Government loses another £130m on Lloyds Bank bailout after cutting stake below 7%

The loss on the latest round of sales is estimated to be £128m, adding to a £400m loss revealed in November

The Government has now lost around half a billion pounds on Lloyds Banking Group after selling more shares for less than taxpayers paid to save the lender from meltdown.

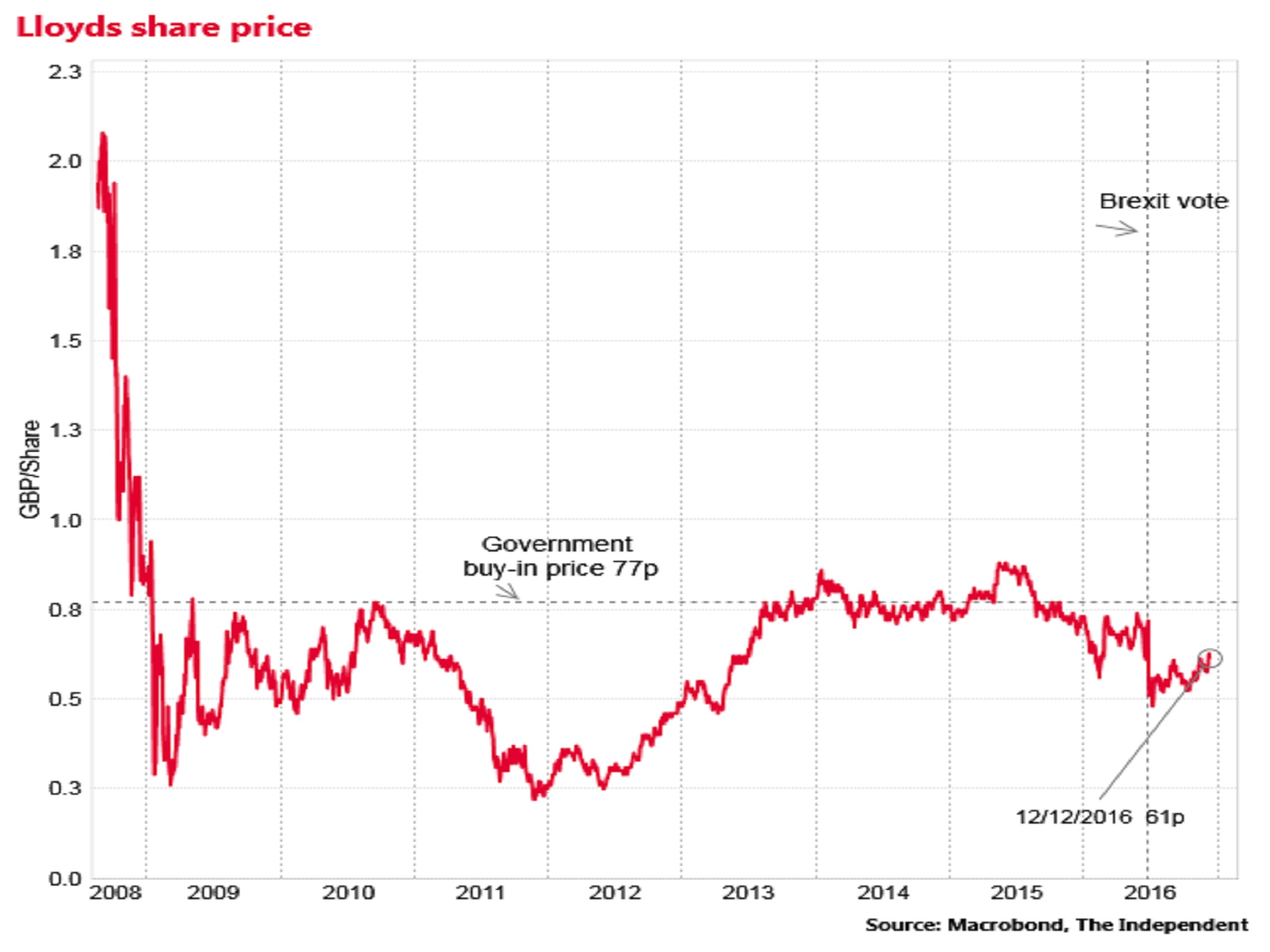

UK Financial Investments (UKFI), which manages the government stake in Lloyds, cut its holding to 6.93 per cent from 7.99 per cent last month. Since then the shares have been trading below 60p, having plummeted in the wake of the Brexit vote. The Chancellor, Philip Hammond, has insisted taxpayer cash will be recouped in full even though shares are trading below the 73.6p average price paid at the time of the rescue.

UKFI would not disclose the exact price achieved in the current round of sales but at a conservative estimate of an average 60p sale price it would mean a loss to the Treasury of £128m. Some politicians and banking analysts have questioned whether restarting sales in the middle of a slump in bank shares represents the best value for taxpayers.

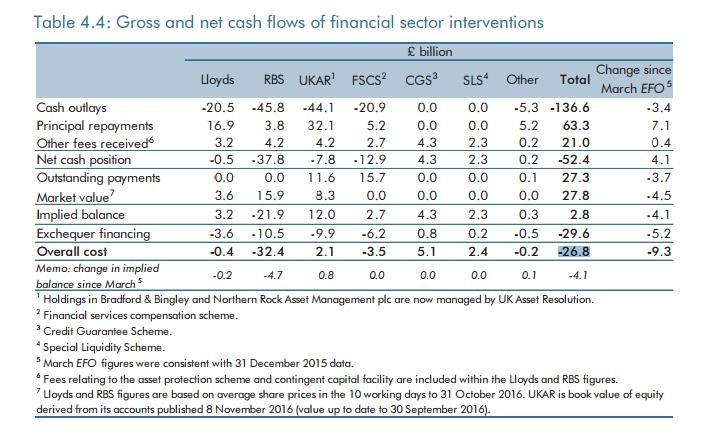

The latest loss adds to around £400m that the Treasury is already down on its Lloyds stake, according to the Office for Budget Responsibility (OBR). However the amount is dwarfed by the £32.4bn deficit on the Government’s RBS shares. In November the OBR said the total cost of the bailout for all banks stood at £26.8bn.

In October Philip Hammond scrapped a pledge to offer Lloyds’ shares to the public at a discount, choosing instead to sell them to large institutional investors with the sale managed by investment bank Morgan Stanley.

The Government has progressively sold down its original 43 per cent stake, but the shares have languished well below their bailout price since June’s Brexit vote.

More than £17.5bn has been returned to Government since the lender’s £20.3bn bailout. However, the true cost of the bailout is higher as this figure does not take into account interest payments on the money the Government borrowed to fund the bailout. Nor does it include the fees paid to Morgan Stanley and others for their services.

Simon Kirby, economic secretary to the Treasury, said: “Selling our shares in Lloyds Banking Group and making sure that we get back all the cash taxpayers injected into it during the financial crisis is a key government priority. So I am pleased that we have continued to reduce our stake in Lloyds.”

A Lloyds spokesman said: “Today’s announcement shows the further progress made in returning Lloyds Banking Group to full private ownership and enabling the taxpayer to get their money back.

“This reflects the hard work undertaken over the last five years to transform the group into a simple, low-risk and customer-focused bank that is committed to helping Britain prosper.”

Lloyds said in October it had set aside another £1bn to meet compensation claims for the mis-selling of payment protection insurance (PPI) as it attempts to draw a line under the scandal.

The Government still retains a 73 per cent stake in Royal Bank of Scotland, which has been hit by ongoing scandals, keeping its share price low and making an imminent disposal unlikely.

In October, leaked internal documents supported allegations that the bank had systematically squeezed its small business owner customers in order to extract profits from them when they were at risk of insolvency. RBS also faces up to $12bn in fines from US regulators over allegations of mis-selling mortgage-backed securities.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments