Global market meltdown sees £140bn wiped off FTSE 100 as slowing China growth breeds panic

The FTSE 100 index suffered its worst decline in eight months, while it was a near blood bath in New York where the Dow Jones index lost 531 points

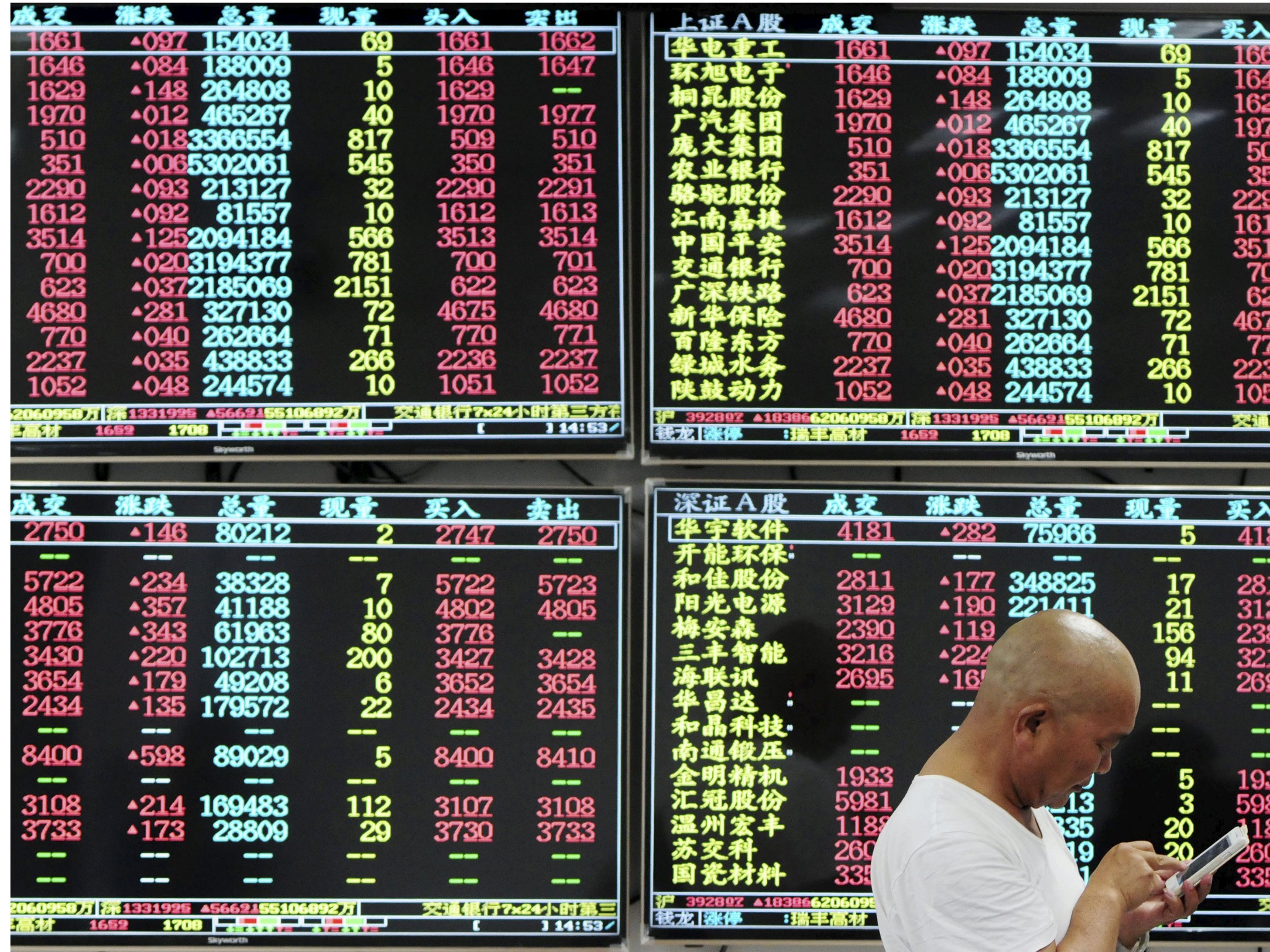

Anxiety about slowing growth in China gripped investors around the globe, clobbering stock and commodity markets yesterday.

The FTSE 100 index in London suffered its worst decline in eight months yesterday, while it was a near blood bath in New York where the Dow Jones index lost a full 531 points, or 3.13 per cent, its biggest single-day decline since 2011. The London blue-chip index fell for the ninth consecutive day – its longest losing streak also since 2011 – by 2.8 per cent, or 180.24 points, to 6,187.65. The FTSE has fallen by 5.8 per cent since the start of the year and is now 13 per cent off its peak of 7,122.74 on 27 April. Two more sessions in the red and it will be the worst streak since January 2003, when the Footsie fell for 11 straight days.

The ugly end of trading numbers for the Dow represented a full 10 per cent drop from its peak. It means that the American leading index is now officially suffering a correction. “Global markets are in panic mode as the full scale of China’s slowdown becomes clearer,” Angus Nicholson, market analyst at IG Index, said. “The word on everyone’s lips is deflation – poison for equity markets. The phenomenal six-year bull market may finally meet its match in China-induced global deflation.”

Selling was sparked by data released yesterday showing that activity in Chinese factories dropped sharply last month. The private Caixin/Markit manufacturing purchasing managers’ index – where a figure below 50 indicates contraction – declined to 47.1 from 47.8 in July.

The Shanghai Composite index gave up almost all its recent gains in response, closing 4 per cent lower, while the largest market in Asia – Japan’s Nikkei – ended down 3 per cent. Fears over China took also their toll on commodities, with Brent crude falling $1.28, or 2.75 per cent, to $45.33 per barrel by late afternoon. In Paris, the CAC 40 ended down 3.2 per cent, while the Frankfurt, Milan and Madrid exchanges all dropped by 3 per cent.

One of the big factors weighing on American markets was the smartphone giant Apple, which shed more than $27bn (£17bn) in value on concerns over demand from China, the world’s largest smartphone market.

The FTSE 100 has been dragged down by commodity and energy stocks such as Glencore, Shell and Rio Tinto, which together make up 20 per cent of the index. Since shares started falling on 11 August, the FTSE has lost 548.57 points, wiping more than £140bn off the value of the country’s top stocks. In a sea of red on trading screens, Royal Mail was the only blue-chip riser yesterday.

Many traders are away on holiday, which has resulted in lower trading volumes than normal and provided little in the way of support to stem the decline.

Nigel Green, chief executive of the wealth manager de Vere said: “This volatility is likely to remain with us, at least until the end of the year. By then, we will have a clearer view as to the risk of a China economic ‘hard landing’, and the degree to which capital markets are prepared to absorb higher American interest rates.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks