Five reasons Italy won’t be leaving the eurozone - and one reason why it might

Though Matteo Renzi has resigned this does not necessarily mean elections or even a change of government

Matteo Renzi’s referendum on constitutional reform has been lost and he has quit as prime minister.

So what now for Italy?

Will the country crash out of the eurozone, possibly breaking up the entire single currency in the process?

Could this even ultimately help bring about the end of the European Union, as some have suggested?

Here are five reasons why some of the more dramatic readings of the consequences of Sunday's vote are likely to be wrong, or at least very premature.

1. There will be a caretaker government rather than immediate new elections…

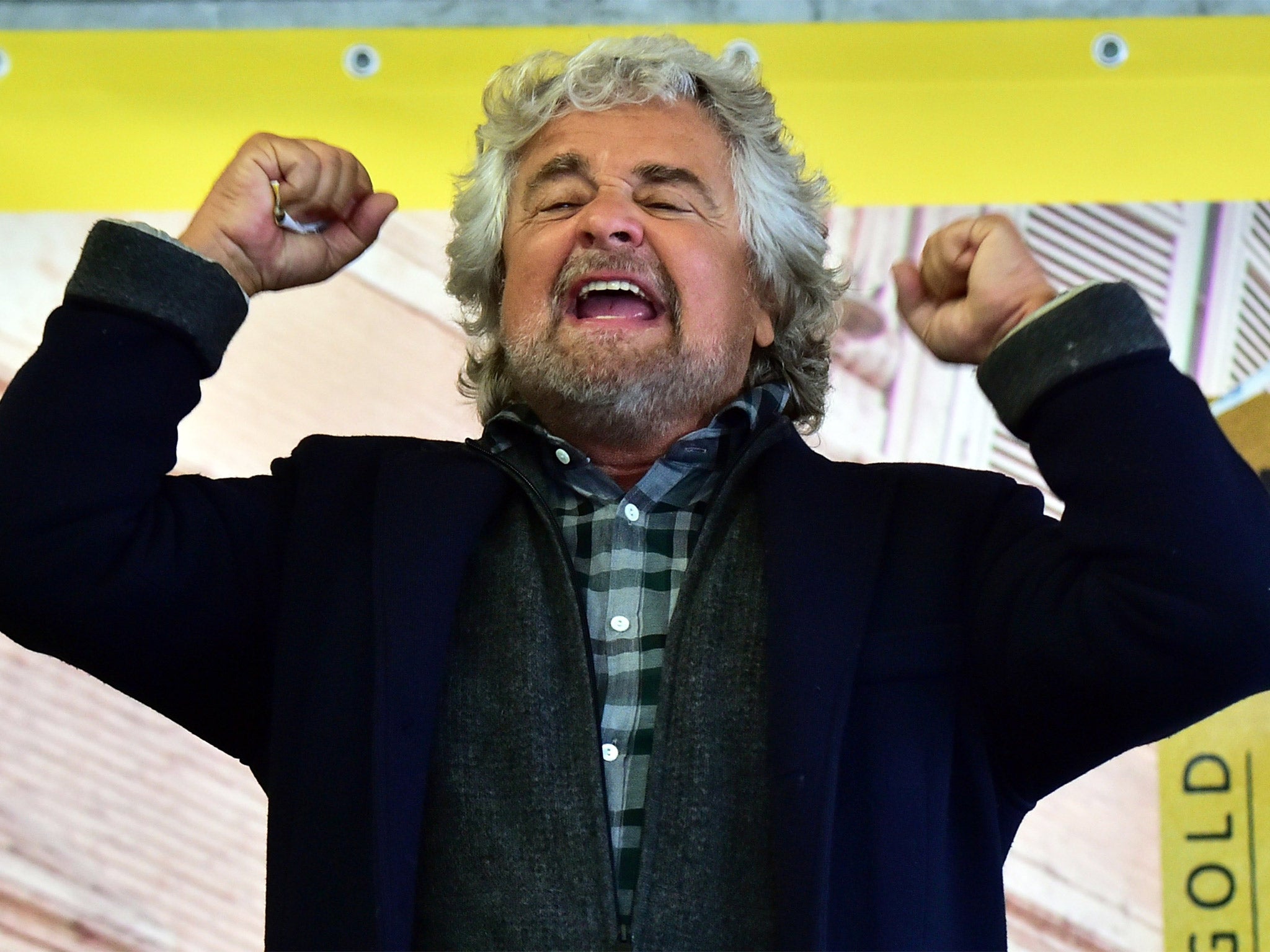

Some have expressed fears that the Five Star Movement, which is led by the comedian Beppe Grillo and which spearheaded the opposition to Renzi’s referendum, will now come to power.

Five Star wants to hold a referendum on Italy’s eurozone membership.

But though Mr Renzi has resigned this does not necessarily mean new elections or even a change of government.

It is very common for Italy to change governments without new elections – it has had 65 governments in the past 70 years but only 17 new legislatures.

The Italian president Sergio Mattarella is expected to appoint a caretaker administration, possibly led by Mr Renzi's finance minister Pier Carlo Padoan.

This would spell continuity, not rupture.

And this caretaker government could carry on until 2018 before needing to hold new elections, by which time some of the populist momentum behind Five Star might well have dissipated.

2. The electoral law will be changed to make it more difficult for the Five Star Movement to win power…

One of Mr Renzi’s reforms was to reform the systems of elections to the lower house to make it much easier for the biggest party to govern without having to form a coalition.

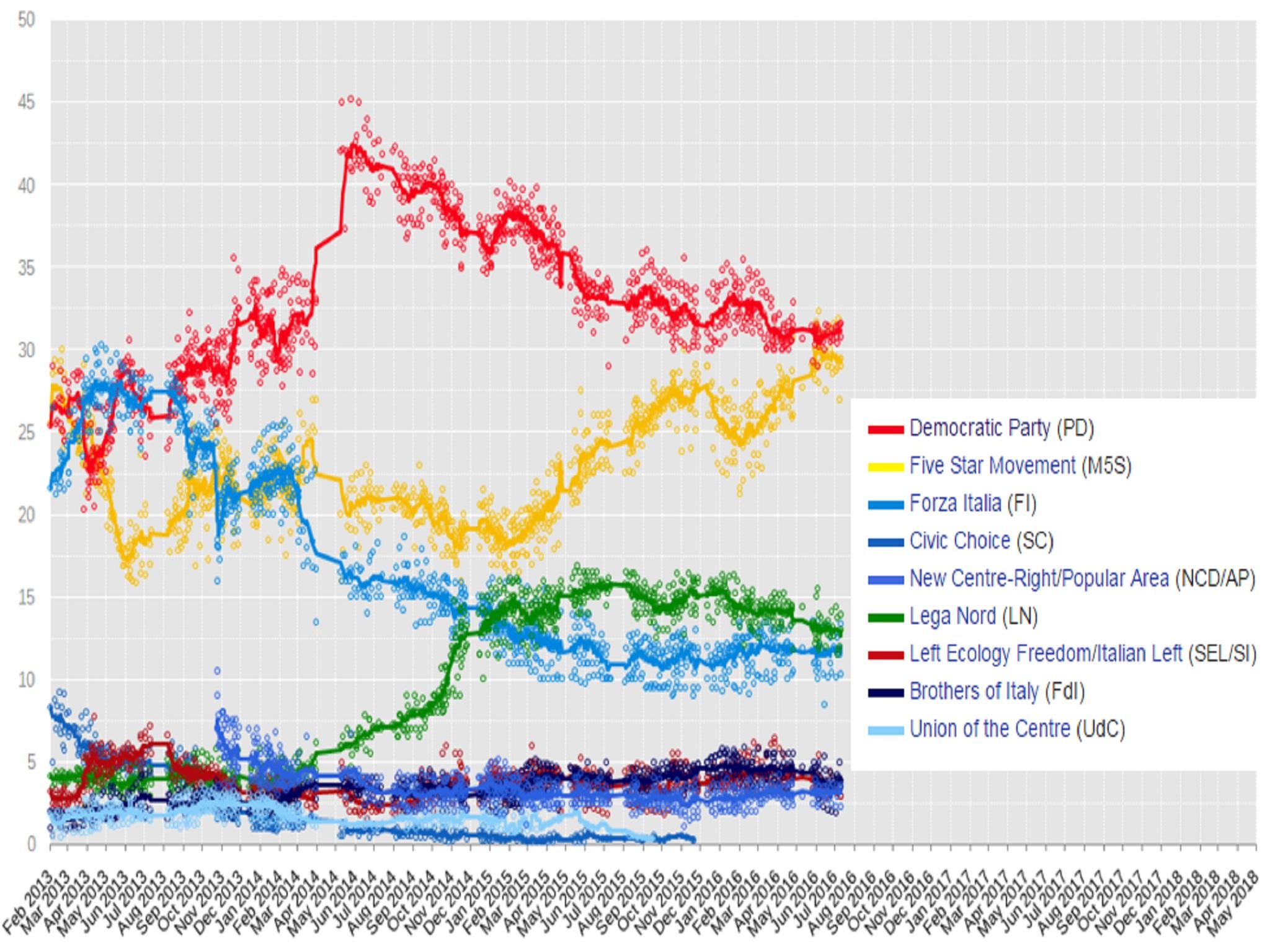

Many said this was dangerous given that Five Star Movement is now the second largest party in the country.

If an election were held tomorrow the new law could mean a Five Star government, uninhibited by the usual checks forced by coalition.

But the caretaker government is widely likely expected to scrap Mr Renzi’s new electoral law before the next elections.

This will return the status quo, significantly reducing the risk of an unbound Five Star administration.

Furthermore, Italy's Constitutional Court is due to deliver a verdict on Mr Renzi’s electoral law shortly.

Even if MPs do not scrap the law the Court might well strike it down.

3. The Five Star movement would have to hold a new referendum before staging a referendum on eurozone membership…

The Italian constitution does not allow referendums to be held in international treaties – a prohibition that covers Italy’s place in the eurozone.

So if Five Star came to power and wanted to hold a referendum on the euro they would first have to hold a referendum on changing the constitution on this point.

All these constitutional hoops make a single currency plebiscite much more difficult to deliver.

4. Most Italians still favour eurozone membership…

Even if those obstacles to a referendum were surmounted and Five Star delivered their referendum, opinion polls suggests that most Italians remain in favour of the country’s single currency membership.

It’s also likely that if a referendum became a serious prospect there would be financial and economic shockwaves as money fled Italy in advance of any possible devaluation.

That economic and financial instability might drive up support for single currency membership still higher.

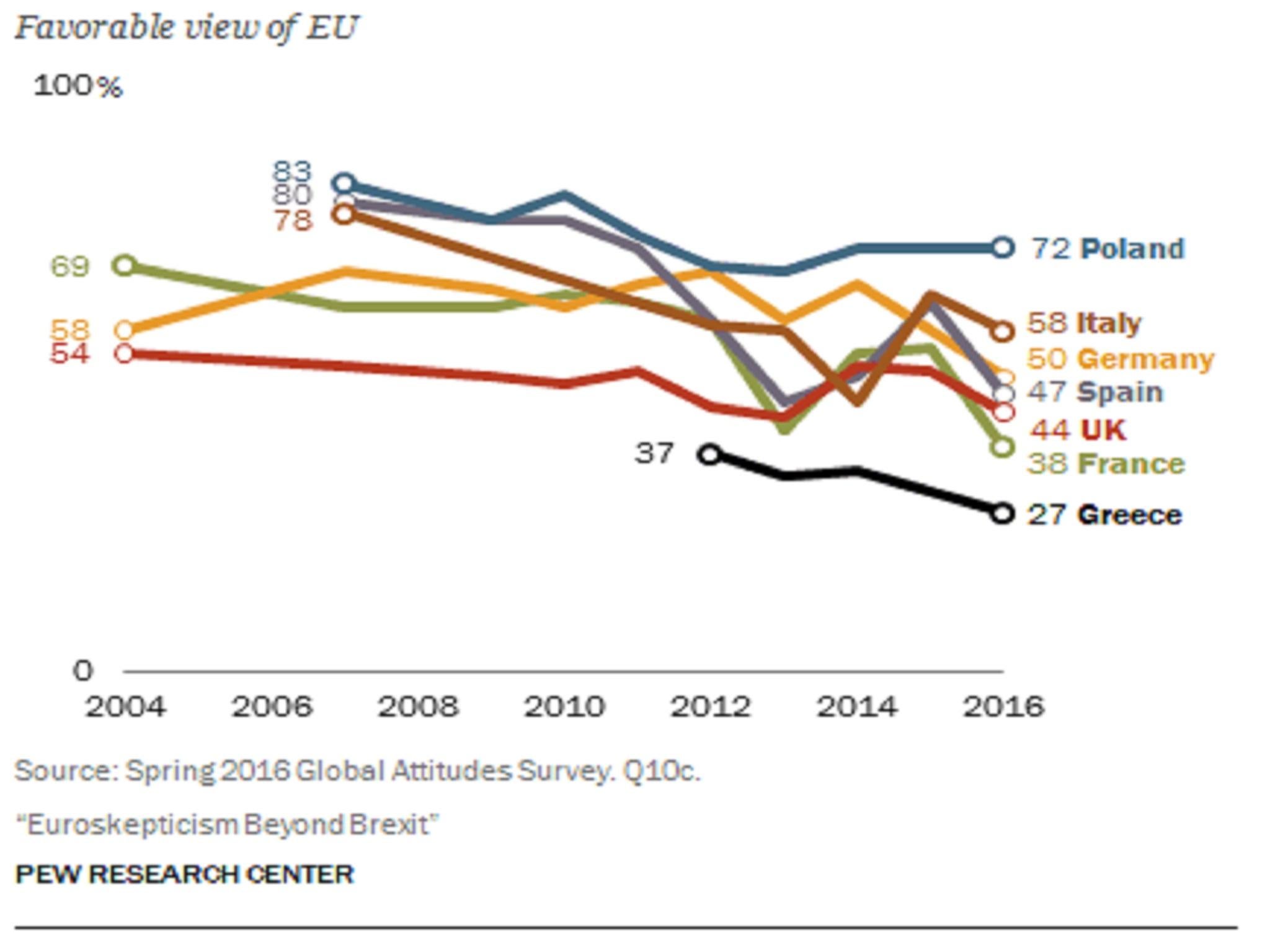

As for Italy breaking up the European Union, there is no major domestic demand for a referedum on this subject and most Italians still have a favourable view of the EU (although it has declined significantly over the past decade).

5. The European Central Bank will act to prevent a new financial crisis...

Italy’s 2012 financial crisis finally receded when the European Central Bank pledged to buy up the country’s bonds to stop domestic interest rates spiralling out of control and the government running the risk of default.

If there is another run on Italian debt the ECB is likely to step up these bonds purchases, easing the pressure again.

This will mean that it’s unlikely the government in Rome will be forced - at least any time soon - to confront a nightmarish choice between leaving the euro and paying public sector workers, as it briefly was four years ago.

But… Five Star could pick up momentum and the economy could deteriorate

The support for the populists has been rising steadily this year. They are on around 30 per cent in the polls, up by around 10 percentage points since January 2015.

They are only just behind Mr Renzi’s centre-left Democratic Party.

If they are able to capitalise on the referendum victory and the economy were to re-enter recession they might be able to break the mould of Italian politics and surmount the many institutional obstacles between them and a euro referendum.

And if that question is put to a popular vote it would be rash indeed to assume that "leave" would lose given that the Italian economy is no larger than it was when Italy swapped the lira for the euro in 2000.

All these factors have prompted Douglas McWilliams of the CEBR consultancy to reduce the probability of Italy remaing in the single currency for another five years to just 30 per cent.

"There is no doubt that Italy could stay in the euro if it were prepared to pay the price of virtually zero growth and depressed consumer spending for another five years or so. But that is asking a lot of an increasingly impatient electorate. We think the chances of their sustaining this policy are below 30 per cent," he says.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments