The watchdogs are pushing robo-advice, but who will take it?

Outlook

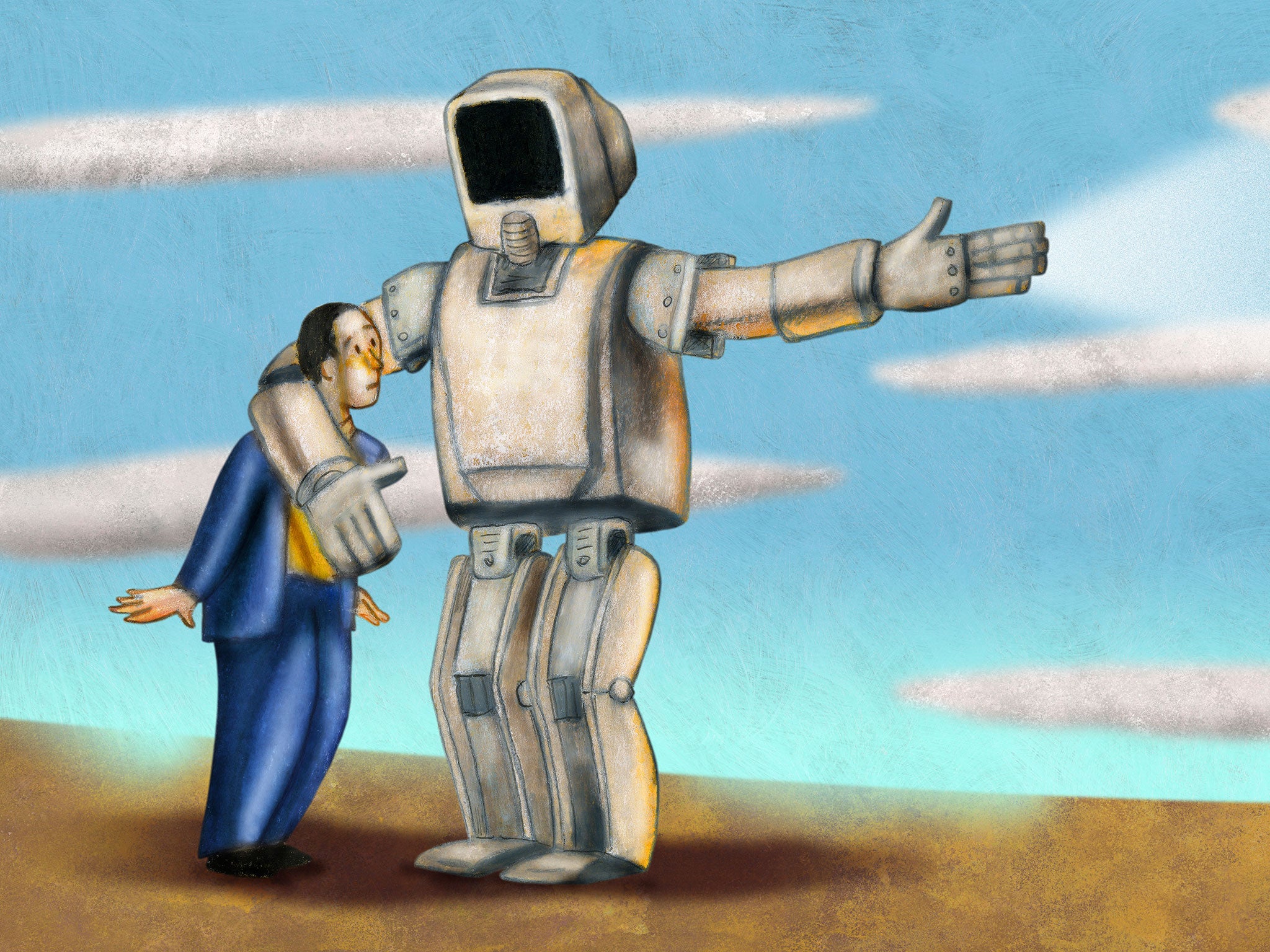

A robot doesn’t wear a shiny suit, drool over commission payments, or attempt to steal your pension. Perhaps that is why the Financial Conduct Authority and the Treasury are keen on what’s been rather clumsily dubbed “robo-advice”. There you were, worrying about AI leading to an army of Terminators when it’s actually just going to tell you how much you need to secure that little cottage on the Devonshire coast you’ve been hankering after for your retirement.

The apparent endorsement of machine intelligence with cuddles is contained in a rather windy report from the FCA and Treasury about how best to get financial advice to people who can’t afford £200 an hour. The report actually manages to make the term “robo-advice” sound snappy: it prefers “fully automated advice models”.

Their overall aim, however, is a laudable one. The so called “advice” gap they want to plug has left millions of people swinging in the wind when it comes to financial planning. The DIY approach can be complex and daunting. When you’ve a mortgage to pay, children to feed and a job that makes you anxious, it is entirely understandable that you may decide that you have worries enough and tomorrow can look after itself.

Part of the problem with the report is that it has been overseen by the Treasury’s head of financial services, Charles Roxburgh, and the acting chief executive of the Financial Conduct Authority, Tracey McDermott. These people live in a strata so far removed from the people they’re trying to reach that they might as well be on a different planet.

It’s not that their tome is entirely bereft of worthwhile ideas. There are some things designed to make life a bit simpler for financial advisers, and to cut the cost of regulation to them. There is also a recognition that the process of advice giving has become so full of bureaucracy and regulation it is putting off people who might help (such as employers) for fear of incurring sanctions. Suggestions about how that might be addressed are included. However, alongside all that there is also lots about working parities, and challenges to the industry and so on.

We’ve been here before. The question about how to get good, cost effective advice to people, without allowing the sharks to make merry, has been raised repeatedly. The fact that the FCA/Treasury report contains more than 20 recommendations, tells you how hard coming up with a definitive answers is proving to be.

PS Royal Bank of Scotland just announced a load of job cuts as a result of its pioneering work with AI. Still think it’s cuddly?

Goals is sent off – to the United States

Goals Soccer Centres has hit a screamer right into the back of its own net, with a rotten set of results. Profits have been disappearing faster than home fans at half time when their team is down 6-0. The five-a-side pitch operator, in which Sports Direct’s Mike Ashley recently bought a stake, is struggling for customers, suspending domestic expansion plans and pinning its hopes on the United States. What’s gone wrong?

Goals talks up the benefits of its premium offer with its self contained, state of the art, fully floodlit pitches. The fact that there’s no running around to ask “please can I have my ball back” if someone boots the ball miles out of play because they fancy an early half-time orange (or can of lager) … well surely that’s worth a couple of quid extra per player? Or whatever the premium costs when compared to the National Lottery funded charity affair around the corner?

The trouble is it’s not, which is why competitors from the third sector and elsewhere are snapping at Goals’ heels. Cheap is good when you’re the chump charged with doing the booking and recovering the cost from players who might not like the idea of paying you. Moreover, the beauty of five-a-side is that you don’t really need premium unless you have a corporate expense account to foot the bill for you. Pretty much anywhere will do for a group of mates who just want a kickabout.

So it’s off to the US for Goals, where football, sorry soccer, is admittedly growing fast. Can the lure of five-a-side tempt people away from softball or games of pick up basketball at the local playground? So far, the company says the results are encouraging, and the potential could be limitless if Goals proceeds with a degree of caution with regard to locations. The only problem? How long before our American friends discover the joy of jumpers for goalposts at the local park.

Don’t do it, George... step away from the cuts

Some advice for the Chancellor from EY’s Item Club of economic forecasters when it comes to the subject of cuts: don’t.

Its members point out that if George Osborne presses ahead he may simply serve to make an already weak looking economic outlook worse. Hang fire until things pick up, is the club’s message, and it is a sensible one. With a slowing world economy, along with the self-inflicted wound of an EU referendum, the outlook is less than optimistic. Throw fresh cuts on to that fire and the economy may burn. Moreover, the low-hanging fruits have already been picked. Further savings will be harder to identify and may prove counterproductive.

The problem is against the economic case laid out by the club is the political totem to which Mr Osborne has attached his colours: that of achieving a budget surplus by 2020. Mr Osborne’s political imperative is almost certain to win over the economic one. Even if the end result sees him cutting off his nose to spite his face.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks