Hamish McRae: Leaders must admit failure before Europe can recover

Economic View: If the German economy were to falter, we would have the makings of a catastrophe on our doorstep

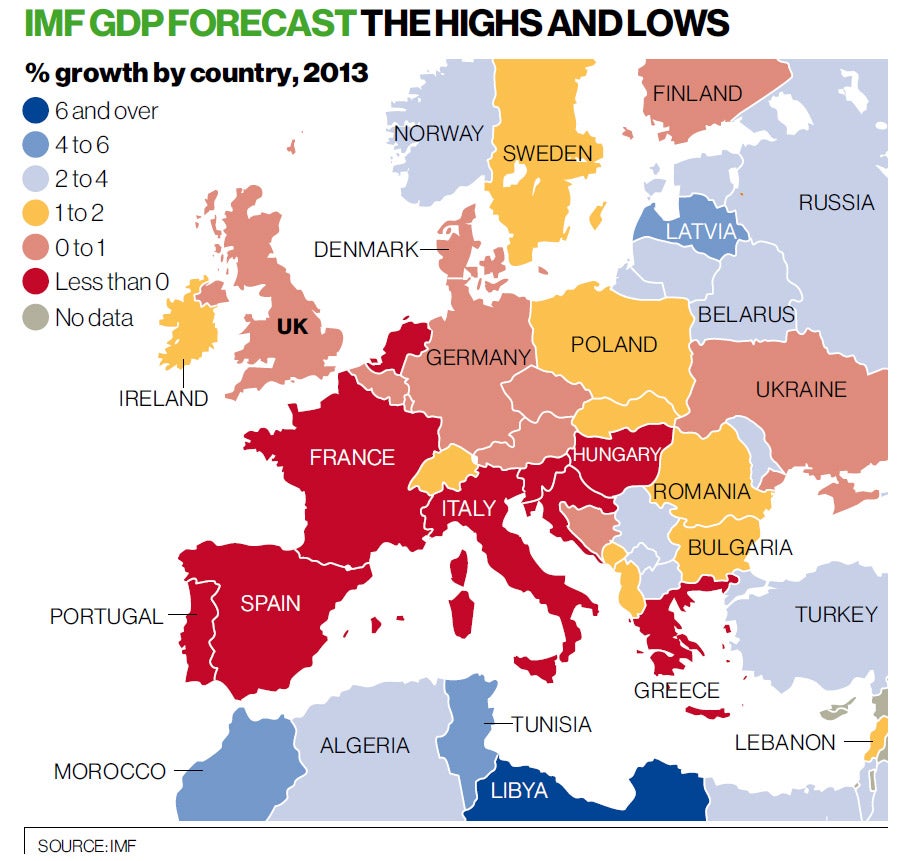

The "three-speed world" was the vivid phrase Christine Lagarde used to describe the global economy now. The developing and emerging countries are growing fastest; North America and some other parts of the developed world are in the middle; and Europe (and for this particular calculation, the UK is part of Europe) is at the bottom.

True, the UK is still projected by the IMF to grow a bit this year. Indeed, the snail-like growth of 0.7 per cent it expects for us is actually higher than that for Germany, while the economies of France, Italy and Spain are expected to shrink.

It is true, too, that growth next year is forecast to pick up. But this is not much of a consolation. As the lacklustre employment and unemployment numbers should remind us, we need continued growth to employ our increasing workforce.

In the medium term, it is encouraging that the UK retains this fundamental feature of a growing economy – more working people – but in the short term, an increase in the size of the workforce without a corresponding rise in the number of jobs leads to higher unemployment.

There is a narrow issue raised by the IMF report, and a broader one. The narrow issue, which attracted a fair bit of attention, was whether the UK should, in the face of weaker growth, slow down its fiscal consolidation programme. Should we ease the squeeze?

This issue has become rather politicised, and the Treasury will not have welcomed the "go slower" advice from the IMF's chief economist. But ultimately it seems a minor matter when set alongside the greater one: what can Europe do to improve its overall economic performance?

As you can see from the map, taken from the new IMF World Economic Outlook, there are now three Europes. The cluster of red creeping north from the Mediterranean shows the countries projected to be in recession this year.

Further north, the orange and gold shows countries, including the UK, that are expected to grow by less than 2 per cent. To the east and far north, there is a little blue, the few countries that are expected to grow by more than 2 per cent: the Baltic states, Norway – and let's be geographically correct and include Russia east of the Urals as Europe too. But if you want rapid growth, you go to the Middle East or Africa – or beyond to Latin America and Asia.

That is the striking thing. Europe is performing very much worse than the rest of the world. Indeed, the only large country outside Europe that has the prospect of economic decline this year is Afghanistan. So what is to be done?

I suppose from a narrow UK perspective we have to find ways of detaching our economy from Europe. That is not an anti-EU comment – simply an observation that we need to balance our trade relations towards faster-growing markets.

We have not done a bad job in maintaining domestic demand in the face of adversity, as you can see by the latest car sales numbers. Yesterday, there were some real shockers from Germany, which saw a 17 per cent fall in car sales in March.

France was down 16 per cent. Overall European sales dropped 10 per cent, the 18th consecutive monthly decline, bringing sales to a 20-year low. By contrast, UK sales in March were up 6 per cent. Indeed, the UK car market overtook the German one. It is only one month but that is something that has not, as far as I can see, happened since German unification.

I find this quite scary. If the German economy were to falter, we would have the makings of a catastrophe on our doorstep because it is at the moment the only thing propping up demand. There seems to have been some sort of collapse in confidence there last month, maybe associated with the problems of Cyprus, maybe something deeper.

Now it may well be that confidence in Germany, and indeed in Europe as a whole, will gradually recover as we move through this year. I think the balance of probability is that it will.

But it is easy to see something else coming along that will knock things back: look to Italy or Spain.

That leads to the wider issue. It is a fact that car sales in Europe are back to 1993 levels.

Unemployment in the eurozone is the highest it has been since the introduction of the single currency, and it will rise further this year.

Living standards are falling. This is not what European politicians said would happen when they introduced the euro.

Now it is not fair to blame everything on the euro. That would be silly. But it is fair to blame the poor performance on the broad thrust of European economic policy over the past decade and more.

To say that is not particularly to praise the UK, for we made huge mistakes too, particularly from about 2003 onwards. Rather it is to point out that Europe cannot really go on like this. Think what another decade of stagnation would do to a whole generation of young people seeking to enter the workforce.

Between the end of the Second World War and the 1990s, Europe narrowed the gap in gross domestic product per head between it and North America.

In the early years, this was essentially catch-up: we were restoring the destruction brought about by war. But from the 1960s onwards, we were genuinely narrowing the gap.

Indeed, on the measure of output per hour worked, some European countries, notably France, surpassed the US. Overall GDP per head was lower but that was because the French worked fewer hours. But over the past 20 years, the gap ceased to narrow, and seems to be widening.

Europe is falling behind. There have been various initiatives, such as the Lisbon Strategy, designed to make it more competitive, but the honest assessment must be that they have failed. The great red band on the map demonstrates that failure.

Until European politicians accept that they have failed, the region cannot begin to clamber out of its third-class status.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks