Hamish McRae: Labour market is strong but flexibility is also key

Economic View: The best hope for any increase in real wages will be for inflation to fall below 2 per cent - that is not out of the question

Yet another strong labour-market report has been met by the usual spectrum of responses. Comments by the analysts ranged from the upbeat "more good news" and "welcome fall in unemployment" through the more ambivalent "surprising resilience" to the quite downbeat assessments that "underlying labour market conditions remain weak" and "further signs that jobs growth is slowing".

My feeling is that if adding half a million jobs in the past year is an underlying weak performance, what on earth would be an underlying strong one? Not only is employment back past its previous peak but hours worked are there too. Actually, there are some reasons to suspect job growth will ease in the coming months but for the moment the pattern remains of a slow, uneven recovery, but a recovery nonetheless.

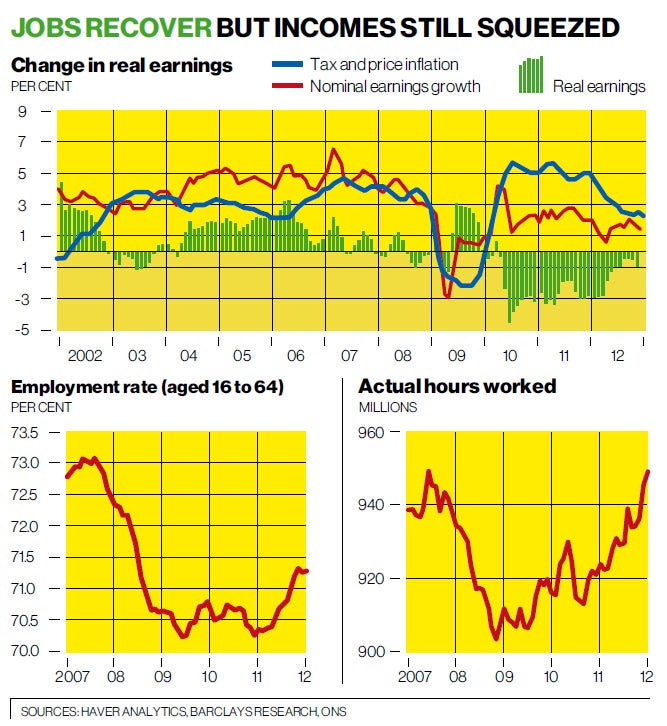

What there has not been is any increase in real incomes – quite the reverse. As you can see from the main graph, inflation has been running ahead of wage increases since 2010 – all the life of the coalition. In fact, the squeeze on living standards has been even greater, as people have also been paying down debt, a reverse of the pattern between 1997 and 2007.

I had hoped that by now the level of inflation would have dipped below nominal wage increases, signalling an end to the squeeze. But while the two lines have narrowed, they still have not crossed over: until the blue line drops below the red one, the squeeze continues. Realistically, there is unlikely to be much of an increase in money wage growth – that is stuck year-on-year at a little below 2 per cent. So the best hope for any increase in real wages will be for inflation to fall below 2 per cent, the centre point of its target range. That is not out of the question, but it would need a number of external factors to come our way, with a fall in the oil price being an obvious candidate.

Meanwhile, it remains true that while some people have been enjoying increases in living standards, many pensioners and most working people are not. Understandably, we feel a bit ratty about this.

So what happens next? The two smaller graphs show the recovery in hours worked, and less marked recovery in activity levels. So the same number of hours are being worked as at the peak of the boom but because the labour force is larger, the employment rate is still much lower than at the peak. That shows up in the unemployment data, for unemployment is one manifestation of inactivity.

One troubling aspect of this recovery is that unemployment is still stuck in the 7.5-8 per cent band it has been in for most of the time since the end of 2008.

That leads to a question that I find quite fascinating: if unemployment is not falling, or at least not significantly so, who is doing the extra work? Part of the answer is that the labour force has grown: there are more people between the ages of 16 and 65. But another part is that older people are staying at work.

The Institute for Employment Studies notes that about half of the additional half million people in jobs are over 50, and there are now almost one million people aged 65 and over at work. That is double the rate of ten years ago and up 13 per cent in the past year. The Institute adds: "Although these older workers comprise only 3 per cent of the working population, they account for 20 per cent of the recent growth in employment."

The reasons are obvious enough. For some workers, it is a desire to supplement an inadequate pension while for others, it is a desire to keep doing something useful. Older workers are in one sense much more flexible than the general body of working people in that nearly 40 per cent of them are self-employed and 70 per cent work part-time.

This raises a number of issues. One is that the idea that, as a country's population ages, it inevitably suffers an economic disadvantage may be wrong. I am aware of writing about the "demographic headwind" that developed countries face and citing Japan, the "oldest" developed economy, as an example of the way growth tends to decline. But maybe that is too simplistic. Countries that are able not just to keep older people in some form of economic activity, but also use that workforce as a flexible resource, will tend to prosper as a result.

A second issue is how to adapt the present tax, benefits and pensions systems to foster keeping people in activity. Quite a lot of the present thinking seems to relate to an employment market that no longer exists. For example, the idea of people having a right to ask their employers not to retire them is less relevant if 40 per cent of people over 65 are going to be self-employed anyway. The tax system for the self-employed is cumbersome. Maybe clearing the barriers towards self-employment would be a better way of keeping older people in work.

A third issue is the extent to which the UK economy can grow: how much spare capacity there is. That is something that has been worrying economists because it goes to the heart of one of the great questions of our time: will the ground lost in the past five years ever be made up, or has there been a permanent loss of wealth as a result of the recession?

If there has been permanent damage, the long march back to the standard of living we enjoyed five years ago will be even longer. But if there is more slack in the labour market – because it can draw on the employment of more part-timers and older people – we could in theory have several years of above-trend growth and at least get closer to where we might have been had everything not gone pear-shaped.

You can look at those labour market statistics in macro-economic terms and conclude that we are probably growing faster than the GDP figures suggest. An economy that had put on half a million jobs is not a stagnant economy. But you should also look at it in micro-economic terms. The more flexible our labour market, the easier it will be to carry on growing as demand picks up.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks