President Donald Trump: The charts that show financial markets freaking out over his victory

The peso plummets, Asian shares slide and VIX and gold price soar at victory of Republican candidate

Markets are showing their highest levels of volatility since the Brexit vote in response to Donald Trump's victory in the US Presidential election.

The Mexican Peso fell more than 10 per cent against the US Dollar, breaching 20 pesos per $ for the first time, as traders anticipate that a President Trump would impose policies that damage the Mexican economy.

Peso down 10 per cent

Volatility in the value of the Japanese Yen, which is something of a safe haven currency, has been higher than in the wake of the 23 June Brexit vote.

Major yen volatility

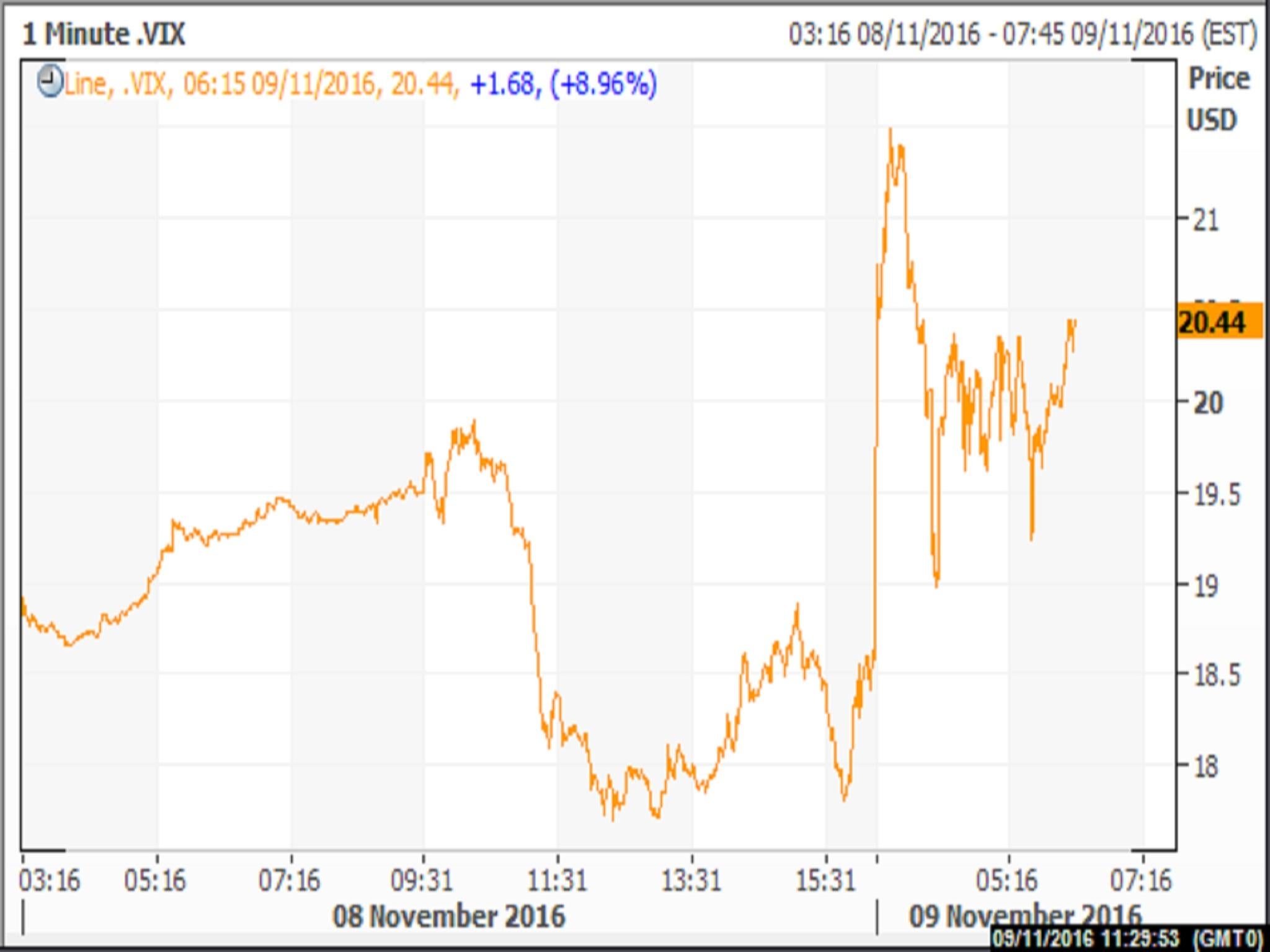

The global financial volatility index known as the VIX has soared 40 per cent.

VIX spiking

The price of Gold - a safe haven in times of stress and uncertainty - jumped $50 to $1,330 an ounce.

Gold soars

The global oil price fell 3 per cent at $44.68 per barrel.

Oil slides

Stock markets in Asia sold off

Japan's Nikkei 225 Index fell 5.36 per cent

Nikkei falls

The markets are also now scrapping bets on the probability of the American central bank, the Federal Reserve, raising interest rates in December, as was previously expected due to the strengthening US economy.

Interest rate rise off the table

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks