Richard Desmond wins ‘£10m’ from City giants over derivatives deal

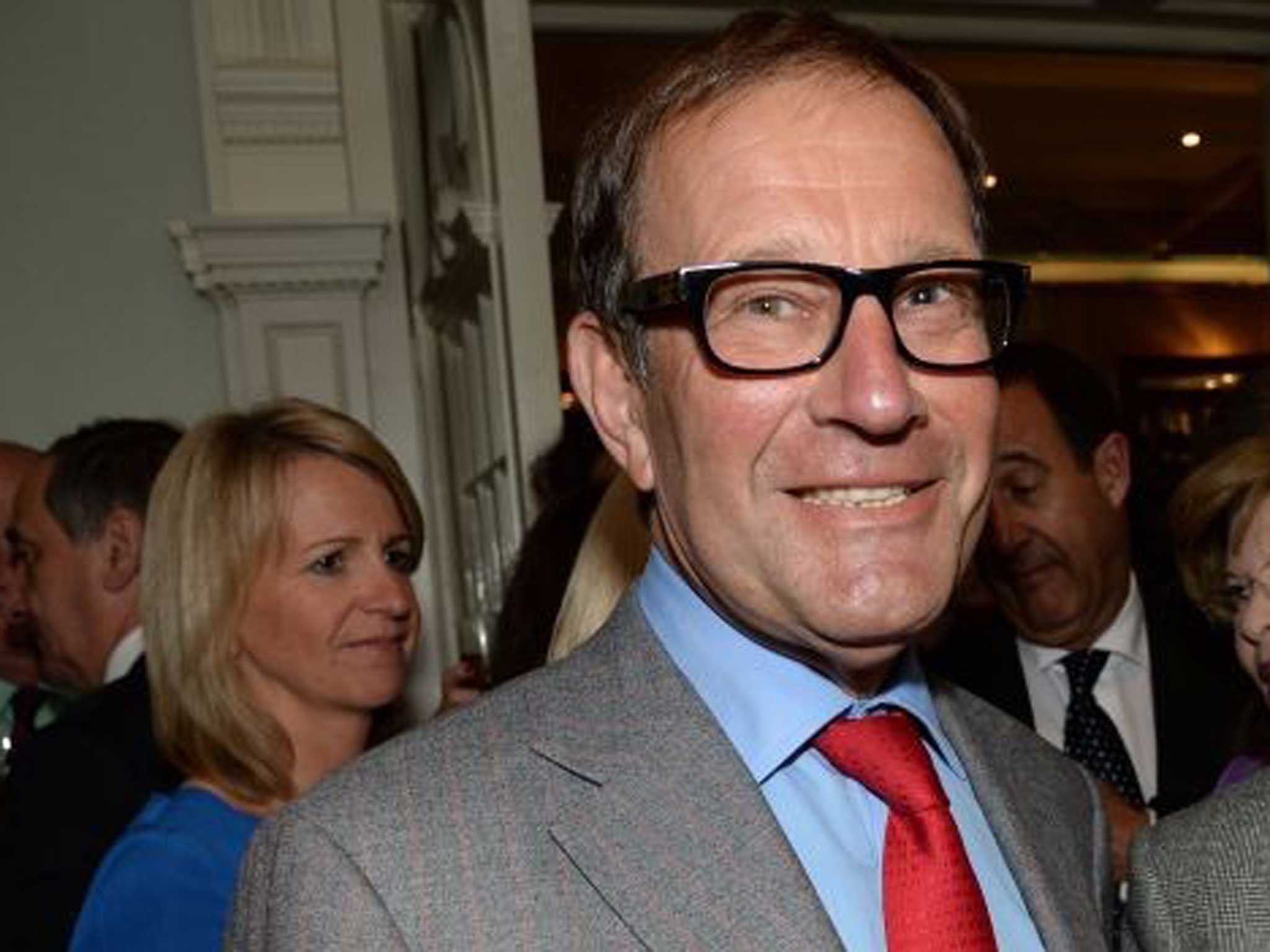

Richard Desmond has underlined his reputation as a formidable litigant by winning a multi-million pound settlement from City giants Credit Suisse and GLG in a £42m court case over what he claimed was an “incomprehensible” financial investment.

The Daily Express and OK! magazine owner is understood to have won a significant sum – thought to be more than £10m – in a joint settlement with the Swiss bank and the GLG hedge fund group.

Mr Desmond, who once told the boss of another hedge fund that he would be the “worst fucking enemy you’ll ever have” during a dispute over a different investment, had been due to take Credit Suisse and GLG to court in a trial in January.

He and trustees of his pension scheme had sued the two firms over a derivative swap he bought in 2007 and terminated early in 2008 in the wake of the global financial crisis.

His lawyers claimed the swap was “incomprehensible except to an expert” and GLG didn’t inform him of the risk of “unpredicted, unpredictable or unmanageable losses”, according to papers filed ahead of the court case.

Mr Desmond was claiming even more than £42m as he also asked for “interests and costs”, which could have taken his payout close to £70m. He began by suing Credit Suisse and then widened his claim against GLG a year later.

Man Group, which bought GLG in 2010, said in a stock market filing in June that it regarded his allegations as “unsubstantiated” and promised it would be “vigorously defending them”. Credit Suisse also denied any wrongdoing.

Sources close to GLG had insisted it wasn’t directly involved as the media mogul bought the £50m product from Credit Suisse, rather than the hedge fund.

It added that it was Credit Suisse which invested in a GLG portfolio of hedge funds. GLG maintained it was not a counter-party to Mr Desmond and had no obligation to advise him on the investment.

GLG also argued that Mr Desmond, who is estimated to be worth £1.2bn by the Sunday Times Rich List, is a “sophisticated investor with significant prior experience of investing in hedge funds and structured products”.

Mr Desmond, Credit Suisse and Man Group all declined to comment on the case or the settlement. The media mogul is known for taking a robust approach over his finances.

He clashed with another hedge fund, Pentagon Capital, in 2008 over an investment worth £75,000 that his son, Robert, had made five years earlier. Mr Desmond was recorded telling Pentagon Capital’s managing director, Jafar Omid, that he wanted to cash in his investment and was frustrated that he could not get back his money more quickly.

“It doesn’t matter if it was £75,000 or £75m, it’s on my mind all the time,” Mr Desmond told Mr Omid. “As good as a friend I am, I am the worst f***ing enemy you’ll ever have.” The recording emerged when writer Tom Bower was defending himself against Mr Desmond, who sued for libel in court in 2009 over claims in his biography of Conrad Black.

Mr Desmond lost the court case against Mr Bower. The author has written an unauthorised biography of Mr Desmond that has never been published.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments