Amec Foster Wheeler shares jump 20% after Wood Group £2.2bn takeover offer

Aberdeen-based Wood Group and Amec Foster Wheeler said that they would combine in a £2.2bn deal

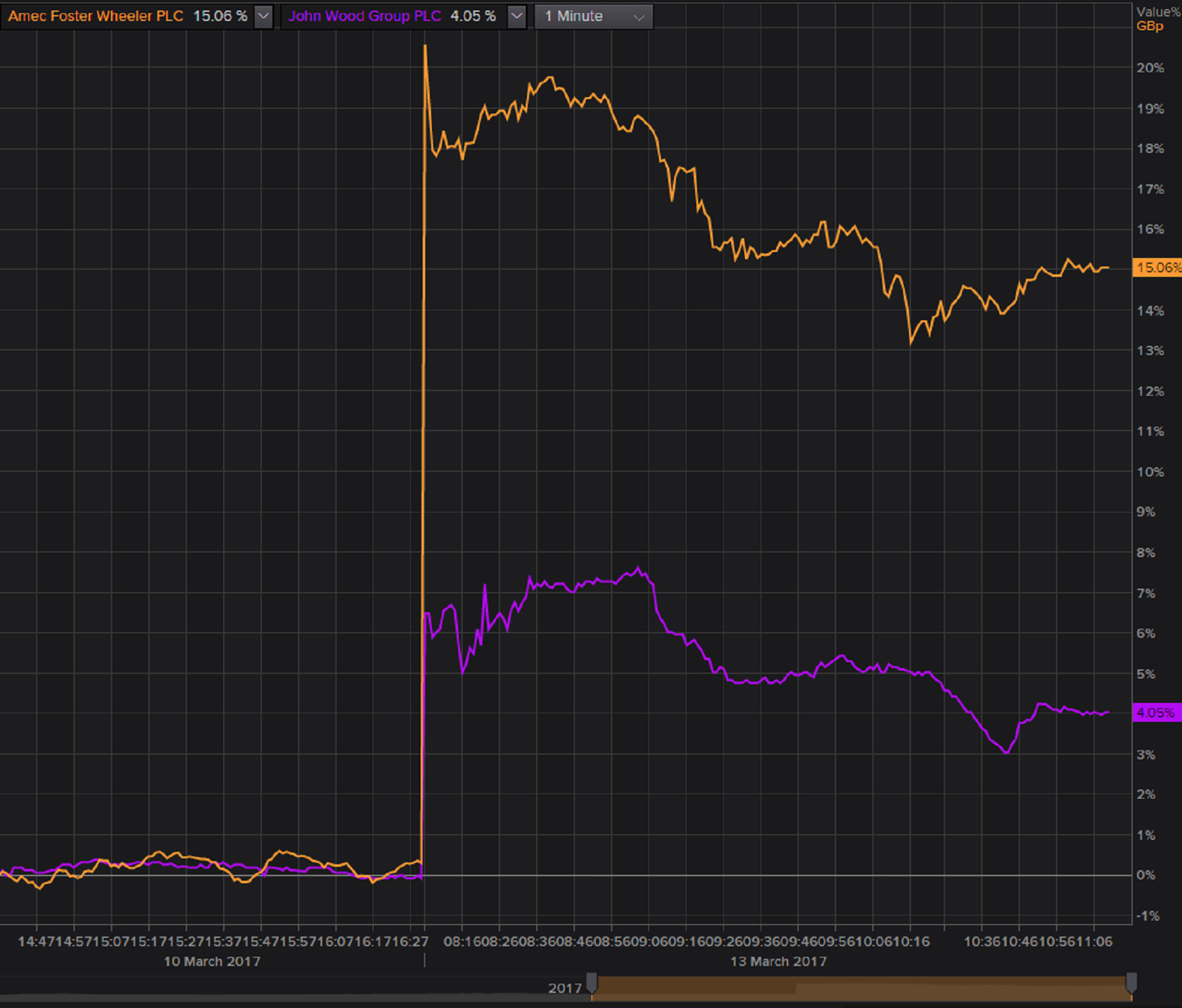

Shares in oil services company Amec Foster Wheeler jumped 20 per cent after it agreed to a takeover offer from larger rival Wood Group in a deal that would create a group worth about £5bn.

Aberdeen-based Wood Group and Amec Foster Wheeler said that they would combine in a £2.2bn deal.

Wood Group said the deal will result in "significant cost and revenue synergies" of at least £110m a year.

Both firms' shares shot up with Wood Group’s climbing by more than 6 per cent in morning trading in London and closing more than 2.6 per cent higher while shares in Amec’s rocketed by 20 per cent and closed 18 per cent higher on the day.

Shareholders will still be asked to vote on the deal, which will give Wood Group 44 per cent of the new company, but the boards of both firms have unanimously recommended it would be approved.

"The combination extends the scale and scope of our services, deepens our existing customer relationships, facilitates further development of our technology-enabled solutions and broadens our end market, geographic and customer exposure,” Wood Group chairman, Ian Marchant, said.

"Delivering significant sustainable synergies will also result in a leaner and more competitive combined group, creating value for shareholders," he added.

Amec chairman John Connolly said the tie-up supports its "standalone prospects".

Loss-making Amec had planned to launch a £500m rights issue to bolster its balance sheet. However, those plans were suspended as a result of the offer from John Wood.

If the deal is approved, Mr Marchant will continue as chairman of the new company while Wood Group's chief executive, Robin Watson, would also remain in the same position in the combined firm.

Additional reporting by PA

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments