Bank Fashion administration: Private equity back on trial as retailer's collapse risks 1500 jobs

Bank was sold to a subsidiary of the specialist retail investor Hilco in late November for just £1 by the listed sports clothing retailer JD

Bank Fashion has become the first victim of a brutal Christmas trading war, collapsing into administration less than two months after it was sold to the controversial restructuring firm Hilco Capital.

The failure comes just days after the Christmas Eve collapse of City Link, which was also owned by a financial firm specialising in turning around troubled firms.

Administrator Deloitte was called in to Bank after cut-throat competition on the high street and online hit the chain’s performance, putting 1,555 jobs at risk.

Bank was sold to a subsidiary of the specialist retail investor Hilco in late November for just £1 by the listed sports clothing retailer JD, which remains its priority creditor. It recorded an £8.1m loss last financial year.

Hilco called in its chief restructuring officer, Alan Ganor, who concluded that keeping Bank solvent was not possible, it is understood. Several parties are interested in parts of the business.

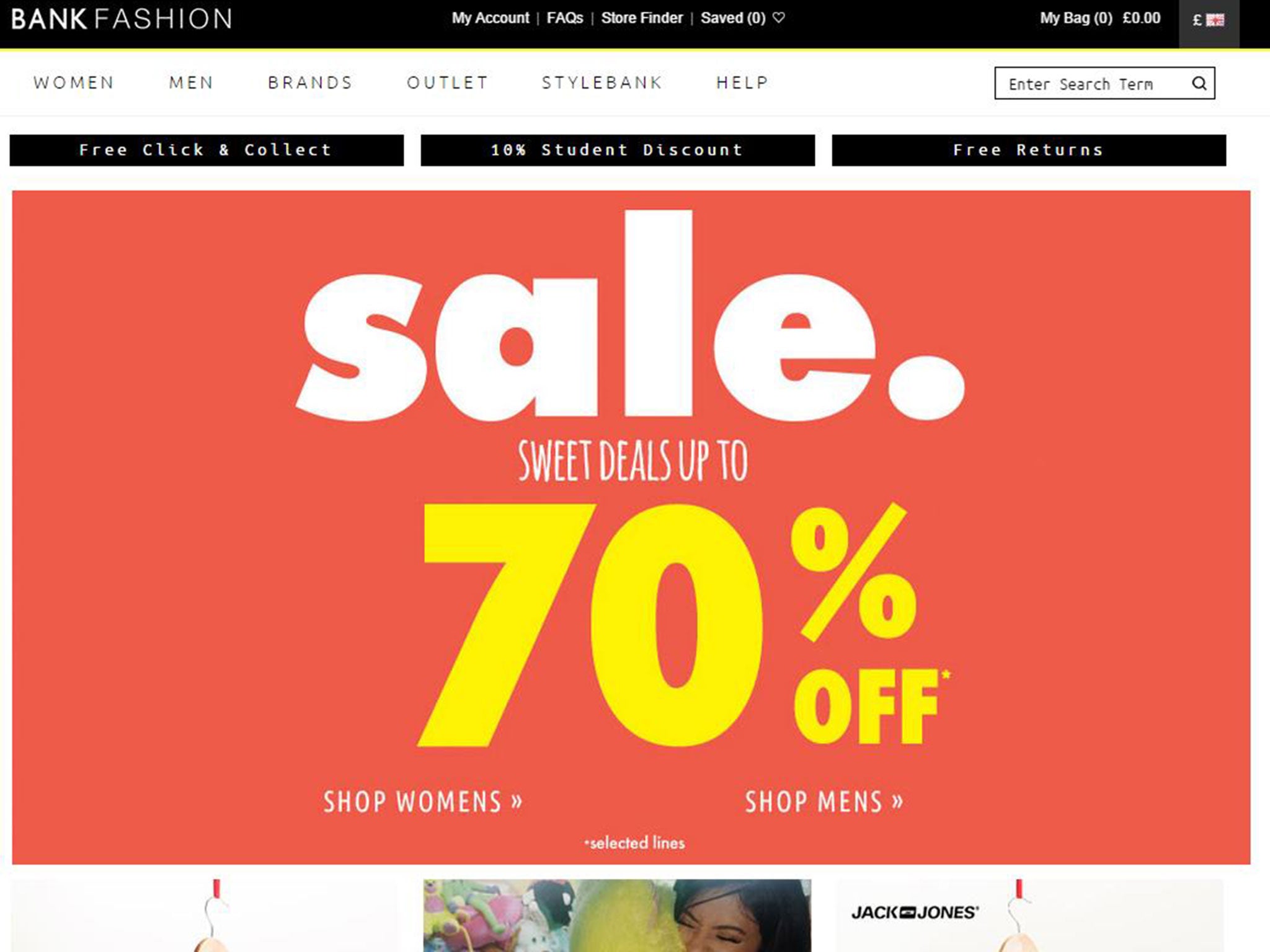

The retailer is based in Bury, Lancashire, and trades from shops primarily across the Midlands, northern England and Scotland. Its 84 stores remain open and sell brands including the fashionable Superdry and Jack & Jones.

Deloitte partner and joint administrator Bill Dawson said: “Bank has struggled in a highly competitive segment of the retail industry and has been loss-making for a number of years.

“A review of the business has determined that a solvent turnaround would not be possible and so its director has sought the appointment of joint administrators.”

Its collapse marks the first retail casualty of 2015 but undoubtedly not the last. Retailers frequently enter administration shortly after Christmas, when the biggest shopping event of the year quickly sorts the high street’s winners and losers.

This year was particularly difficult for struggling retailers thanks to the increased demand for expensive online delivery, in addition to onerous quarterly rent bills falling on Christmas Day.

Hilco’s short tenure over Bank had already caused customer ire, after reports it refused to accept older gift vouchers.

Hilco will be low on the list of creditors eligible for a payout from the administration as it did not buy the secured debt from Bank.

The move will do little to improve the already controversial image of Hilco. It has gained a reputation as an asset stripper in the retail trade following the parts it played in the last throes of firms including Allders, Ethel Austin, MK One and Woolworths – for which it ran a closing down sale. Hilco was part of a consortium which bought Allders’ debt for 26p in the pound before its members received 90p in the pound post-administration despite a black hole in the pension fund.

However, Hilco has returned the entertainment chain HMV to profitability after its administration in 2013 and continues to trade the pottery maker Denby and the 100-store Irish DVD chain Xtra-vision.

JD shares rose on news of the disposal in November after it said the move “should result in a substantial recovery of its intercompany loan”.

JD executive chairman Peter Cowgill said it would attempt to retain a broad range of fashion brands.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments