Gas companies spend €104m lobbying to ensure Europe remains 'locked in' to fossil fuels for decades, report finds

Gas industry representatives met with the two European commissioners in charge of climate and energy policy and their cabinets 460 times, according to analysis of European transparency filings

Gas industry firms are spending millions of euros influencing European policy makers to ensure that the continent continues to rely on fossil fuels for decades to come, according to a new report.

It claims that gas lobby groups have used their financial firepower to push the “myth” that gas is a clean fuel in order to win financial and political backing from the European Commission for costly and potentially useless pipelines and other infrastructure.

A group representing gas companies and set up by the Commission is mandated to recommend projects and then analyse their cost-effectiveness, which many of its members then build, the report from campaign group Corporate Europe Observatory (CEO) said.

In the past two and a half years, gas industry representatives met with the two European commissioners in charge of climate and energy policy and their cabinets 460 times, according to CEO’s analysis of European transparency filings.

Eight out of the 10 most frequent business visitors received by Miguel Arias Cañete, commissioner for climate action and energy, and Maros Sefcovic, vice-president for energy union, were linked to the gas industry, CEO said. Overall, gas companies from all parts of the supply chain spent €104m (£92m) on lobbying in 2016, though it is not possible to ascertain exactly how this expenditure was allocated.

This dwarfs the amount spent by public interest groups advocating a fossil-free future by a factor of 30, according to the analysis. It did not say how much renewables companies spent on lobbying in that time.

The top spender is CEFIC, the European Chemical Industry Council, with a budget of over €12m and 82 lobbyists, followed by General Electric which spent €5.75m in 2016 and Shell which spent €4.75m.

The report alleges that there are clear conflicts of interest in the way gas projects are approved and how money is allocated for their construction. Fossil-fuel infrastructure companies provide the commission with a “wish list” of projects that they think should be completed over the next 10 years, via a group called the European Network of Transmission System Operators for Gas (ENTSO-G).

This list is based on projections of demand for gas, which ENTSO-G calculates. Its past projections significantly overestimated gas usage, according to independent climate change think tank E3G. The commission then asks ENTSO-G to analyse the costs and benefits of these projects, despite the fact that, in more than three-quarters of cases, the group’s own members stand to benefit from their construction, CEO said. The next list of proposed Projects of Common Interest (PCIs) is due before the end of this year.

Projects included on the PCI list can have their permits and impact assessments fast-tracked and are also eligible for various funding streams, including the Connecting Europe Facility, which has already handed out more than £1bn to gas PCIs.

Despite its claims not to carry out lobbying, ENTSO-G supplied draft amendments to multiple MEPs on the recent regulation guaranteeing future gas supply as it passed through the European Parliament, according to a parliamentary source cited by CEO.

The industry group was also present during a shadow rapporteurs’ meeting, where compromises are thrashed out between the political parties.

ENTSO-G’s proposal for emergency gas supply routes – extra dedicated pipelines – was eventually proposed by three different political parties and accepted by the European Parliament.

The group works in the same building and shares several staff with Gas Infrastructure Europe (GEI), a trade association which spent €1.5m on lobbying in 2016.

The true influence of the industry may be significantly greater than the analysis suggests because of lax EU transparency rules. The EU’s Transparency Register is supposed to keep track of lobbying activity but it is entirely voluntary and only top-level meetings are recorded. The bulk of work, however, is done at lower levels of the Commission, CEO said.

Of the gas companies identified by the researchers as actively lobbying in the EU, 40 per cent simply did not appear on the register, while others had made entries in the past but had then stopped doing so, the report said. Just 11 of ENTSO-G’s members are on the register, despite their proximity to EU policy-making.

“If asked, of course the gas industry will say we need more gas," said Pascoe Sabido, a researcher and campaigner at CEO.

"Turkeys aren't going to vote for Christmas. But the EU should know better than to listen to the fossil fuel industry. If we are serious about tackling climate change then the companies causing it should be kept as far away from policy-makers as possible. In London, in Brussels and at the upcoming UN climate talks.”

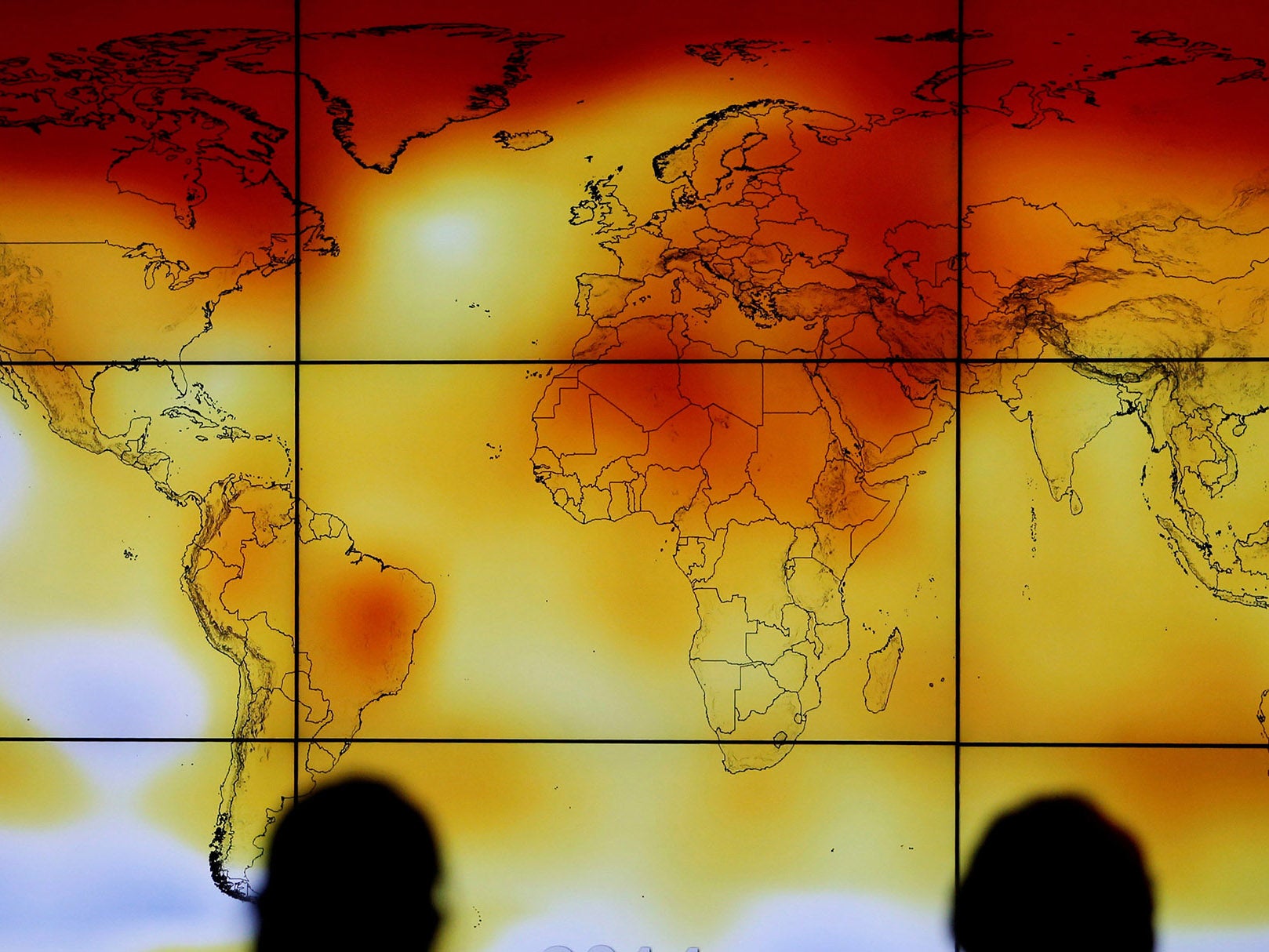

The revelations come as world leaders prepare for the UN Climate Change Conference in Bonn, Germany next week to establish the next steps to implement the Paris climate agreement and accelerate the transformation to a low-carbon world.

'Clean' gas

Many oil and gas companies have pushed natural gas as a “bridge to the future”; a way to reduce carbon dioxide emissions while providing the consistent supply of energy that renewables like solar and wind cannot yet deliver.

But natural gas is mostly methane – a greenhouse gas 84 times more potent than carbon dioxide over a 20-year period, according to the Intergovernmental Panel on Climate Change. Even that is an underestimate of the warming effect methane has in the short term because the gas has a lifetime of just 12.4 years.

Any unburned methane released into the atmosphere therefore contributes to climate change and several natural gas projects have been shown to leak significant amounts of the gas.

Scientists calculate that a leakage rate of just 3 per cent makes gas a bigger contributor to climate change than coal, while multiple studies have found that the industry underestimates the amount of gas that escapes. A 2016 study by the American Geophysical Union found that methane emissions in the US jumped by more than 30 per cent between 2002 and 2014. Gas is also a competitor to renewable energy sources.

“Investing in big infrastructure risks locking us into using gas for decades and slowing down the transition to renewable energy”, CEO’s report said.

“In particular, tighter regulation on climate change and the use of fossil fuels would create a risk of stranded assets, ie infrastructure built now will no longer be usable, let alone profitable, in a decarbonised futures, making investments worthless.

“We can therefore anticipate that the gas industry will marshall all of its firepower to try and prevent the introduction of any regulations discouraging the use of gas and devaluing its assets.”

A spokesperson for ENTSO-G said it does not participate in the European Commision's decision-making process, but "facilitates the process by providing knowledge and expertise, as required and when requested".

"The decisions regarding the PCI list are taken between the EC and Member States. ENTSOG do not participate and has no role in these decisions," the spokesperson said.

The group said it took an objective approach to predict demand for gas and that many unforeseen factors had reduced that demand, causing its previous forecasts to turn out to be overestimates. Some of these included the economic crisis, the Fukushima nuclear disaster, and the changing price of gas relative to coal, the group said.

A European Commission spokesperson said that decisions on gas infrastructure were "conducted in an open and transparent manner".

Decisions on projects are made by consensus between the Commision and EU member states, to which bodies such as ENTSO-G are not members, the spokesperson said.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments