Darling unveils his great bank bailout – Mk II

Treasury hands RBS another £25bn to shore up balance sheet

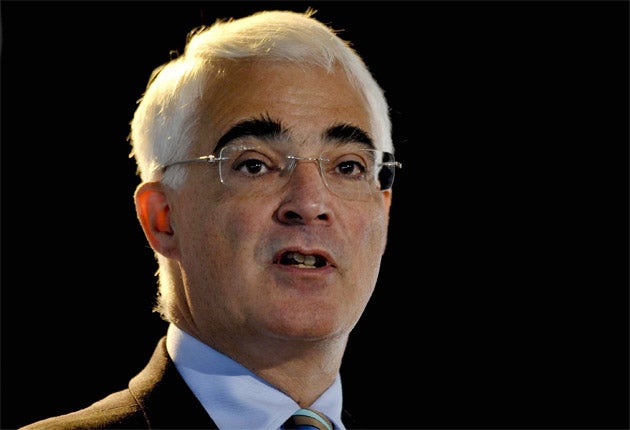

It was groundhog day in the Square Mile yesterday as the Chancellor, Alistair Darling, unveiled his second attempt to revive Britain's "zombie" banks in just over a year.

Lloyds and Royal Bank of Scotland were allocated a further £39.2bn to prop them up, just 13 months after the Treasury injected £35bn into the ailing institutions to save them from collapse.

Most of the cash will go to RBS, which will get £25.5bn of taxpayers' cash to strengthen its balance sheet; up to £8bn more will be available to ensure it can keep trading if there's a second recession. RBS will also have £282bn of risky assets protected by a state-backed insurance scheme.

The bank's chief executive, Stephen Hester, insisted that he was unlikely to need the cash. But the taxpayer could be liable for billions more if the economy takes a turn for the worse and his projections of brighter times ahead for the bank prove ill-founded.

Lloyds will call on a more modest £5.7bn, with private investors set to plug the remaining hole in its finances through the biggest rights issue yet seen in London. That will raise £13.5bn while institutional holders of bonds will be asked for £7.5bn.

Mr Darling insisted that the bailout would ultimately benefit the banks, their customers and the taxpayer. "We are creating a strong and vibrant financial services sector for the future," he told the House of Commons.

But the shadow Chancellor, George Osborne, said: "Let's not miss the elephant in the room. The Government is having to put another £39.2bn of taxpayers' money into the banks – a bigger bailout than the original bailout last autumn." He said he was still concerned that there was no guarantee that the second bailout would result in a renewed flow of credit to businesses and consumers.

The FTSE 100 also reacted badly to the announcement, falling by 67 points to 5,037.21. Seven per cent was wiped from the value of Royal Bank of Scotland, whose shares finished down 2.72p at 35.9p.

There were concerns that RBS could suffer from an exodus of staff after the Government demanded a ban on cash bonuses to anyone earning more than £39,000 a year. Mr Hester said this would make it harder to retain staff, though he insisted that better times were ahead and maintained that his five-year turn-around plan would allow the taxpayer to profit from the investment.

The EU has also ordered RBS to sell several of its most profitable businesses. Some 318 branches are set to form a new bank under the resurrected Williams & Glyn brand, while insurance businesses including Direct Line and Churchill could be floated and parts of its business banking, payments and commodities businesses also put on the block.

Investors were more upbeat about Lloyds after its chief executive, Eric Daniels, said the worst was over for the bank. Lloyds will have to sell 600 branches, which will make up a second new bank that is likely to trade under the TSB name together with internet banking operation Intelligent Finance.

Mr Daniels, under pressure after agreeing to merge Lloyds with HBoS to save the latter from collapse, was backed by his chairman Wim Bischoff. "He's the right man for the job," said Mr Bischoff.

As revealed by The Independent last week, the Government wants the two new banks created from the sell-offs, together with a Northern Rock stripped of its toxic debt, to shake up the market and improve competition.

The Government will continue to own 43 per cent of Lloyds after the sale, together with 87 per cent of Royal Bank. It bought into the former at 122.6p and the latter at 50.5p, so its investments are heavily in the red. It could take five years or more for it to see a return on the money pumped into the banks.

Bailout at a glance

* £39bn cash injection into both banks. RBS to receive £33.5bn, Lloyds to be handed £5.7bn

* No cash bonuses for bank employees earning over £39,000

* Executive directors to have their bonuses deferred until 2012

* Both banks forced to sell off branches to reduce market share

* Government stake in RBS to rise to 84 per cent

* Lloyds to pay the UK government £2.5bn to avoid joining the Government Asset Protection Scheme

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments