Paradise Papers: Apple, Nike, Glencore, Everton FC and the other companies exposed in the tax leak so far

Massive leak of over 13 million documents has exposed the sometimes murky dealings of many multinational firms

The massive leak of over 13 million internal documents from leading offshore law firm Appleby and corporate services provider Estera has exposed the sometimes murky dealings of many multinational firms and wealthy individuals. The files were obtained by German newspaper Suddeutsche Zeitung and shared with the International Consortium of Investigative Journalists. Here’s what we know so far about the revelations surrounding large companies in the cache of documents.

Glencore

The world’s biggest commodity trader was one of Appleby’s top clients and the law firm even had a “Glencore Room” at its Bermuda office that kept information on the trader’s 107 offshore companies, according to the ICIJ.

In 2009, Glencore made a $45m (£34m) loan to a company owned by Israeli billionaire and diamond tycoon Dan Gertler. The leaked documents reportedly show that in return for the cash, Mr Gertler was required to secure approvals from the Congolese government.

Glencore owns two huge copper and cobalt mines in DRC. Confidential board minutes, published by the ICIJ, show that Mr Gertler, a notorious middleman in Congo, personally negotiated mining licences in favour of Katanga Mining – a company Glencore was in the process of taking over.

Mr Gertler, a friend of Congolese president Joseph Kabila, has previously been implicated in a scheme to bribe officials in the country on behalf of US hedge fund manager Och-Ziff Capital Management.

“Glencore is described as the biggest company you’ve never heard of - now it’s making headlines precisely because of the tools it uses to cover its tracks,” Daniel Balint-Kurti, head of investigations at Global Witness, said in a statement.

“It must explain to the world why it used a secret offshore company to pump millions of dollars to a controversial friend of the Congolese president linked to bribery scandals. The UK’s Serious Fraud Office must investigate.”

Glencore dismissed allegations of impropriety in relation to the loan to Mr Gertler.

The company said: "In February 2009, Glencore Finance (Bermuda) Ltd made a loan to Lora Enterprises Limited (Lora), an entity affiliated with Mr Gertler, which was effected through a transfer of a participation in the convertible loan facility which Glencore had provided to Katanga."

The commodities giant also carried out a $25bn currency swap in 2013, according to the Guardian. Such deals are legal but have been investigated by Australian tax officials who suspect they have been used to avoid tax.

Everton FC

The BBC’s Panorama investigated whether documents revealed in the leak show that Everton had broken Premier League ownership rules.

Everton’s biggest shareholder, Farhad Moshiri, denied claims made by the programme that he was gifted millions of pounds by Arsenal director Alisher Usmanov which were later used to purchase the Merseyside club in February 2016.

Mr Moshiri insisted his stake in Everton was bought with his own money. He and Mr Usmanov jointly held a 30 per cent stake in Arsenal before Mr Moshiri sold his shares to his business partner in February 2016.

Former FA chairman Greg Dyke told Panorama that a gift “sounds unusual”, adding: “If these papers say what you say they say, I feel sure that the Premier League will want to do their own investigations.”

The Everton deal was administered by Isle of Man company Bridgewaters Limited, which leaked documents suggest was secretly taken over by Mr Usmanov in 2011, the BBC said.

According to Premier League rules, anyone who owns 10 per cent or more of a club, cannot hold any shares in another. To do so could represent a conflict of interest in games between the clubs and in transfer dealings for players.

Everton’s lawyers told the BBC that any allegation Premier League rules had been broken were false.

Facebook and Twitter

Though the social media companies are not directly implicated in offshore activity by what we know about the Paradise Papers so far, the documents have revealed that Kremlin-linked VTB Bank helped fund purchases of large stakes in the company.

Silicon Valley investor and Russian citizen Yuri Milner was given £146m by VTB, part of which was invested in Twitter, the ICIJ reported.

The leaked records also reportedly show that a financial subsidiary of energy company Gazprom, which is also linked to the Russian state, funded an offshore shell company. That entity invested in a Milner-affiliated company that held roughly $1bn in Facebook shares shortly before the social media company floated in the stock market in 2012.

Milner’s company DST Global owned a more than 8 per cent stake in Facebook and 5 per cent stake in Twitter before selling its shares. There is no indication that DST Global helped either Gazprom or VTB Bank gain influence over Facebook or Twitter, but the revelations come as the social media firms face investigations into how Russia used them to influence the 2016 US presidential election.

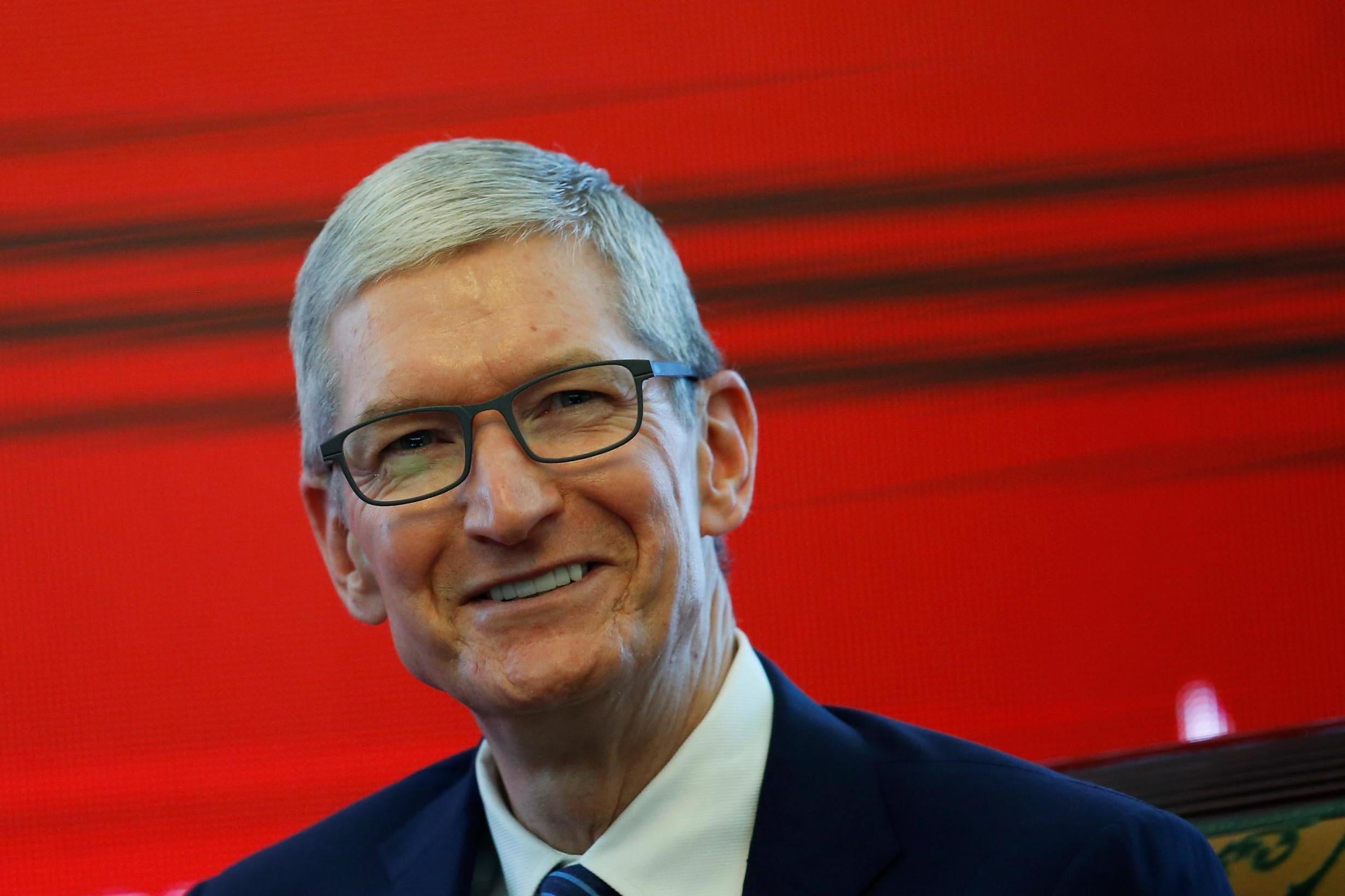

Apple

The ICIJ says the leaked documents expose the tax engineering of more than 100 multinational corporations, including Apple, Nike and Botox-maker Allergan.

Apple chose Jersey as a new haven to continue avoiding billions in taxes after a 2013 crackdown on its controversial tax practices in the Republic of Ireland.

Apple moved the firm holding most of its huge untaxed offshore cash reserve to the Channel Island, allowing it to avoid billions of tax around the world – but has insisted the secretive new structure had not cut its taxes.

In an email obtained by the ICIJ, an Apple lawyer asked Appleby whether moving to one of six tax havens would allow the tech firm’s Irish subsidiary to “conduct management activities ... without being subject to taxation in these jurisdictions.”

The European Commission recently ordered Apple to pay €13bn (£11.5bn) in back taxes over a “sweetheart” deal with the Irish government that allowed it to pay almost no tax on its sales in Europe and some other global markets.

Until 2014, Apple had been exploiting a loophole in tax laws in the US and the Republic of Ireland known as the “double Irish”.

This allowed Apple to funnel all its sales outside of the Americas – currently about 55 per cent of its revenue – through Irish subsidiaries that incurred hardly any tax.

Nike

Nike shifted billions of dollars of profits to a Bermuda subsidiary by holding trademarks for its logo and shoes in offshore entities, the Paradise Papers reveal.

The offshore entity, Nike International Ltd, owned the famous Swoosh design among other trademarks. It then charged royalty fees to its European headquarters in the Netherlands for sales made across Europe.

On paper, billions of dollars flowed back to Bermuda, where Nike has no staff or offices, the ICIJ reported. This arrangement effectively shifted profits from Europe, where they would have been taxed, to Bermuda, where they faced none.

It was allowed to do this legally thanks to a 10-year tax avoidance deal with Dutch authorities.

A Nike spokesperson said: “Nike complies with tax regulations and we rigorously ensure our tax filings are aligned with how we run our business, the investments we make and the jobs we create.”

BrightHouse

The Queen holds a small investment, via a Cayman Islands fund, in the rent-to-own retailer which has been accused of exploiting people with mental health problems and learning disabilities in order to sell its products.

The Duchy of Lancaster, which manages investments for the Queen’s £520m private estate, invested around £10m in Cayman and Bermuda-based funds.

The funds have not previously been disclosed in official Palace accounts. There is no suggestion that they are illegal.

Navigator Holdings

Donald Trump's commerce secretary, Wilbur Ross, has been accused of doing business with Vladimir Putin's son-in-law through an interest in Navigator Holdings.

The shipping firm earns millions of dollars a year transporting oil and gas for Russian energy firm Sibur.

When he joined Mr Trump's cabinet Mr Ross divested his interests in 80 companies.

But kept stakes in a number of companies, including a number in the Cayman Islands that link him to Navigator. One shareholder of Sibur is President Putin's son in law, Kirill Shamalov.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments