is at the outer limits of our expectations. Actually my quick tally of the IMF's forecast for the UK seems to suggest a downturn that is not as serious as our recession of the early 1980s. So as far as the UK is concerned, we would still be within post-war experience, but that is not a huge comfort, for the early 1980s recession was a stinker.

But the question that matters is whether the world economy is still broadly within the "normal" post-war cyclical pattern or heading into unknown and frightening new territory. There can be no convincing answer to that yet. In any case, people do not want to hear that what is happening is "normal" in the sense that any cycle can ever be described as that. But I took some comfort listening to two people here yesterday. One was Bill Clinton. He made two basic points. One was to echo the view of the Chinese Prime Minister, Wen Jaibao, that the crisis started in America, adding that it would be in America that the crisis would end. Unsurprisingly, he supported the new plan of President Barack Obama to boost the economy, in particular the efforts to repair the banking system. His second point was that there was an economic cycle and that there would inevitably be some sort of recovery, though one could not know its timing or its durability.

The other was Stephen Green, chairman of HSBC, one of the very few bankers prepared to go on a podium here – but then HSBC is probably the strongest bank in the world, so he has less to fear than his competitors. His view was that, yes, there had to be better regulation of the banks, but there also had to be a greater sense of morality within the economy. So regulation was not enough.

There seems to me to be two conclusions you could draw from all this. One is that there are a number of mechanical things that have to be done to secure the recovery, of which re-establishing the financial system is the most important. The other is that we have to accept that finance will be different for a generation, for the scars of this breakdown run deep.

The best parallel is not the Depression of the 1930s, but rather the great inflation of the 1970s. Then, as now, there was a similar sense of despair. The fear then was that governments would not be able to regain their authority over the value of their currencies, and that the instabilities – the strikes, the destruction of savings, and so on – would destroy the market system. Now it is the banks who are in the dock, though in reality it must be the monetary authorities and regulatory agencies that share in the blame. But the idea that the system was broken is similar. I remember a conversation at Davos in the late 1970s with Edward Heath, when he felt that the UK was too disorganised and demoralised for any government to be able to rebuild its authority. That was post the IMF rescue and before the election of Margaret Thatcher.

Well, the world did, albeit at great cost, rebuild the system. Governments recovered authority, inflation declined, and the world started the greatest quarter-century of growth that it has ever sustained. China, India and many other emerging economies adopted market reforms and helped to drive this growth.

The present efforts to reboot the world economy carry huge costs, and those will be carried for a decade, at least. If the Institute for Fiscal Studies is right, it will be longer, and the prospect of the UK not being able to get its debt back to the 1998 level before 2030 is daunting indeed. To double your national debt not to fight a world war but merely to blunt the worst of a recession is pretty dire, and the UK is not alone in the way it is increasing the burden on the next generation. The only possible outcome is a much slower rise in living standards than we have been used to, if there is to be any significant rise in living standards at all.

All this points to a slow economic recovery, but a recovery nonetheless, probably starting some time in 2010. That would be the IMF's view, and I think for once the Fund's economists have caught up with the market.

What might make it worse?

There are two obvious candidates. One is financial protectionism. We all know about trade protection and dangers of that. But we are now in danger of getting a similar pattern in finance, where banks find they are restricted in the extent to which they can lend to other countries. You can see that in the UK in the criticism that the Royal Bank of Scotland has run into for making international loans. Foreign banks have withdrawn from the British market in similar fashion. Some contraction in international lending is inevitable, but it would be very dangerous were we to try to run a global economy with only national banks.

The other is that the destruction of wealth that has taken place will have unforeseen consequences. Mr Clinton said that half the world's wealth had been destroyed in the past four months. My back-of-an-envelope calculation makes it about 40 per cent. Now you could say that the wealth was not real, and part of it maybe wasn't. But the idea that companies are poorer, people are poorer, pension funds are poorer, countries are poorer – well, that will have painful effects that have yet to work through the system.

Put these two together, and do you see the end of this generation-long period of prosperity? Actually, I think not; there will be a resumption of growth by 2011 at the latest. But they will make the pull out a long slog, and there is not much we can do about that.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks