Oil price crash looks like sub-prime mortgage crisis, bank warns

In both instances, housing and oil prices were fueled by periods of massive credit expansion,

The oil price crash looks “remarkably similar” to the subprime mortgage crisis, according to analysts at one US Bank.

The price of Brent crude continued to swing on Tuesday, picking up in morning trading only slip towards $30 a barrel again by lunchtime.

The Organisation of Petroleum Exporting Countries said it expected a rebound in 2016 because such low prices couldn’t last forever.

“The market definitely will achieve a new balance because the oil prices nowadays by no means, are sustainable,” Abdullah al-Badri, OPEC secretary general secretary, said.

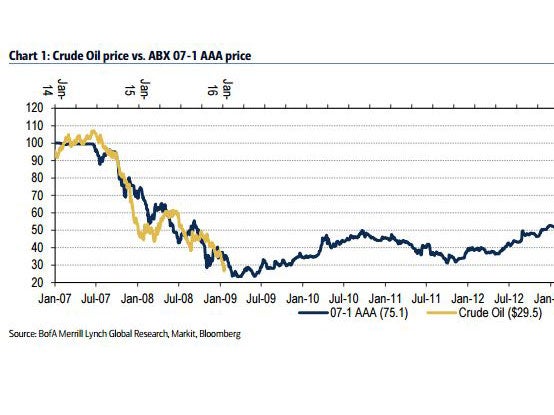

The price of oil (yellow) is tracking the same path as sub-prime mortgages (blue) before they hit rock bottom

But Chris Flanagan, mortgage-backed security strategist at Bank of America Merrill Lynch in New York, said the price of Brent crude could fall by another 25 per cent and may not hit rock bottom until March or April, at around $20 a barrel.

He charted the price of oil from 2014-2016 and noticed similarities to the subprime index in 2007-2009 on ABX, a credit derivatives index that references subprime mortgages and, ultimately, the US housing market.

“We’ve seen this before. Last time it was subprime, this time it’s oil,” he said.

In 2007, sub-prime mortgage lending to people with poor credit histories was blamed for the housing market crash that took the UK into recession and dramatically shrunk the size of the global economy.

In both instances, housing and oil prices were fueled by periods of massive credit expansion.

“It’s probably more than just coincidence that the respective 'bubble' bursting patterns are so similar,” Flanagan said.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments