Just saying sorry – and meaning it – could save banks money and effort

Outlook: The Financial Ombudsman today reports that complaints are on the rise again

Could solving one of banking’s most intractable problems really be as simple as saying “sorry” in a way that makes people feel the apology is meant?

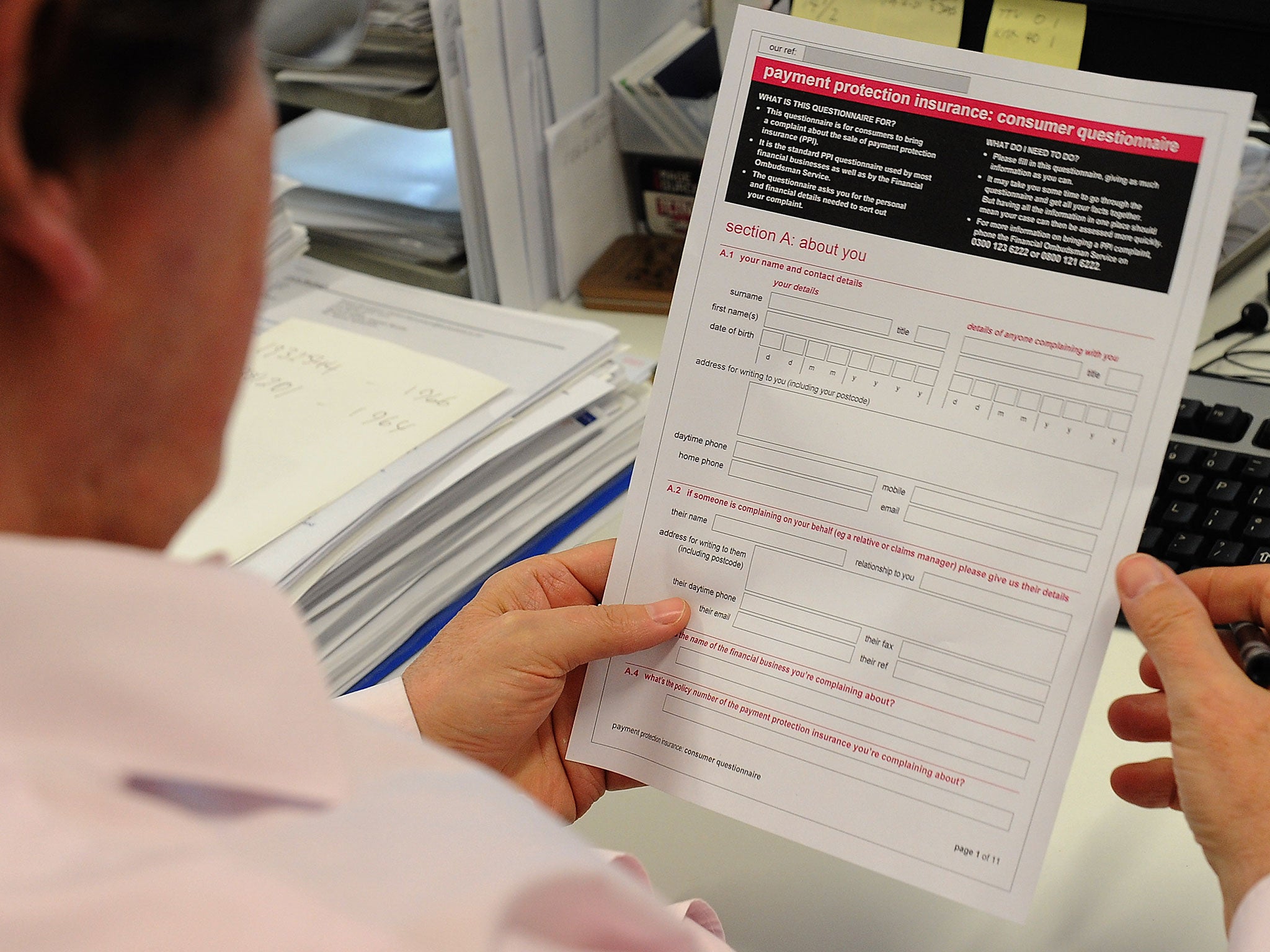

The Financial Ombudsman today reports that complaints are on the rise again, if you strip out the payment-protection insurance (PPI) scandal. Guess which industry is on the naughty step?

An overall rise of 3 per cent to just over 57,000 complaints for the financial-services industry as a whole in the first half of this year was fuelled by a 7 per cent increase in gripes about, you knew it, banks.

It’s true that PPI complaints were down by about a half, but that issue still accounted for 134,000 new cases and with 2.5 million set to be re-reviewed by the banks themselves at the behest of the Financial Conduct Authority (FCA), that scandal is not even close to being put to bed.

Interestingly, the Ombudsman says that even before the FCA stepped in a lot of the complaints it was handling were repeats. These have included people querying the way their case was handled, or the amount of compensation they were offered.

Sometimes they approached the Ombudsman after being driven to distraction by those chilly letters filled with acronyms and legalese that are put together by computers with a screen printed signature of some beetle-like non-entity added to the bottom.

The Ombudsman says a huge weight of files are being generated simply because customers don’t feel they have been listened to.

At this point, the industry’s defenders will likely jump in and point to the sheer scale of the PPI review that banks have been conducting, which makes some sort of industrialisation of complaints handling not just necessary but essential.

That’s not unreasonable. But the Ombudsman can point to the fact that it too is dealing with an industrial process and that showing customers – who have after all been ripped off – a little love needn’t cost all that much.

A little thought being put into the letters that are sent out, their presentation, on the training given to staff and the way the process works could count for a lot. Thousands of man-hours of complaints-handling work could potentially be eliminated and the industry might save itself a big chunk of the costs it has been wracking up.

There’s a story the Ombudsman tells about the customer who rings a bank up to complain. They’re offered £50 “go away” money. Explaining that they’re still not happy the person on the other end of the phone says gruffly: “Well, d’you want the money or not?”

This is why we won’t likely see the volume of complaints easing anytime soon. You’d think that by now someone might have seen the business case for doing things a little differently. But it looks like billions more will be wasted before the penny drops. If it ever does.

Expanding Heathrow is the least-worst option

If its economy is to flourish over the coming decades the UK needs to see a step change in capacity at its airports, and particularly at those in the South-east. Like it or not, that means Heathrow.

It’s true Heathrow’s expansion isn’t a particularly palatable option. It’s an unlovely introduction to this country at best. The environmental cost of expanding it will be considerable and its neighbours will be outraged. But none of this changes the fact that it is still the least-worst option. This was abundantly clear even before Sir Howard Davies assumed the role as head of the Government’s Airports Commission. It will strain credibility if Sir Howard and his colleagues come to any other conclusion.

This country is being damaged by the fact that businessmen from its rivals can simply hop on direct flights to South-east Asia that simply aren’t available from London.

Eurosceptics like to argue that the UK should forget about a declining EU and concentrate on trading with the world’s most economically dynamic region. It is ironic that a man who many see as their potential champion is doing everything in his power to frustrate that ambition.

Despite the deals, Barclays shares are still too cheap

Sometimes the stock market makes little sense. Take Barclays. It’s just announced the sale of two businesses, in Spain and the United Arab Emirates, realising a net loss of £500m and a profit of £100m respectively as its de-risking efforts continue.

The Spanish deal, in particular, looks hurried and Investec’s Ian Gordon, for one, has questioned whether Barclays really needed to take quite such a hit.

All the same, the deal does improve the bank’s capital and leverage, while demonstrating it’s serious about getting shot of the junk parcelled up into its bad bank – sorry, non-core division.

All of which begs the question, why are the shares so cheap? It is true Barclays has lots of regulatory issues to deal with – which could lead to potentially enormous fines – but the bank is hardly alone in that. And even with investment banking struggling, should the shares really trade at a whopping 30 per cent discount to the value of Barclays’ in force book of business, making it 20 per cent cheaper than even RBS?

Wags call chief executive Antony Jenkins “Saint Antony”. Numbers like that make one wonder what he has to do to bring in the worshippers.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks