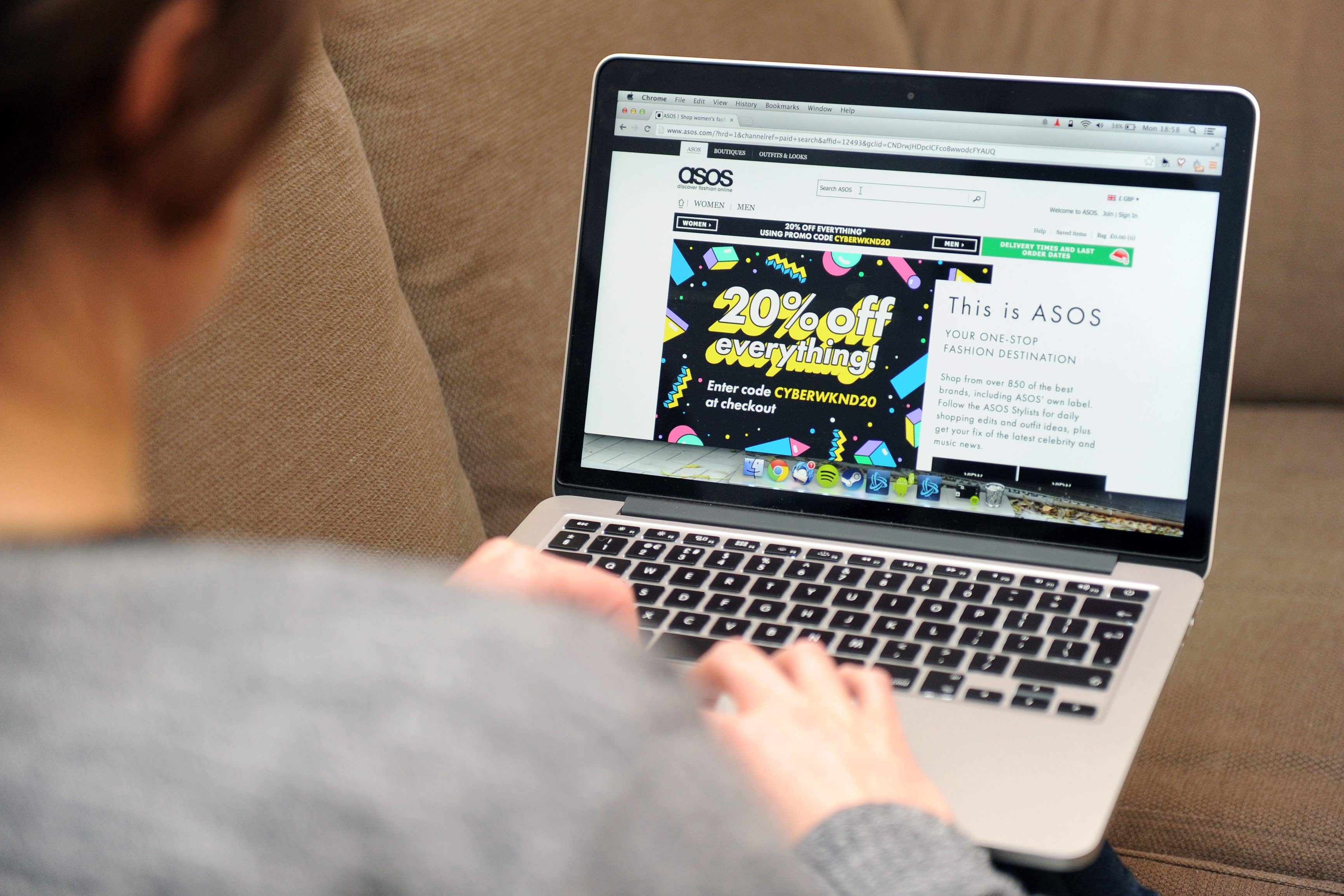

Asos secures £75m fundraising to support turnaround plan

It comes after the fast-fashion firm earlier this month revealed losses of more than £290m for the half-year to February

Fast-fashion firm Asos has raised £75m to support its turnaround plan.

The online retail business confirmed on Friday that it has completed a share placing, with 17.9 million shares at 418.1p each to secure the cash injection.

Earlier this month, it revealed losses of more than £290m for the half-year to February, as it booked costs from restructuring efforts and lower sales as customer spending comes under pressure.

Asos said the fresh funding will be used for its turnaround plan, which will include shaking up the company’s approach to buying and merchandising, and giving the firm more financial headroom.

Asos told investors it has entered into a £200m senior term loan and a £75m revolving facility with specialist lender Bantry Bay Capital through to April 2026.

The new credit lines will replace its existing £350m facility which was due to expire next year.

AJ Bell investment director Russ Mould said: “The fast-fashion online retailer hopes this can create a solid base for the company’s recovery.

“However, with the company paying high rates of interest on its newly agreed debt, much of the money raised from shareholders will almost immediately be going out the door on servicing its borrowings.

“The danger is Asos hasn’t raised enough this time round, either through choice or necessity, and it will have to dig out the begging bowl again before too long.”

Shares initially opened higher after the update but swung lower after analysts digested the update.