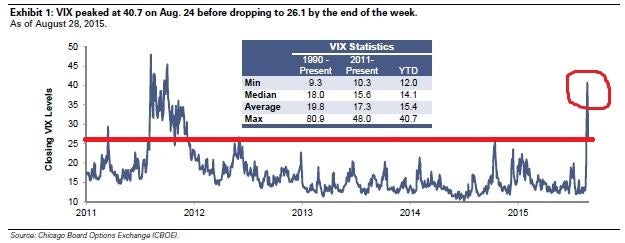

The one chart that shows stock markets only ever move this fast when there's about to be a recession

A Goldman Sachs analyst spotted that the VIX index is at recession levels

A Goldman Sachs analyst has spotted that the VIX index, which is used to see how fast US stock market prices are changing, is at a level it only usually hits when the US is in recession.

Krag Gregory, a Goldman analyst with four maths degrees who has been called 'the oracle of VIX', said: "While extreme VIX levels periodically occur, our analysis shows that VIX levels in the high- twenties to low-thirties for extended periods of time are rare outside of recessions."

The stock market is in trouble when the VIX goes above the red line

Volatility in the stock market is not the only signal used to tell if the US is in recession, as first noted by Business Insider. But it does show that traders are nervous about something and trading more often. If all those traders got nervous enough to trade in the same direction at the same time, the stock market could plummet.

In fact, Gregory thinks the US is not at risk of recession, and the VIX will actually move lower.

VIX levels only go back to January 1990, but Gregory notes that it has only ever traded in the high twenties or early thirties during a recession. Average VIX levels in the first two recessions (1990-1991, 2001) were 25 and 26 respectively. The worst was the Great Financial Crisis in 2008 and 2009, when average VIX levels were 34.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks