Apple shares drop below $100 over fears iPhone 6s sales have peaked

There are reports of the iPhone 6s models piling up at shops because of an oversupply

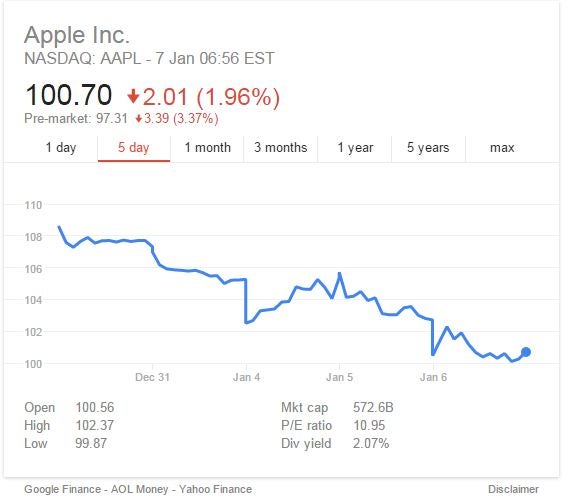

Rumours of slowing iPhone production have hit Apple shares, sending them tumbling below $100 for the first time in nearly five months as investors worried that Apple might cut production for the first time.

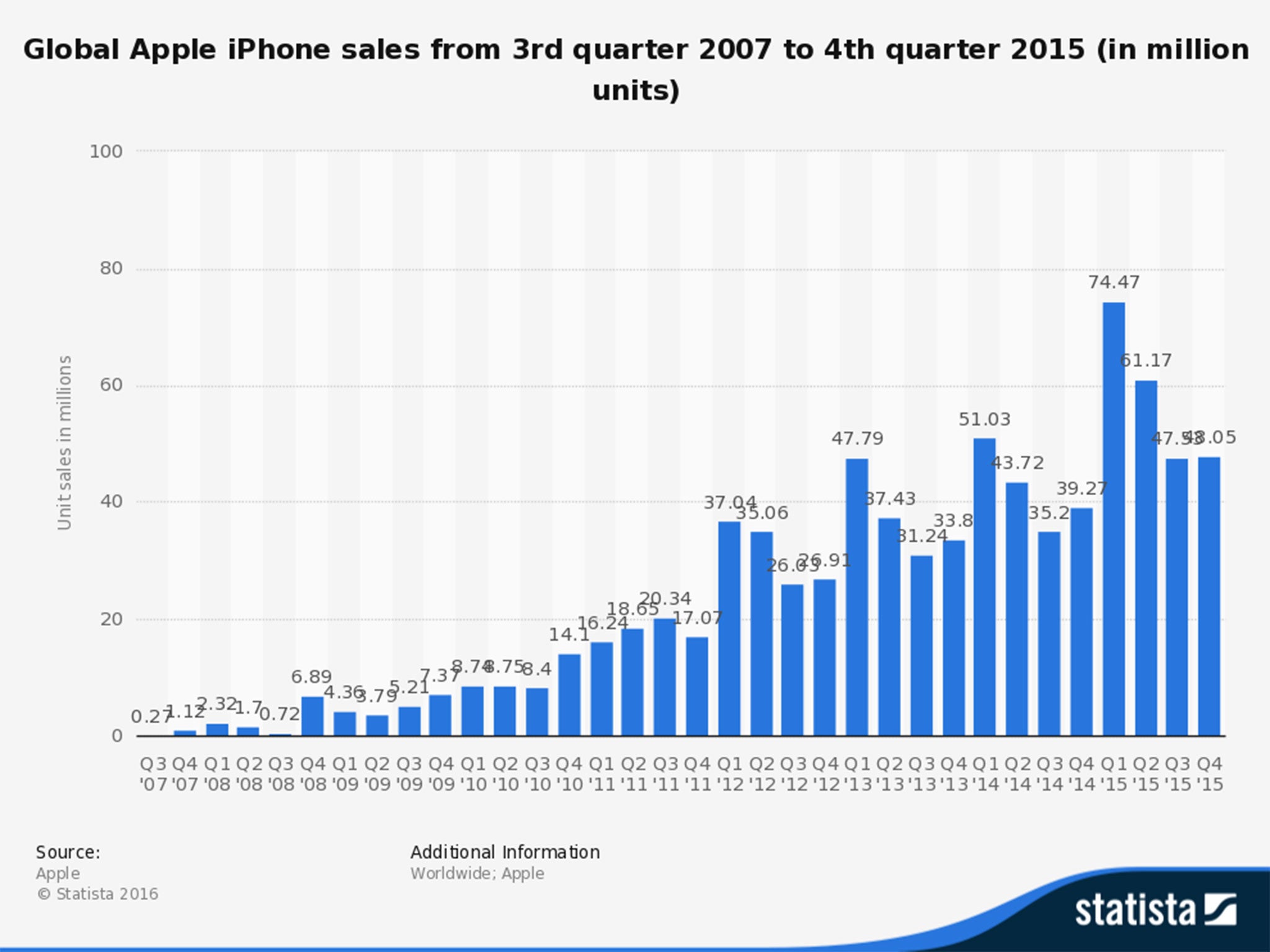

Investors are worries that iPhone sales might have peaked.

Shares dropped briefly to $99.87 on New York's Nasdaq stock exchange on Wednesday before recovering slightly to close at $100.70.

The rumour came after a Taiwan-based company that assembles iPhones cut its working hours over New Year weekend. Many onlookers saw this as a sign that Apple was slowing production.

Apple has declined to comment on the rumours, which come amid reports of slowing shipments and stockpiles of the iPhone 6S and 6S plus.

A report in Japan daily the Nikkei said the number of these models coming to market will be cut by 30 per cent in January-March, prompting Apple shares to slide 2.5 per cent.

Apple is one of the world's most valuable companies. When its share price is hit, there are ripples in connected companies alike chip-maker ARM, whose share price was down 2.6 per cent in London a day later, while Imagination Technologies was down 3.6 per cent.

Tim Cook, Apple CEO, has commented before on the effect of iPhone production rumours. In reponse to a similar panic in 2013, he said it was always good to question rumours, because it is hard to say what effect the working hours in a factory in Taiwan might have on Apple's entire business.

"The supply chain is very complex and we have multiple sources for things. Yields can vary, supplier performance can vary. There is an inordinate long list of things that can make any single data point not a great proxy for what is going on," Cook said.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments