Nikhil Kumar: Tim Geithner's plan would put an end to short-term deals and drama on debt

US Outlook Here we go again. It's been less than two months since the noisy debate over the fiscal cliff and now Washington is fighting over the awkwardly named sequester, a package of spending cuts worth around a trillion dollars over the next decade.

The first round, worth some $85bn (£56bn), kicks in at the beginning of next month. Already, the United States defence department, which will bear the initial brunt, has warned nearly a million civilian employees that unless the cuts are averted it might be forced to cut back on their hours. Among others, the unemployed will be affected, with many facing a reduction in benefits.

In all, Douglas Elmendorf, the director of the congressional budget office, a non-party-political body, reckons the cuts could lead to some 750,000 job losses this year.

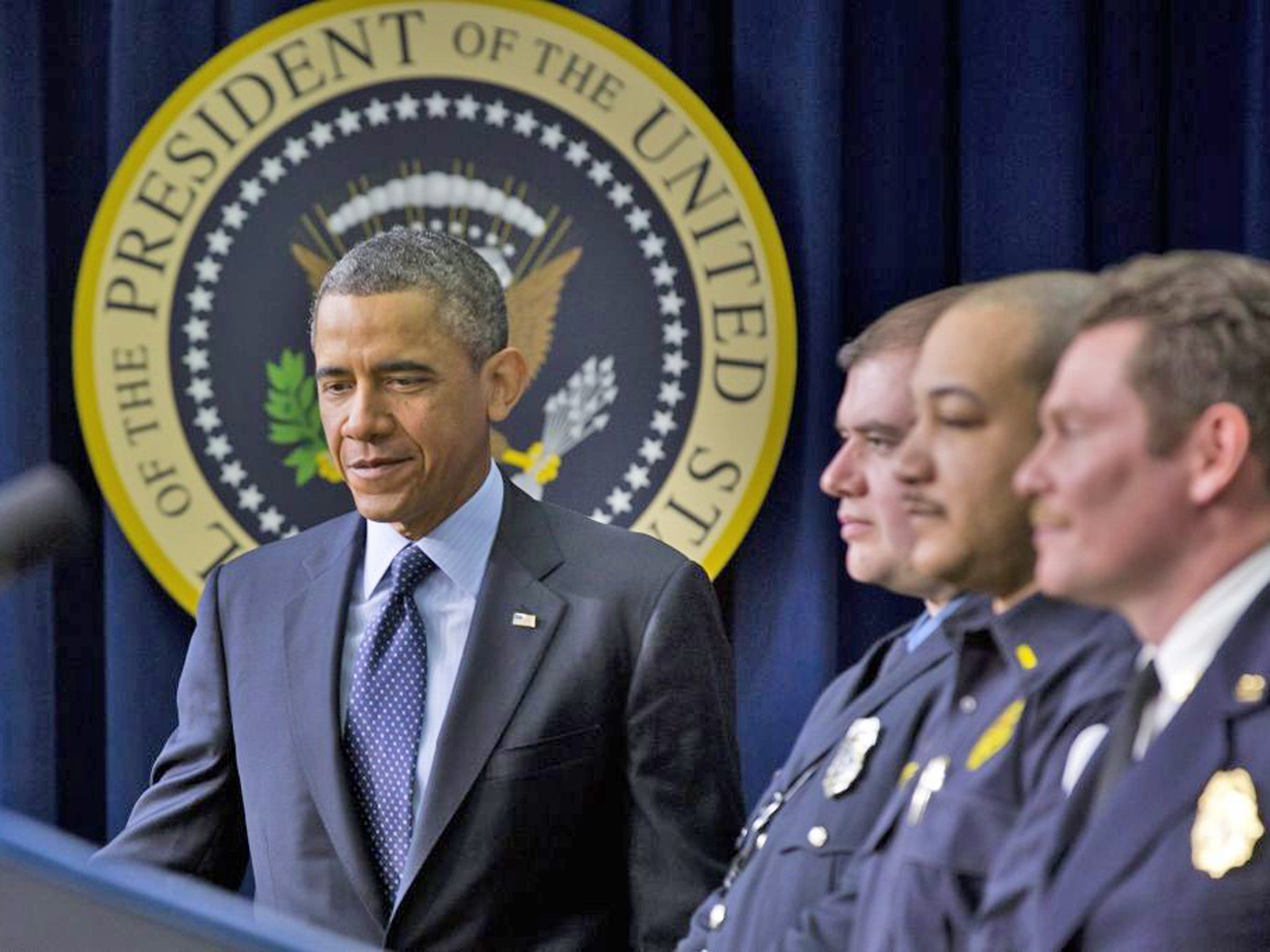

What else might the cuts mean? Here's President Barack Obama, speaking this week: "Emergency responders … their ability to help communities respond to and recover from disasters will be degraded. Border Patrol agents will see their hours reduced. FBI agents will be furloughed.

"Federal prosecutors will have to close cases and let criminals go. Air traffic controllers and airport security will see cutbacks, which means more delays at airports across the country. Thousands of teachers and educators will be laid off."

Sounds bad, doesn't it? And it could be but, if you can believe it, this is just the warm-up act. The real fight isn't until May, when the issue of the debt ceiling again comes up for debate. While Washington may yet reach a deal to push back the cuts, it will have to revisit the arguments for and against budget cuts when the federal borrowing limit needs to be extended.

Yes, the debt ceiling, which has been suspended, but not dealt with in any meaningful way. Democrats and Republicans only delayed a showdown when they passed a law to suspend the limit last month.

In fact, it was the debt ceiling which led to the creation of the sequester. Back in 2011, Republicans in the US House of Representatives refused to raise the government's borrowing limit without any significant cuts to the federal deficit. Democrats resisted without higher taxes to raise additional revenue.

A deal was eventually reached to resolve the debt ceiling issue (for a while), and put the deficit issue before a bipartisan committee, which was given a deadline of January this year to come up with a plan to balance the books.

If it didn't – which, unsurprisingly, it didn't – the sequester cuts would kick in. The only reason they didn't was because the fiscal cliff deal kicked the can down the road. But now we're there.

No doubt another short or medium-term deal beckons. And then another one when the debt ceiling debate is reviewed.

The only solution, surely, is the one floated by Tim Geithner last year: give the executive branch the power to raise the debt limit as and when necessary. Congress could pass a resolution to block any increase, but the President would have the power to veto it. However, and this would ensure meaningful oversight, not repeated, meaningless bickering, if Congress felt particularly strongly about it, then lawmakers would have the power to block an increase with a two-thirds vote to override the veto.

The Republicans claim such a shift would amount to a power grab. In reality, it would only bring the US in line with other countries; Congress, after all, authorises spending – not the President. It would also spare us the pointless partisan drama and the economic uncertainty, which is the last thing the American economy needs as it attempts to recover.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks