UK inflation hits two-year low as petrol prices fall

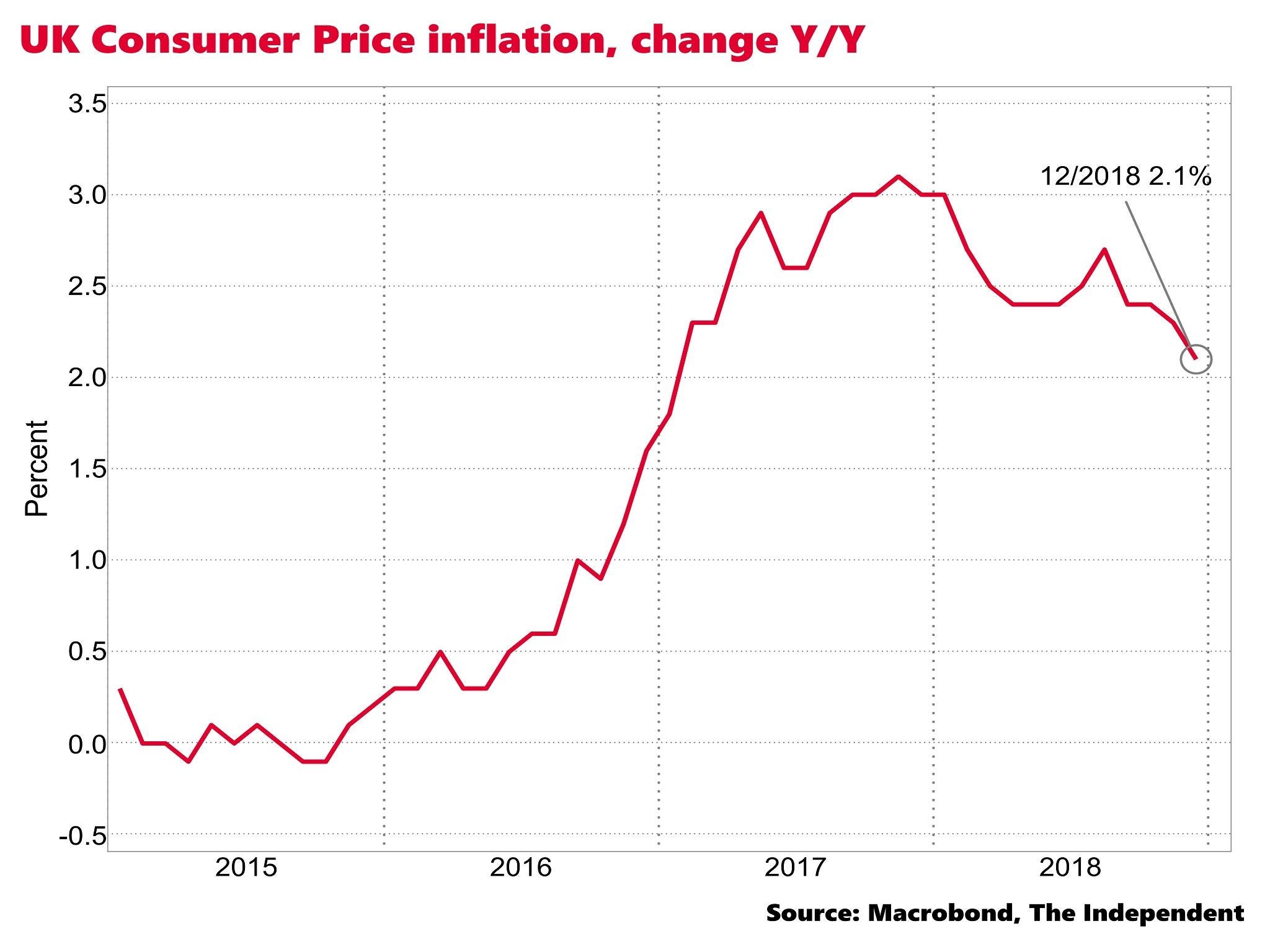

The Consumer Price Index was up 2.1 per cent year-on-year in December – the lowest since January 2017

Falling petrol prices pushed UK inflation to its lowest in almost two years in December, official data on Wednesday showed.

The Consumer Price Index was up 2.1 per cent year-on-year during the month, down from the 2.3 per cent growth rate in November.

It was the lowest since January 2017.

“Inflation eased mainly due to a big fall in petrol, with oil prices tumbling in recent months. Air fares also helped push down the rate, with seasonal prices rising less than they did last year,” said Mike Hardie of the Office for National Statistics (ONS).

Transport fuel prices were up 3.4 per cent year-on-year in December, well down from the 12 per cent growth rate in the middle of last year.

The global oil price currently stands at $60.7 a barrel, down from $86 in October.

The average price for a litre of unleaded petrol in the UK currently stands at 120p, down from a recent peak of 131p last autumn.

However, the ONS also reported on Wednesday that core inflation, which strips out volatile energy and food prices, rose to 1.9 per cent in December, up from 1.8 per cent in November.

The Bank of England signalled last year that it sees underlying inflationary pressure in the UK economy, despite the uncertainty over Brexit, which is likely to prompt it to increase the cost of borrowing over the next two years.

But analysts said the latest prices data suggested there was no need for rapid action.

“With inflation within a whisker of its 2 per cent target, the [Bank of England’s Monetary Policy Committee] will probably feel comfortable in waiting until Brexit uncertainty is resolved before moving again,” said Ruth Gregory of Capital Economics.

“We would not rule out two interest rate hikes in 2019 but we believe one is more likely as significant uncertainties persist – with expected lower inflation easing pressure for more aggressive Bank of England action,” said Howard Archer of the EY Item Club.

Inflation spiked to a peak of 3.1 per cent in 2017, mainly due to the record slump in sterling in the wake of the 2016 Brexit referendum, which pushed up firms’ import costs.

Lowest since January 2017

Analysts have warned that the pound could plummet again if the UK crashes out of the European Union with no deal in March.

Mark Carney, governor of the Bank of England, warned in November that one of the consequences of a no-deal Brexit will likely be another spike in the cost of living.

Separately, the ONS said that UK house price growth was 2.8 per cent in the year to November, up slightly from the 2.7 per cent rate in October, but well down from the 8 per cent growth rates seen before the Brexit vote.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks