Brexit: 5 charts that show the vulnerability of the UK economy

There was fragility even before the political and economic earthquake of the Brexit vote

The latest batch of official statistics demonstrates how unbalanced and potentially vulnerable the UK economy was even before the political and economic earthquake of the Brexit vote.

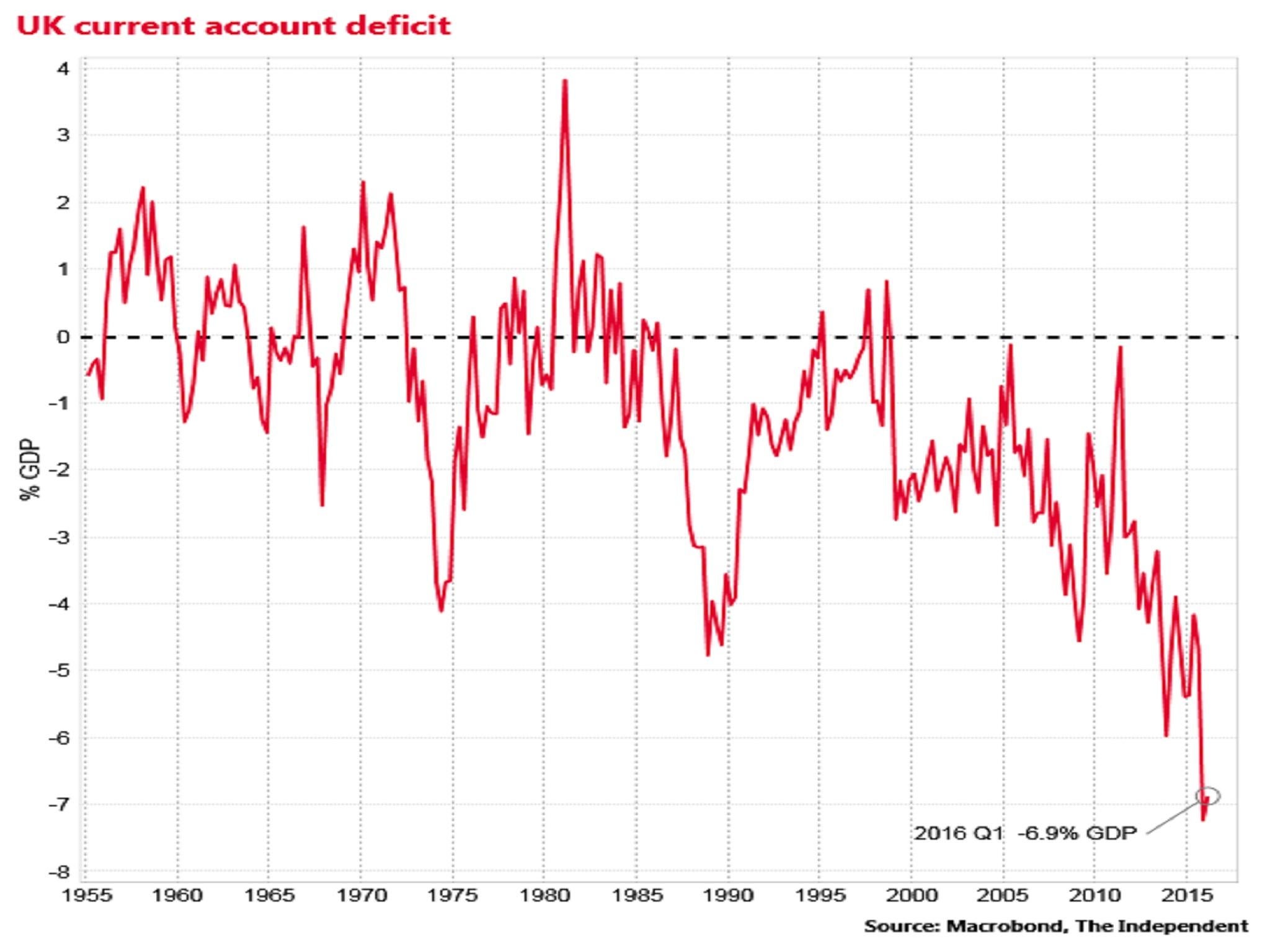

The UK current account deficit – the gap difference between everything the UK earns and spends – was 6.9 per cent of our GDP in the first three months of the year.

Current account deficit close to record high

In cash terms that’s £32.5bn. That’s the sum, over just three months, the UK had to attract, through loans and investments, from abroad to finance our spending.

One of the big fears over Brexit is that the uncertainty about the UK economy might make it harder to attract those funds, forcing a rapid and traumatic closing of that current account deficit, which would mean deep cuts to household incomes and job losses.

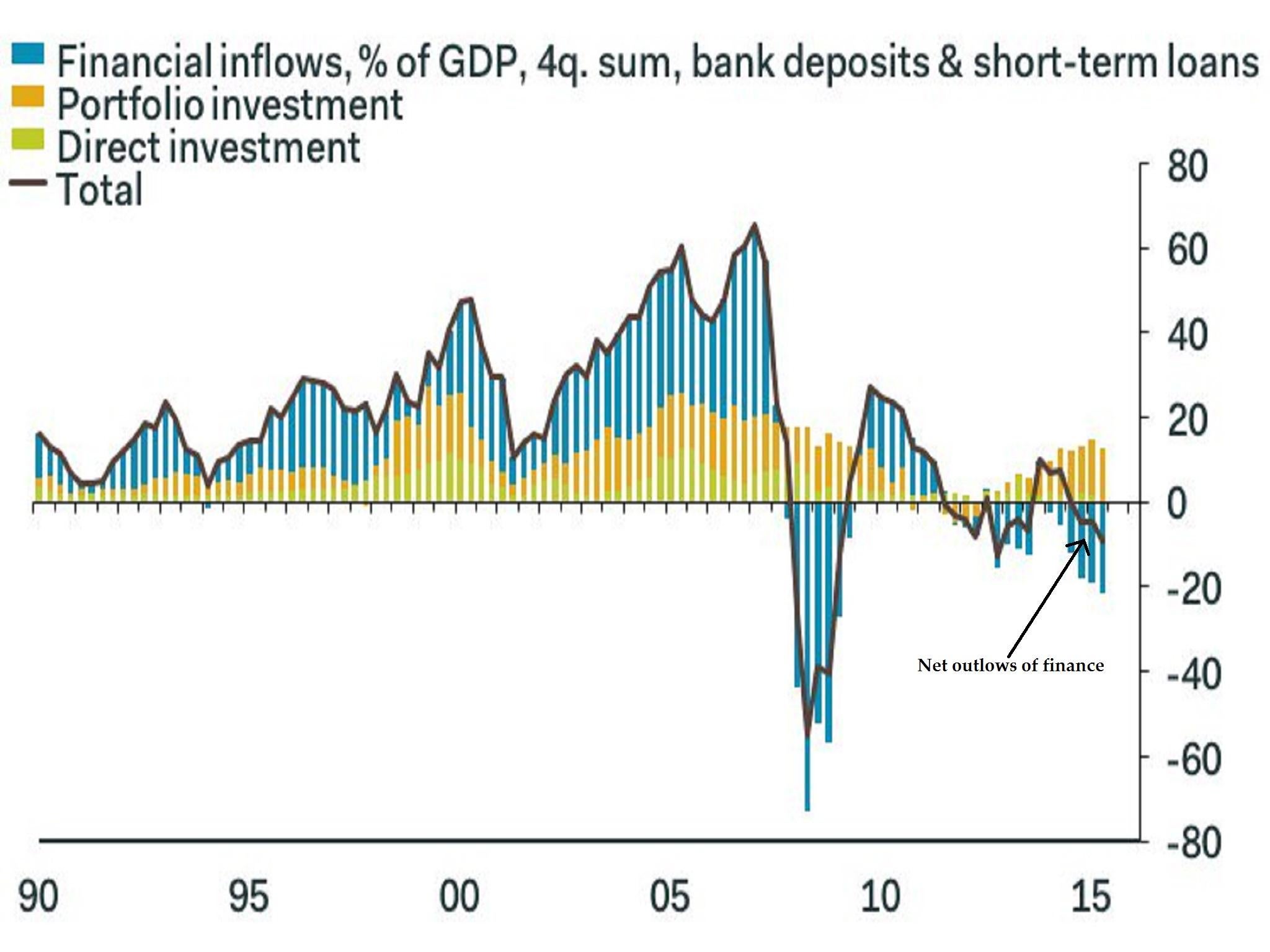

This chart, created by Samuel Tombs of Pantheon, shows negative net inflows of foreign money into the UK in 2015 and it seems to be getting worse.

Foreign money already leaving UK

“Financial outflows from the UK likely will pick up following the referendum, requiring either UK residents to sell overseas assets quickly to maintain current spending, or reduce current consumption sharply” said Tombs. “Both potential responses underline how UK residents will become worse off as a result of the referendum.”

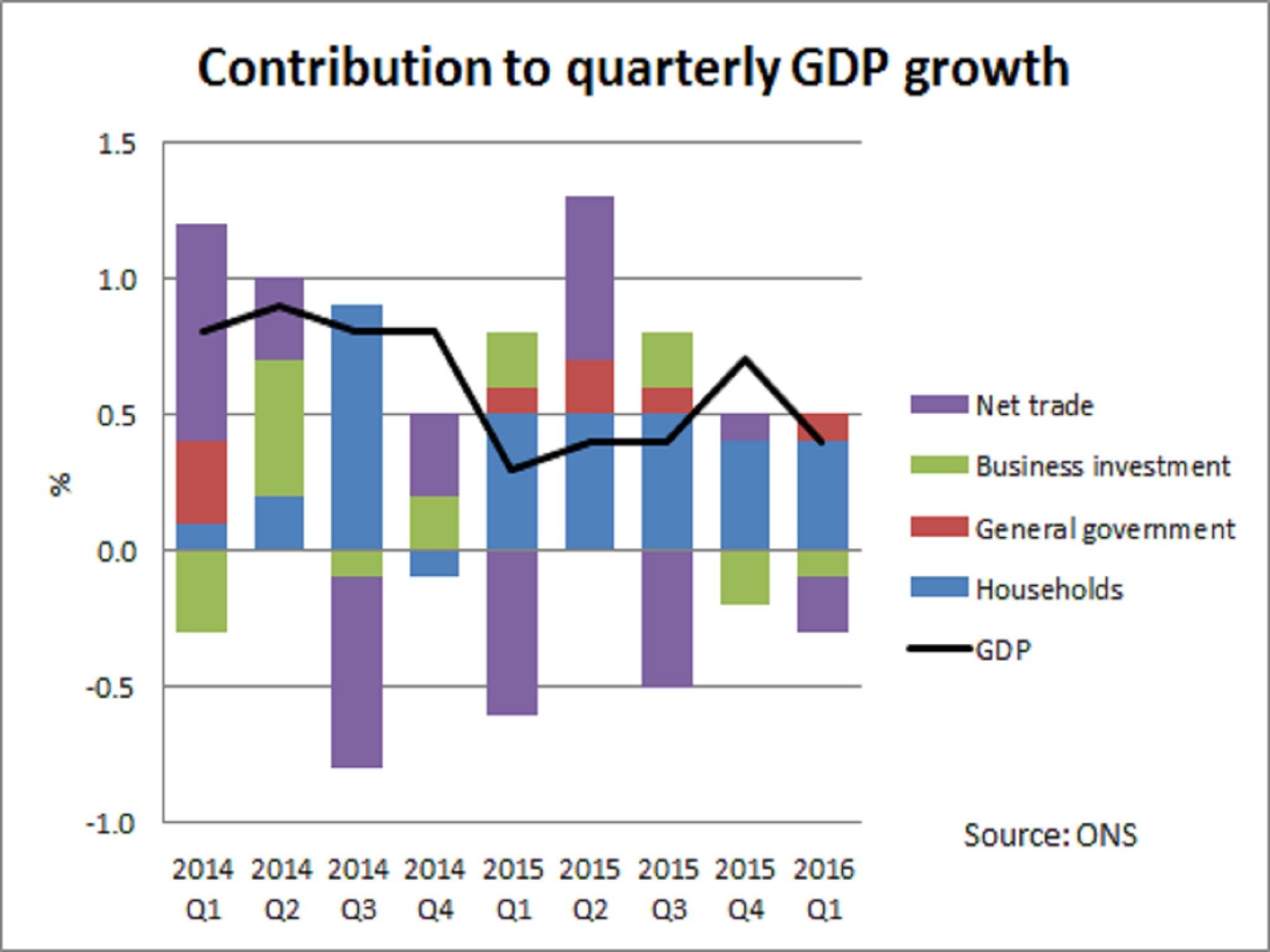

Then there is overall UK output. GDP growth in the first quarter was confirmed at 0.4 per cent, down from 0.7 per cent in the final quarter of last year, and gently gliding down since the middle of 2014.

Moreover, this growth has been heavily reliant on consumer spending. If consumers lose some confidence in the wake of the Brexit vote then overall growth will almost certainly fall.

Growth sustained by consumer spending

Some have suggested that the dramatic fall in sterling versus the euro and the dollar since last Friday should help our exporters by making them more competitive and boosting GDP through the net trade channel.

There may well be some boost, but given the failure of a large depreciation in 2008 to do much for exports this should certainly not be assumed.

And, even so, there are likely to be countervailing downward pressures.

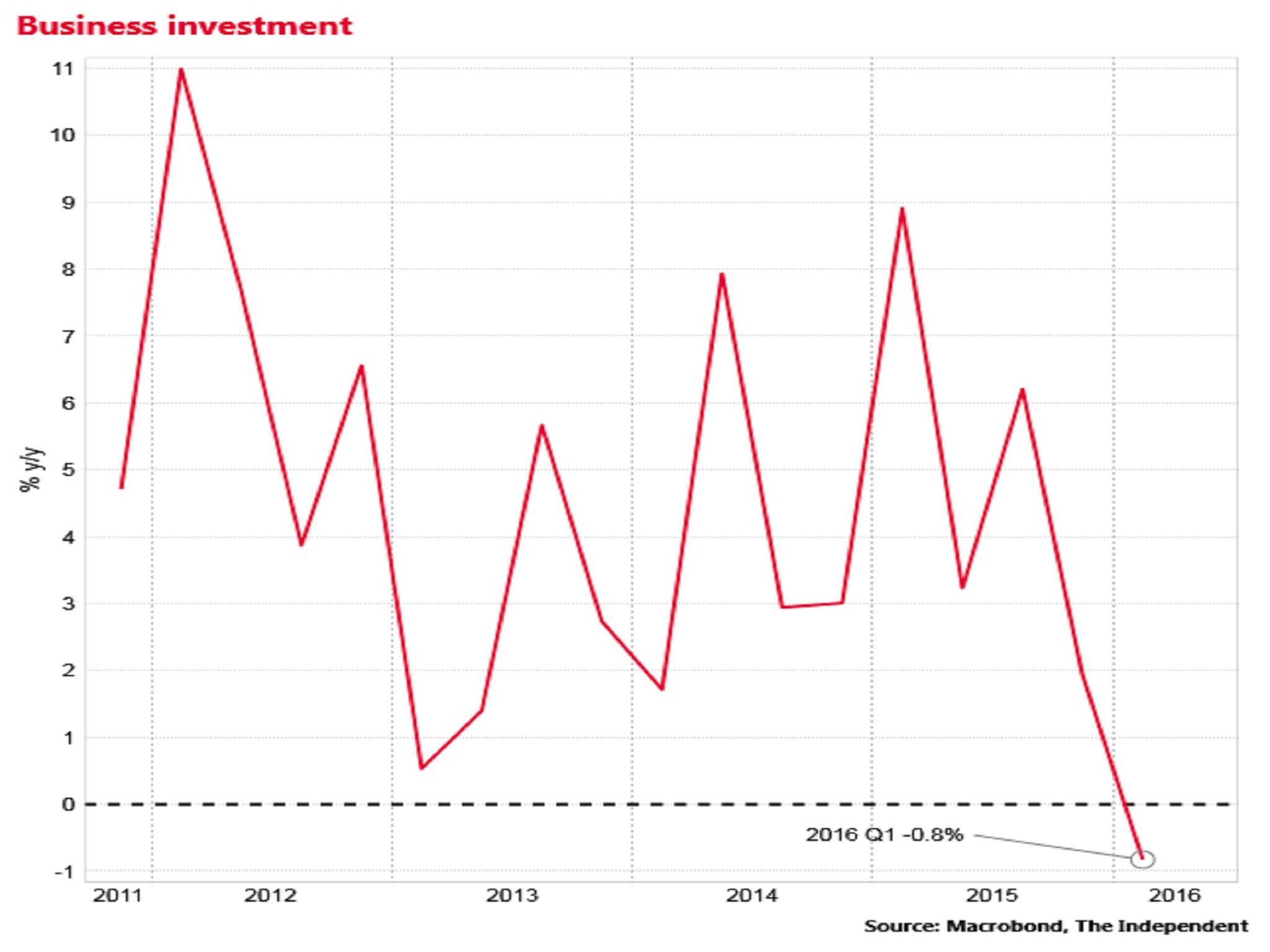

The statistics today show business investment has been falling since the third quarter of 2015 and year on year growth turned negative in the first quarter of this year, falling 0.8 per cent.

Business investment already falling

Things are almost universally expected to get worse on this front over the coming quarters as firms, many of which export to the EU, hold off investment until the shape of the UK’s future trade relationships with the rest of the continent come into focus.

A weakening currency and a very large UK current account deficit. Major threats to consumer confidence and business investment.

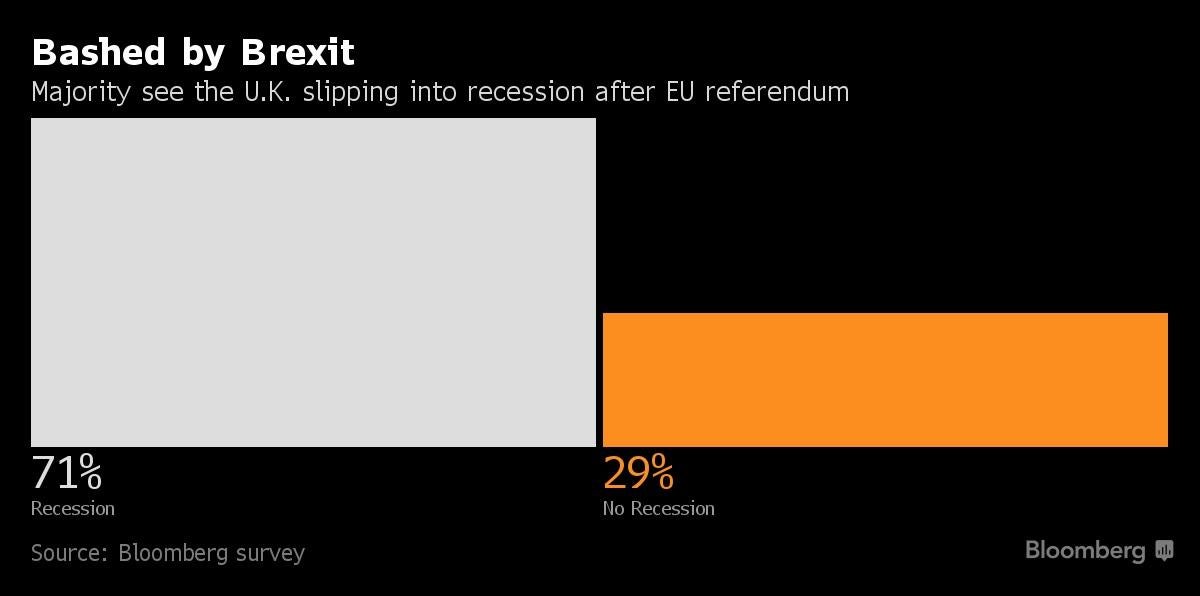

These are the reasons the majority of economists surveyed by Bloomberg, are now expecting a return to recession for the UK.

High expectations of recession

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments