Hamish McRae: Putting on a show: an invaluable advert for brand Britain

Economic Life: I cannot quite see how we monetise the Royal Family but, to borrow from Napoleon, a nation of shopkeepers ought to be able to work something out

It will, apparently, be the largest-ever televisionaudience ever, with more than 2 billion people – one-third of the world's population – expected to watch at least part of today's royal wedding. If that proves right, it will be double the previous record of the 1 billion that watched the opening ceremony of the Beijing Olympics. So what do we, as a country, get out of it?

Click HERE to upload graphic (240k jpg)

That might seem a rather nerdy question to pose, just the sort of question that justifies economics' soubriquet of "the dismal science". Any tally of the additional money spent by visitors, setting that off against the loss of output because of the extra bank holiday, does have a dismal ring to it. But what lifts the whole matter to a differentlevel is the value and role of a brand. On its ability to attract a global television audience, the British royal family would appear to be the greatest brand on earth. But is it worth anything?

On conventional arithmetic the impact of the wedding on the economy looks to be broadly neutral, maybe slightly positive. On the one hand it is disruptive, not just because of the extra day of holiday but because it comes in the middle of a whole wodge of extra days off, with the late Easter jumbling up with the early May bank holiday. You would normally expect any lost output to be recovered quickly, as common sense would suggest. But if you look back at the precedent of the Queen's golden jubilee in June 2002, there was indeed a sharp fall in industrial output that was not immediately offset by subsequent gains.

On the other hand, the wedding is global in a way the jubilee was not and the commercial sector in London has responded vigorously to the occasion, with all sorts of incentives for visitors to part with their cash. There has been a boom in tourist numbers with estimates varying from 200,000 to 600,000 extra visitors. And I suppose all those foreign news crews who are developing coverage for the 2 billion viewers must be spending a fair amount extra too.

PricewaterhouseCoopers has attempted to put some numbers on this whole thing, estimating that some 550,000 people will witness the event in or around Westminster; that 560,000 people will have travelled to the capital; and that the commercial benefit to the London economy would be £107m. That is helpful, particularly at a time such as this, but it is not huge in the context of a regional economy of upwards of £200bn a year. It depends on how you measure it, but I saw calculations recently that ranked the London economy as the third largest in the world, behind only New York and Tokyo. PwC notes that the Olympics next year is expected to attract more than 10 times the number of visitors, and that they will stay for around a fortnight, not just a day.

Put all this together and I would guess that there is a net plus, particularly to London, but it will not be huge in the context of the whole economy. But in the longer term it reinforces the British brand, gaining publicity that money literally could not buy. No promotional video for the UK could conceivably do what this wedding does.

Now you may say this is not the image that Britain should want to sell to the world, in that it might make the country appear backward-looking and is not related to current realities, problems and achievements. There are two objections to that.

One is to point out that countries cannot control the image they present to the world. For mostpeople the US is what people see in Hollywood movies or TV soaps. As anyone who knows that country well, the reality is vastly more attractive than the image. For France, the perception in the UK at least is some odd amalgam of old nouvelle vague films and Peter Mayle's tales of life in the Midi, spiced with the odd visit to the Calais supermarkets. Even China cannot really control the image it shows to the rest of us, and anyone who goes there would find the reality is more eye-opening, both positively and negatively, than they could have believed possible.

The second reason is that the spectacle element of the wedding does indeed fit in with one unique role in which London, in particular, finds itself occupying. It has become the world's premier urban resort – the most visited place on earth, in the sense that more people fly through its airports than anywhere else in the world.

Unlike that other great European resort, Paris, it is not just a place that people visit; they also come to work. It is a resort where people work as well as play. The London commuter region has the largest number of non-national professionals anywhere in the world. Putting on a show like this anchors and reinforces this role.

Now you can push your luck. Arguably, London did overprice itself. Arguably, the UK came to depend too much on the surplus it generated and the current attempt to rebalance the economy away from the region reflects that. But the plain fact is that if the region's economy prospers it will help the whole economy and in any case this wedding is about the British brand, not just the UK one.

Brands have to justify themselves. They can become tired. That can be damaged by inappropriate actions. They can be challenged by newcomers: look at the way the Japanese car bands have surpassed those of Detroit. But one of the effects of the spread of wealth to Asia is to increase the importance of brands, particularly at the very top end of the market. Look at the way China buys top-ranked clarets or S-Class Mercedes. I cannot quite see how we monetise the brand of the Royal Family – to try explicitly to do so would be to devalue the brand. But to take Napoleon's jibe to heart, a nation of shopkeepers should be able to figure out a way. And the economy needs some help.

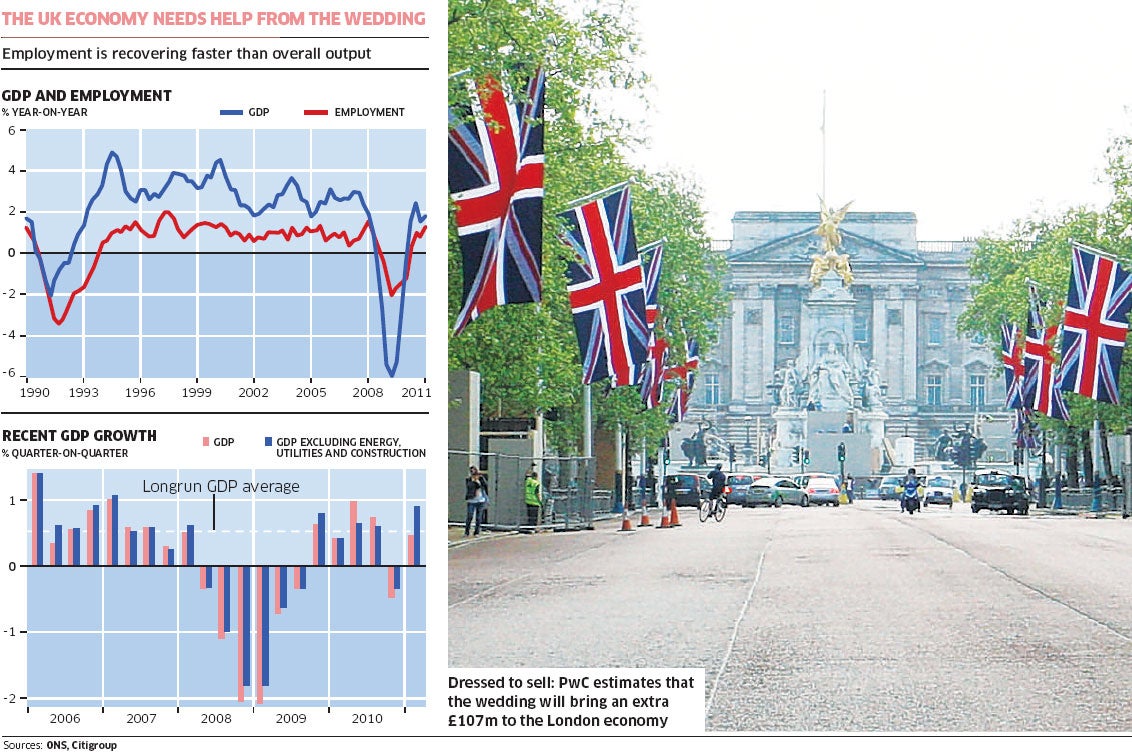

So what of those first quarter GDP figures, showing 0.5 per cent growth, which was only enough to reverse the loss of output reported during the last quarter of last year? My own view remains that when the figures are finalised in a couple of years time we will see that there was indeed some growth over this period, though of a muted nature. Meanwhile there are some slightly encouraging details in the data, highlighted in the two graphs.

One is that employment is now growing decently, at pretty much the rate it sustained from most of the past decade. The other is that if you strip out construction (distorted by the weather), utilities and energy (distorted by a number of things including the oil price) the economy has done rather better these past six months than the overall figures would suggest. That is on the official figures. Citigroup has been digging into the rest of the data and reckons that the economy has been growing at or even above its long-term trend.

But – and this is a big but – the lacklustre performance may be discouraging enough to make the Bank of England hold back on increasing base rates at its next meeting. My worry is that if it does so that may mean it has to increase rates faster through next year.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments