Hamish McRae: Only our politicians are keeping markets from partying like it’s 1999

Economic View: For most people in Britain this does not feel like a great recovery. For many businesses, it doesn't either

It has been a long wait, but it is just possible that UK equities will celebrate the apparent chaos in world markets by at last breaking through their previous all-time high for the FTSE 100 of 6,950.6, reached on the final day of trading in 1999. Shares were off a bit yesterday but they are only a couple of percentage points away. Given the movements we have seen, that is two days’ good trading.

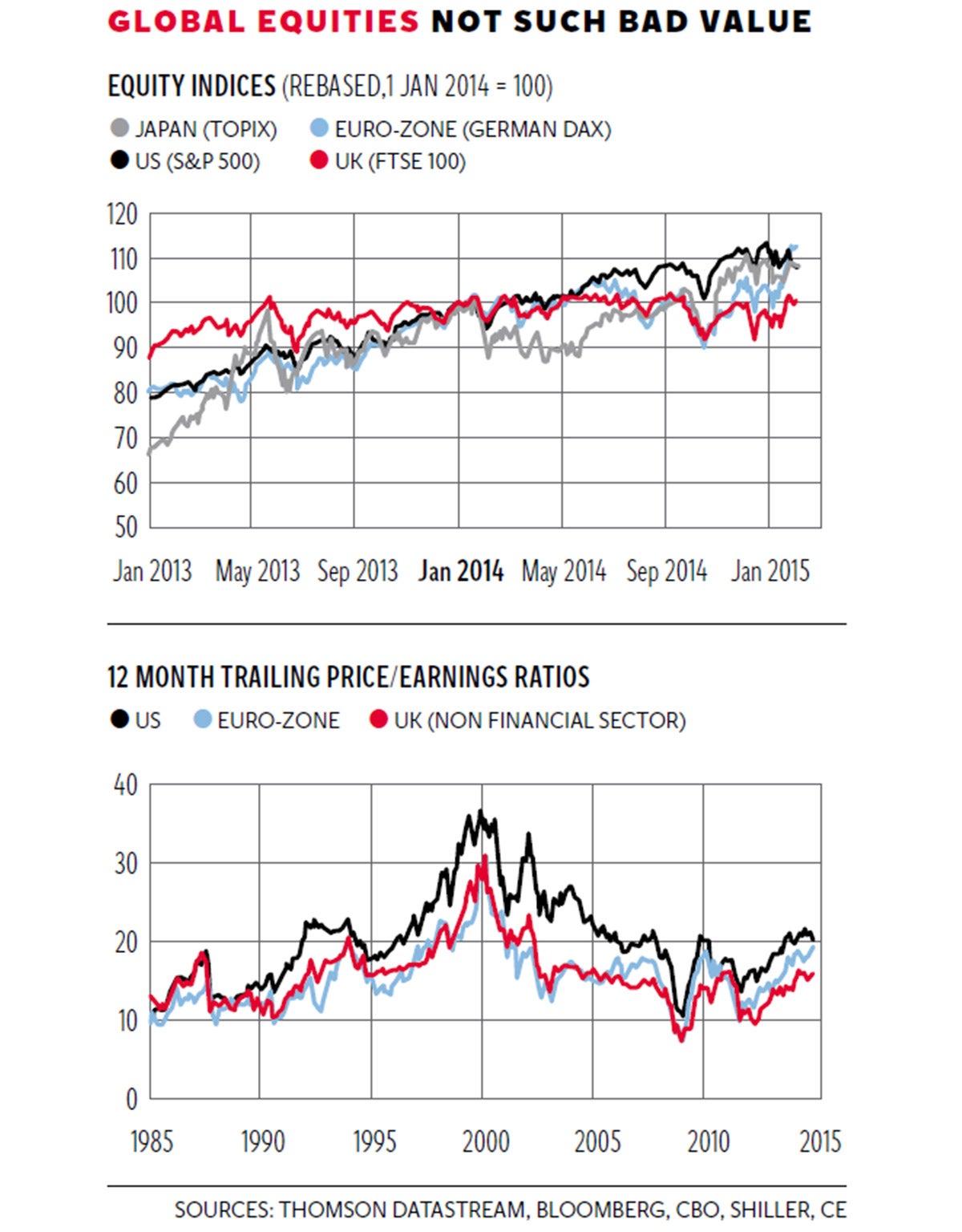

Indeed, were it not for political uncertainty here – Labour bashing companies, the Tories threatening to pull out of the EU – I suspect we would be there already. UK shares have done rather worse in recent months than European or US markets (or indeed Japanese ones), as you can see from the first chart. Of course, prices may retreat again, as they have so often in past assaults on the 7,000 barrier, but once they do go through it, I expect they will race well past.

This – and of course the buoyancy of equities in general – should give us some cause for thought. For most people in Britain, this does not feel like a great recovery. For many businesses, it doesn’t either. True, the FTSE 100 index is more of a sterling-based investment in large international companies than a stake in the UK economy as such, but since the UK has had one of the stronger recoveries in the developed world, you might have expected it to do a bit better than it has in relative terms. So what should we think about all this? Here are some propositions.

First, equities everywhere are driven by the spirit of Bruce Bairnsfather’s First World War cartoon of two Tommies crouching in a bomb crater as the shells explode overhead: “Well, if you knows of a better ’ole, go to it.” What else do you do, now that the yield on even some corporate bonds has gone negative? At least there is some possibility of growth in real wealth, rather than the certainty, or near-certainty, of losing money in bonds.

The surge in asset prices has been the result of lower short-term interest rates than at any stage in history, which, coupled with QE, was bound to have distorting effects. But what is interesting now is that the first rise in US rates is in sight (and actually UK ones too), yet equity investors seem sanguine about that outlook.

Second, what is happening in Europe, and particularly in Greece, does not seem to matter. Indeed the rock-star status accorded to the country’s new finance minister, Yanis Varoufakis, suggests a certain regard for his swagger. His book The Global Minotaur, which blames much of the world’s troubles on America, seems to have sold out on Amazon – or at least the edition that is rather cheaper than the one I quoted yesterday has. Nothing like sudden celebrity appeal to send people scurrying to see what you think.

Arguably the more serious challenge to the European dream comes from Russia, but again, even a civil war on the borders of the EU does not seem to have fazed European investors. The prospect of the ECB printing a trillion euro overrides any such concerns.

Third, global equities are not that bad value: maybe not great, but certainly not dreadful. The bottom graph shows the trailing price-earnings ratios for US, European and UK shares (ex-finance) since 1985. P/E ratios are not the most-sophisticated of benchmarks; indeed they are pretty crude ones. But maybe on a long view simplicity is an advantage. As you can see, while ratios were lower in the 1980s and early 1990s, present values, especially for UK shares, are really quite modest. Even US shares are miles from the heady levels of the turn of the century – although Capital Economics, which did the graph, argues that valuations are relatively stretched.

Fourth, the world economy is in the middle of a cyclical growth phase. We don’t know how long it will last, nor do we know how severe the eventual downturn will be. We don’t know how long the boost from the collapse in oil prices will continue to drive real growth, although we do know that European consumption is at last climbing, which must be a relief. And we know that consumers in the US and in Britain are pretty optimistic.

If, therefore, there will be another three or four years of decent cyclical growth, that will underpin dividends, which in the absence of much of a return on bonds, will keep shares attractive.

Finally, I think it is worth noting that many people, particularly investors, are still cautious, even frightened. The mood is a very long way from the heady days of the dotcom boom or, as we now know, the dotcom bubble. If there is a bubble – asset prices artificially boosted by unsustainable forces – then surely it is in bonds, not equities.

So can you have a continuing strong performance from equities, if bonds go into reverse? I suppose that depends on the reasons why bonds might go into reverse. Would that be more confidence, particularly in Europe, that growth has resumed and that, accordingly, the shelter of fixed-interest securities is no longer necessary? Or would be a revival of concerns that some European governments are not able to service their debts?

What I think you can say is that is a world of great uncertainty, investing in the giant companies that provide the goods and service that we all buy every day cannot be really stupid. Maybe the thinking behind that rather back-ended compliment will be the force that eventually does drive the FTSE 100 index to a new peak. How many people in those heady final days of the 20th century, though, could have imagined that it would be 2015 before British shares would again see that level?

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks