Housing crisis: London has the second most over-valued homes of any major city around the world

UBS Wealth Managment’s latest ‘Bubble Index’ shows that London is at high risk of forming a housing bubble

London has the second most over-valued property market of any major city around the world and is in “bubble risk territory”, a new report has found.

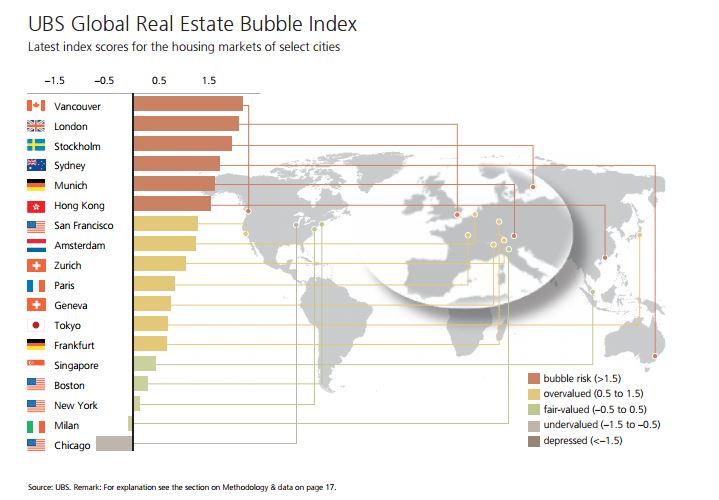

UBS Wealth Management’s “ Bubble index”, released on Tuesday, looks at the state of the property markets in 18 cities and ranks them according to the risk of "bubble" status.

House prices of the cities within the bubble risk zone have increased by almost 50 per cent on average since 2011. In comparison, the average price rise in other financial centres has been less than 15 per cent.

Vancouver has replaced London as the city with the highest bubble index score. London ranked second followed by Stockholm, Sydney, Munich and Hong Kong.

London is also the second-least affordable city in the world after Hong-Kong when taking into account increasing house prices and average earnings, according to the report.

House prices are now 15 per cent higher than during the 2007 market peak, while real incomes are 10 per cent lower.

The report said that “inflated prices” were likely to continue due to an acute housing shortage and easy to access to mortgages.

Claudio Saputelli, UBS Wealth Management, said: “What these cities have in common are excessively low interest rates, which are not consistent with the robust performance of the real economy. When combined with rigid supply and sustained demand from China, this has produced an “ideal” setting for excesses in house price.

The report stated that, with the exception of Milan, low interest rates in the euro zone have pushed all the European cities reviewed into bubble territory.

Matthias Holzhey, real estate economist at UBS Wealth Management, said: “The situation is fragile for the most overvalued housing markets. A sharp increase in supply, higher interest rates or shifts in the international flow of capital could trigger a major price correction at any time.”

Soaring property prices have cut home ownership in England to its lowest level since 1986, according to a recent report by the Resolution Foundation.

Across the UK, home ownership has dropped 6.8 per cent from peak of 70.9 per cent in 2004.

The data shows that the housing crisis has spread beyond London, with regions in the North and the Midlands becoming increasingly unaffordable.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments