Pound sterling value: What happens now Donald Trump has won the US election?

The most significant reality for the pound revealed last night is that, unlike the Japanese Yen and Swiss Franc, it is no longer considered by traders to be one of the world’s major safe haven currencies

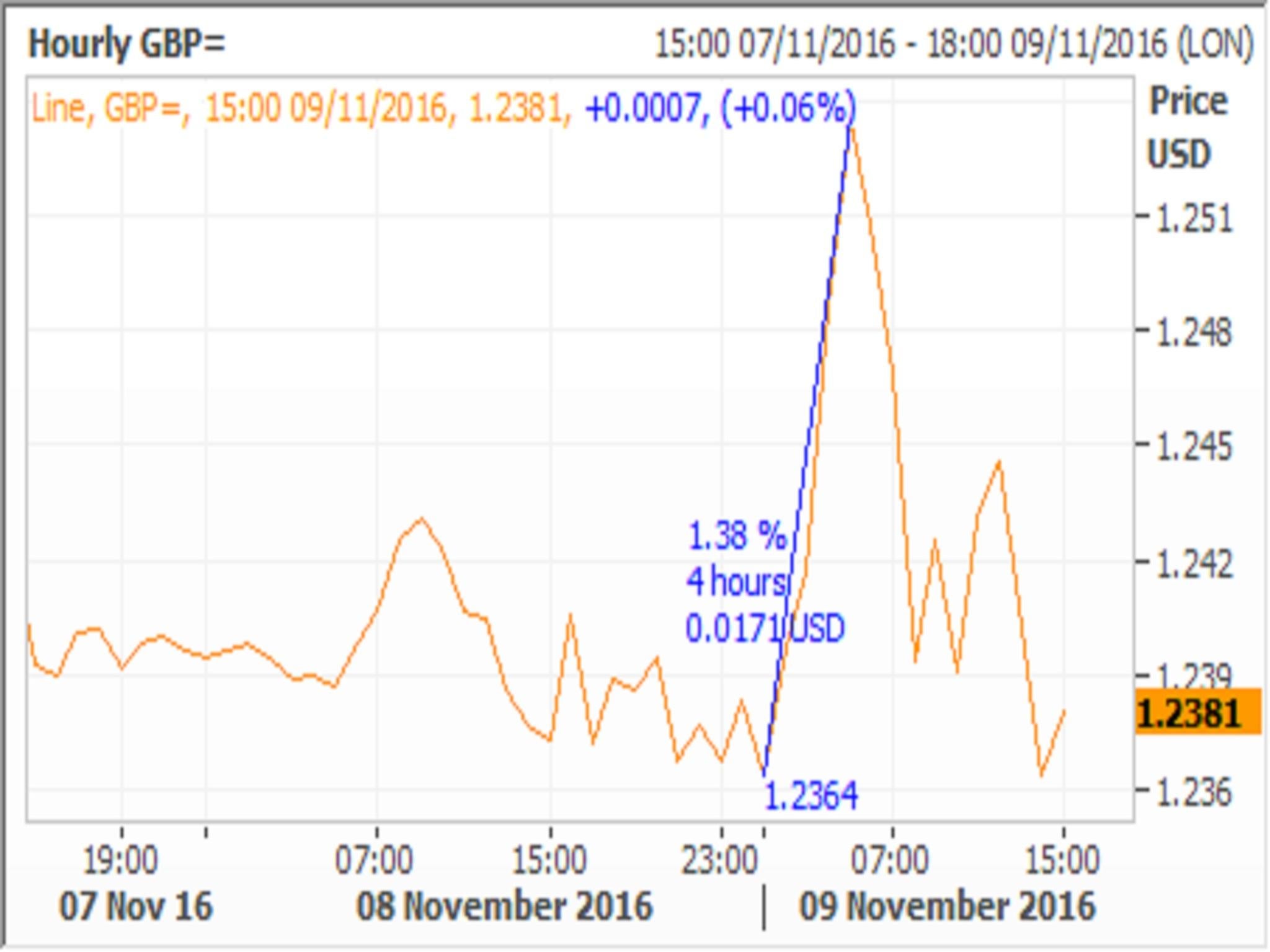

The pound has yo-yoed wildly against the dollar today in the wake of the seismic news that Americans have chosen Donald Trump as their next President.

It shot up as much as 1.7 cents to $1.253 in the morning, but is now trading flat on the day at $1.238.

Up against the dollar

Against the euro sterling has gyrated in the opposite pattern. Against the European single currency sterling fell as low as €1.10, down 1.4 per cent, in the morning before bouncing back to €1.128, above where it began.

Down against the euro

So what is going on? And what might the UK currency head next?

The rise against the dollar this morning was a result of the dollar’s weakness, rather than sterling’s strength.

Traders initially sold the dollar after it became clear Trump was heading to the White House.

The dollar index - which measures the value of the greenback against a basket of currencies - fell almost 2 per cent.

Dollar weakness

But whether Trump is in the White House or not the dollar is seen as a safe haven currency and demand probably kicked in for safe dollar assets from nervous investors.

This is likely why the value of the dollar index bounced back to where it was before the vote began to be counted – and why the dollar’s trading pattern against the pound was the same.

To some extent the sterling versus dollar value going forward will be a “least ugly” contest.

The dire economics of Brexit might well continue to weigh on sterling – which is still down almost 20 per cent against the dollar since the June referendum.

It’s possible there may be more lurches down from the dollar if Trump shoots his mouth off in an undisciplined way about his economic or trade policies while he waits to receive the keys to the White House.

“America is taking a leap into the unknown and the potential for Dollar volatility beckons,” says David Lamb of FEXCO.

But expect that safe haven demand to remain a powerful support - possibly putting a floor under the dollar against sterling.

Another technical factor that might keep the dollar lower and the pound a little stronger is the lower likelihood that the Federal Reserve, America’s central bank, will raise interest rates again in December, which it had previously signalled it would.

Markets are betting that the Fed will now hold off until next year.

Other things equal rising domestic interest rates tend to support a currency's value against its peers - and lower rates do the opposite.

Against the euro, the pound is likely to remain weak – although the European Central Bank will be wary about seeing the single currency rise too sharply because growth and inflation is still very weak on the Continent.

More money printing from the ECB may support sterling’s value against the euro.

Perhaps the most significant reality for the pound revealed last night is that unlike the Japanese Yen and Swiss Franc its value did not go up that significantly when the dollar fell, possibly indicating that in the wake of the Brexit vote it is no longer considered by traders to be one of the world’s major premier safe haven currencies.

Sterling a safe haven no longer...

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments