Coca-Cola says sugar tax will not reduce childhood obesity

Leendert Den Hollander, vice-president and general manager of Coca-Cola, said a sugar tax was the wrong way to address the issue

Coca-Cola has said the Government’s plan to introduce a tax on sugar will not reduce obesity.

Leendert Den Hollander, vice-president and general manager of Coca-Cola, said a sugar tax was the wrong way to address the issue.

His comments come after George Osborne announced a tax on sugary drinks which aims to combat childhood obesity.

“We believe and acknowledge and understand the issues around obesity and we have worked for a long time to try and address [this] as an industry and as a company,” he said at Retail Week Live this morning.

“Still, there’s clearly more that can be done. If we are truly after behavioural change there’s no evidence in the world that it is actually coming from sugar tax so we are not debating the issue we are debating the solution,” he added.

Den Hollander said the nutritional information on Coca-Cola products helps consumers to make “informed choices” and argued that the brand offers a range of alternatives to its traditional sugary drink such as its low calories products.

“We just believe there’s no proof or evidence that sugar tax works. There’s no evidence that calories significantly reduce after sugar tax,” Den Hollander said under further questioning from host journalist Declan Curry.

Companies will be given two years to reformulate their products with reduced sugar levels, after which drinks with over 5g of sugar per 100ml and over 8g per 100ml will be hit with greater taxes in two bands.

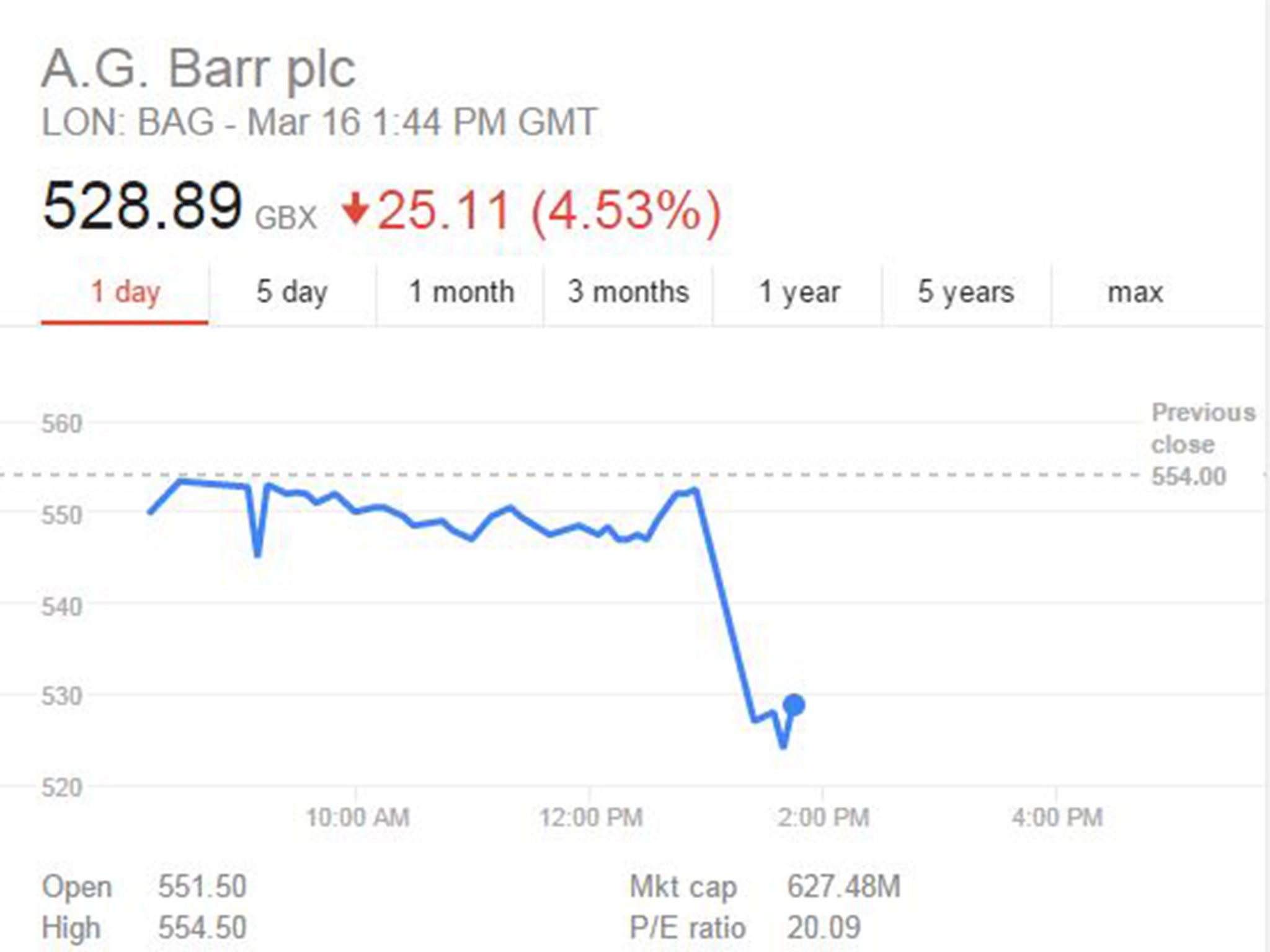

Shares in soft drink firms have been hit hard by the announcement of the new tax. A G Barr, the maker of Irn Bru, shares were down almost 5 per cent in the moments after the speech was made.

Britvic, which is the UK licensee for Pepsi products and also produces Robinson’s drinks, saw its shares fall almost 3 per cent.

Mr Paul Johnson, director of the IFS, said the tax on sugary drinks could lead to people consuming more sugar as they turned to sugary food instead.

Mr Johnson stressed that the policy for a sugary drinks tax - not a blanket sugar tax - could mean consumption of sugary foods will rise in the aftermath “as people move away from drinks to other sugary products”, substituting Coca-Cola for chocolate, for example.

But evidence from other countries that have tried a sugar tax suggests it does have an impact.

In Mexico a tax led to a 6 per cent drop in purchases. Research by Diabetes UK, meanwhile, found that 43 per cent of people in the UK would buy fewer soft drinks if the price rose by 20 per cent.

The Chancellor expects the tax to raise £520 million. The money to be side set aside as additional funding for sport in schools.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments