Bank of England confirms biggest interest rate hike since 1980s

The UK could be facing the longest period of recession since reliable records began

The Bank of England has hiked the interest rate by the largest amount in 33 years as it tries to get a grip on soaring inflation.

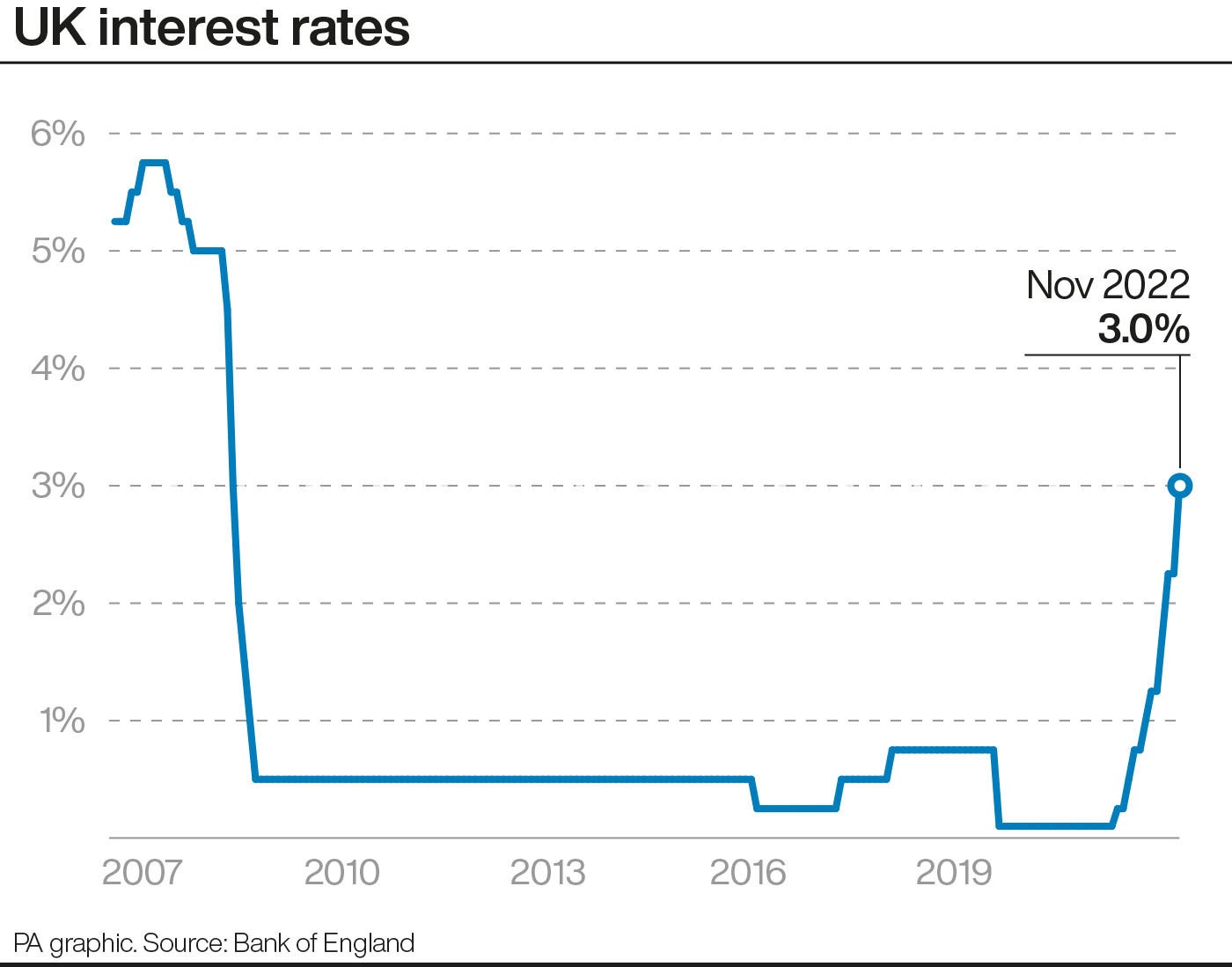

The Monetary Policy Committee (MPC) raised the base rate by 0.75 percentage points this afternoon to 3 per cent after warning last month that growing inflationary pressures would require a “stronger response” than previously thought.

The decision has pushed the interest rate to its highest level since 2008.

The UK could be facing the longest period of recession since reliable records began, the Bank has warned.

It added that the economy could fall into eight consecutive quarters of negative growth if current market expectations are proven. It would be the longest period of uninterrupted decline that the nation has experienced for around a century.

According to the Bank, inflation is forecast to rise to 11 per cent this quarter before beginning to fall at the start of 2023.

The committee voted in favour of the increase by seven votes to two. One member preferred to increase the bank rate by 0.5 percentage points and one preferred to increase the rate by 0.25 percentage points.

This is the eighth time in a row that the Bank has hiked interest rates. Less than a year ago the rate was 0.1 per cent.

“As set out in the accompanying November Monetary Policy Report, the MPC’s updated projections for activity and inflation describe a very challenging outlook for the UK economy,” the Bank said in a statement.

“GDP is expected to decline by around 0.75 per cent during 2022 H2, in part reflecting the squeeze on real incomes from higher global energy and tradable goods prices,” it added.

In a press conference after the announcement, Bank of England governor Andrew Bailey warned “the road ahead will be a tough one”. He acknowledged that eight rate rises since last December amounted to “big changes and they have a real impact on people's lives”.

But he said: “If we do not act forcefully now, it would be worse later on.”

However, he added: “We think the bank rate will have to go up by less than is currently priced in by financial markets.”

This means that “the rates on new fixed-term mortgages should not need to rise as they have done”, according to the central bank boss.

Commenting on the announcement, chancellor Jeremy Hunt said the “most important” thing the government could do right now was to “restore stability, sort out our public finances and get debt falling so that interest rate rises are kept as low as possible”. But he admitted “there are no easy options”.

However, shadow chancellor Rachel Reeves called on Rishi Sunak to “face up to his mistakes”, which she said had led to the “vicious cycle of stagnation” after the Bank of England issued a stark inflation warning.

“Families now face higher mortgages and more anxiety after months of economic chaos,” the Labour MP said.

“Today’s recession warning lays bare how 12 years of Tory government has weakened the foundations of our economy and left us exposed to shocks, lurching from crisis to crisis with falling living standards and low growth.

“Working people are paying the price for Tory failure. Britain deserves more than this.”

Earlier this month, markets had predicted the interest rate increase could be as much as one percentage point. But sentiment has calmed somewhat after the change of chancellor and prime minister, as well as Bank of England bond purchases that pushed down the cost of borrowing.

Markets have also witnessed a decreased appetite for large hikes globally, with the Bank of Canada increasing its interest rate by 0.5 percentage points, below the 0.75 percentage-point rise that had been widely predicted.

A leading trade union has warned that a hike in interest rates will plunge more workers into debt and financial hardship amid fresh evidence of the impact of the cost of living crisis.

A survey of 6,000 adults for the Unite union found that just over half said they could not pay or would have difficulty paying their household bills this year.

Almost a third said they had already gone into debt or increased the levels of their debt just to put food on the table.

Unite said the survey, published hours before the Bank of England decision on interest rates, also revealed that one in seven admitted they were facing food poverty.

Unite general secretary Sharon Graham said: “Unite’s research shows that many workers face insurmountable financial pressure. An interest rate hike will shackle those workers with more debt while corporate profiteering runs rampant.”

The Federal Reserve also announced an interest rate increase on Wednesday as it sought to combat inflation in the US economy.

The central bank said in a statement that job gains, Russia’s assault on Ukraine and related economic activity had increased inflationary pressures across the globe.

As a result, the Federal Reserve said in a statement that it would raise the interest rate to between 3.75 and 4 per cent, also known as 75 basis points.

UK inflation returned to a 40-year high of 10.1 per cent, driven by soaring food prices. The rate of Consumer Price Index inflation rose to 10.1 per cent in September from 9.9 per cent in August, the Office for National Statistics said.

Inflation was slightly higher than economists had expected. They had predicted a figure of 10 per cent.

This matches the 40-year high inflation rate hit in July and remains well above the government’s target of 2 per cent. The figure was last higher in 1982.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks