What exactly the fall in inflation means for your money

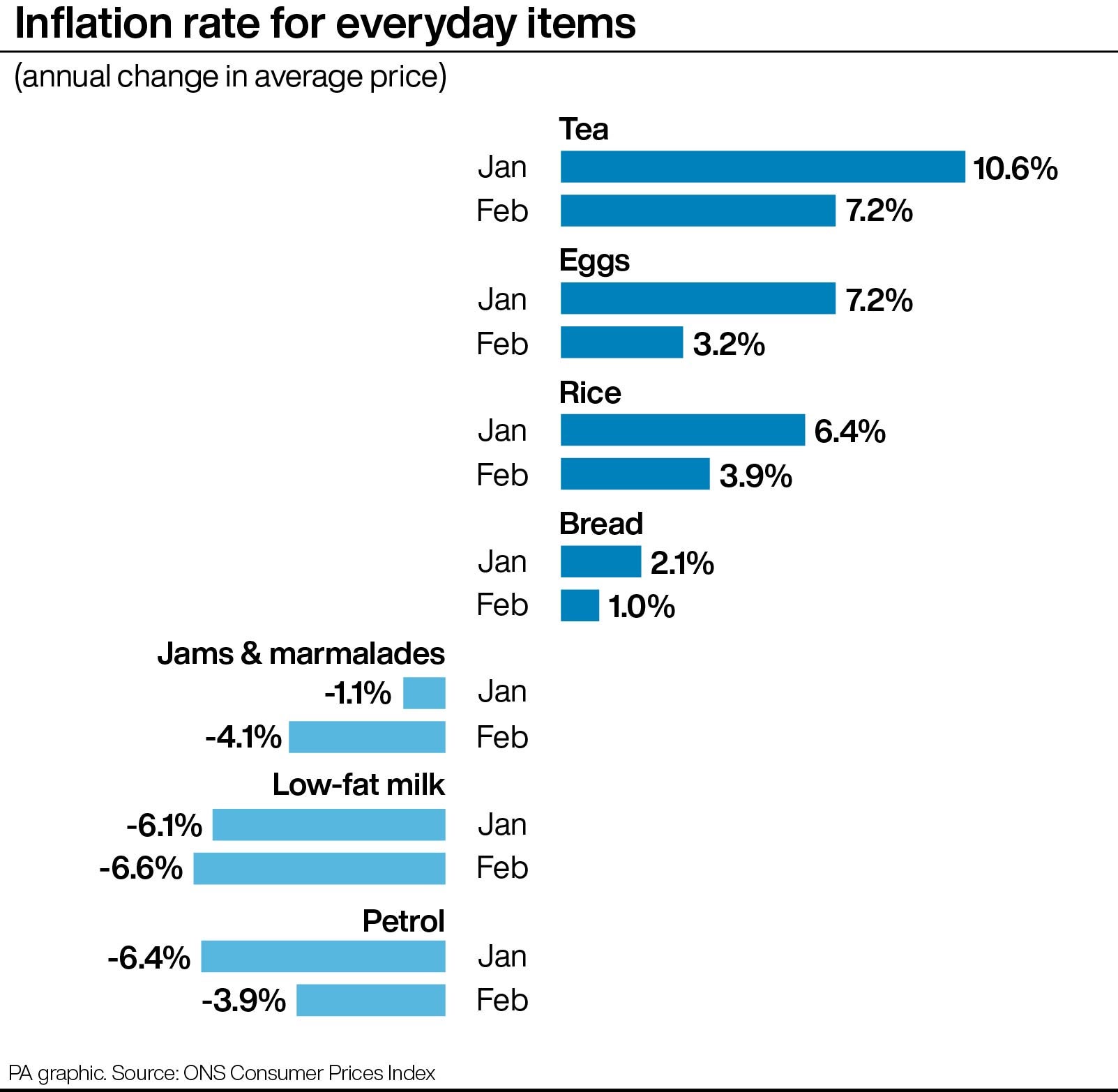

The big driver of the drop is a slowdown in food, drink and hospitality prices

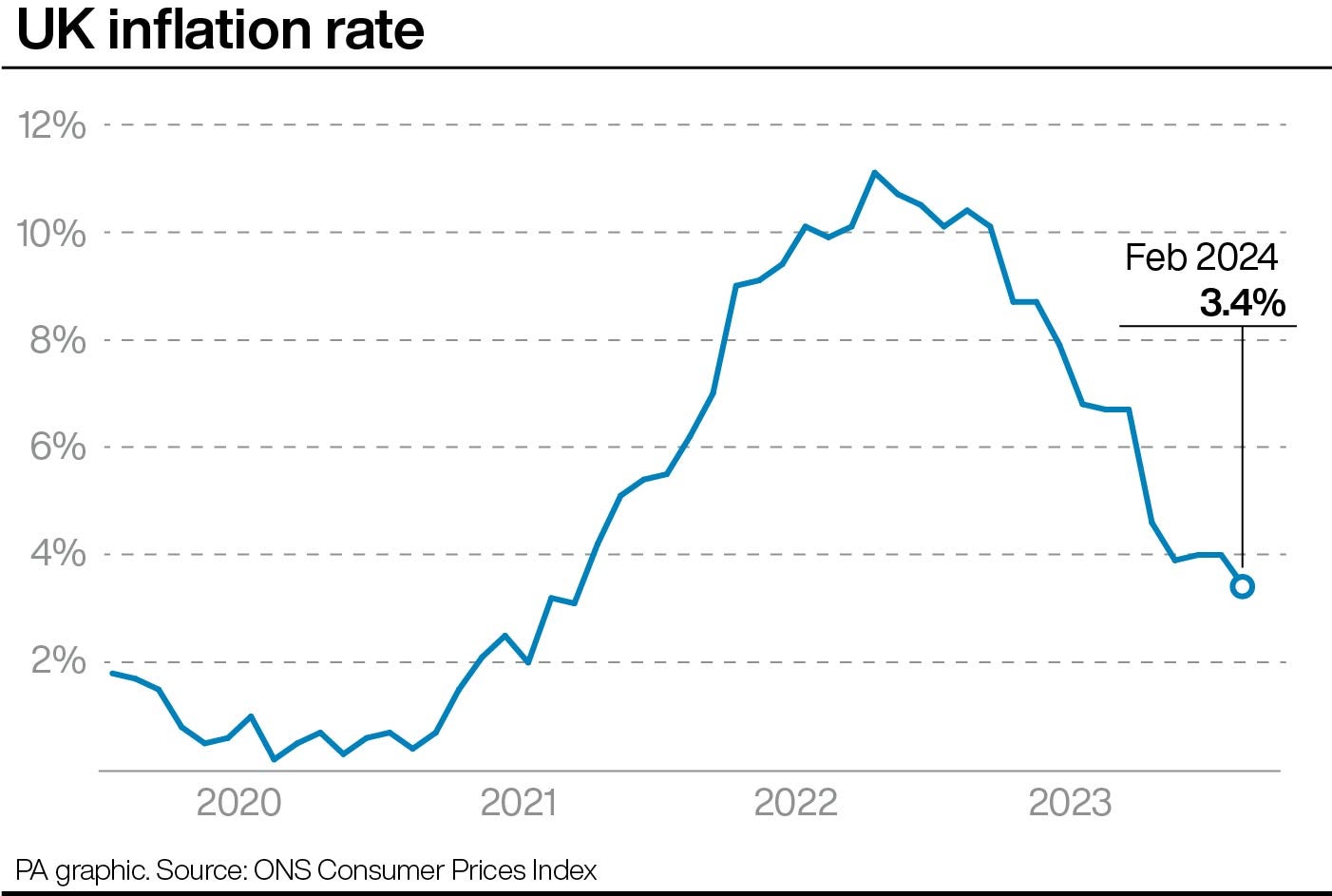

Last month, the rate of inflation in the UK plummeted to the lowest it has been over the last two years. Official figures have shown that the drop is due to the relaxing of food prices for households seriously impacted by the cost-of-living crisis.

According to the Office For National Statistics (ONS), the Consumer Prices Index inflation fell to 3.4% in February, from 4% in January, which is the lowest it has been since September 2021.

As a result, the level of inflation is nearer to the 2% target set by the Bank of England, just before its interest rate decision takes place on Thursday.

Grant Fitzner, chief economist at the ONS, said: “Food prices were the main driver of the fall, with prices almost unchanged this year compared with a large rise last year, while restaurant and cafe price rises also slowed.”

So what exactly does the fall in inflation mean for your money? Finance experts share everything you need to know…

What is inflation?

According to Rajan Lakhani, personal finance expert at smart money app Plum, inflation measures the pace at which the price of goods and services in the UK is rising.

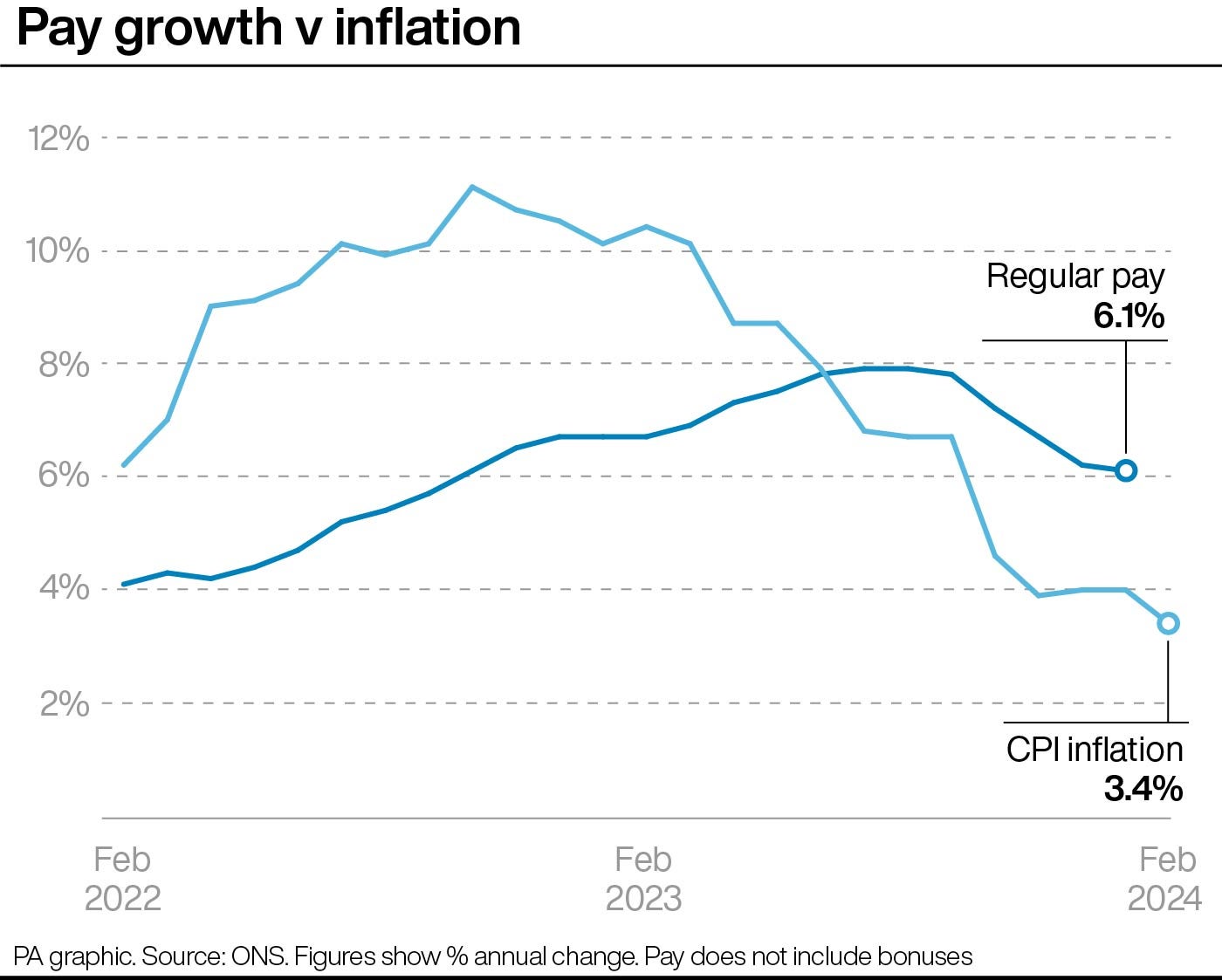

“The ONS looks at price changes over the previous 12 months to calculate inflation. [But] the key thing to remember with inflation is when inflation is falling, like today’s announcement, that doesn’t mean prices have fallen. It just means on average prices are rising less quickly,” Lakhani said.

“For example, the ONS would measure the price of items in February 2023 and what it is in February 2024.”

Mortgages

For Rob Morgan, chief investment analyst at Charles Stanley, mortgages and other forms of borrowing are not directly impacted by inflation.

“But many products are affected by expectations for the Bank of England base rate, which is influenced by it,” said Morgan.

“Recently, lenders have been increasing rates a little, after hopes of an earlier string of interest rate cuts receded. Today’s figures do little to move those expectations as they are already baked into market rates. However, if inflation remains on a downward trajectory and interest cuts arrive later this year as predicted, then borrowing costs should come down a little. Any falls will be modest compared to the steep rise since early 2022, though.”

Lakhani added: “Lower interest rates would be good news for mortgage holders, whether they have a variable or tracker mortgage, or are having to remortgage this year.

“Higher mortgage rates, which are influenced by the base rate expectations, have been hitting mortgage holders hard. The quoted monthly interest rate on a 2-year fixed mortgage loan to value (LTV) 75% was 1.64% in January 2022.

“The quoted mortgage rate for the same type of product two years later is 4.73%. For a 25-year £200,000 mortgage, that means an extra payment of £325 per month (£1,138 vs £813), a major increase.”

<strong>Savings</strong> and interest rates

An interest rate is the additional money you earn upon making payments into a savings account with a bank, app, or building society, Lakhani explained.

“It’s important [to make] the most of the savings while rates are higher. Many outlets offer a real rate return (i.e. a return over and above the rate of inflation). For example, at Plum, we’ve just launched a Cash ISA at a market-leading rate of 5.15%, so well above the rate of inflation,” Lakhani said.

Morgan added: “It’s a case of making hay while the sun shines. The best deals for fixed-term cash rates are now behind us as the market looks ahead to a decline in Bank of England rates over the course of 2024. Cash can therefore be expected to lose its gloss, versus assets such as bonds and shares, as the year progresses.”

Food, drink and tobacco

The latest inflation reading is the lowest since September 2021. On the face of it, that’s good news for consumers across the country.

Lakhani said: “The big driver is a slowdown in food, drink and hospitality prices. Broader things like easing supply-chain pressures and cooling energy prices have contributed to this slowdown too.

“All that said, the cumulative increases in prices of things like energy and food over the past 18 months have taken a toll on people’s financial resilience. Many of them will have dipped into their savings and are now finding they have little left, yet prices are still rising, albeit at a slower rate.

“Importantly core inflation, which strips out more volatile items like food, energy, alcohol and tobacco, is falling as well, alongside services inflation. That means the Bank of England can be more confident about cutting the base rate.”

Business

Business owners would also be affected by the fall in inflation.

Angus Milledge, head of new business sales at SAP Concur said: “For businesses, this is also a challenge, as we are still technically in a recession – albeit a weak one. If you aggregate the top-line revenue numbers of all businesses in the UK this is slightly less, but their costs are 3.4% higher, which means that their net profit will be less if they do nothing about controlling their costs.

“From our own data, we have seen businesses having a 24% increase in costs in 23/24 compared to 2019, driven by inflation. So today’s announcement is slightly misleading, as consumers and businesses alike will still see higher costs.”

Pension

Dr George Hulene, finance associate professor at Coventry University said: “With the pension triple lock, the fact that pensions will go up by 8.5% in just under a month will be very good news for pensioners. On one hand, prices are starting to go down, and on the other, state pensions are going up, which surely will help ease quite a bit of the cost-of-living pressure.

“Add to this the fact that the energy cost for a typical household will go down by £238 between April and June, compared to January and March, and the good news is even greater.”

Bookmark popover

Removed from bookmarks