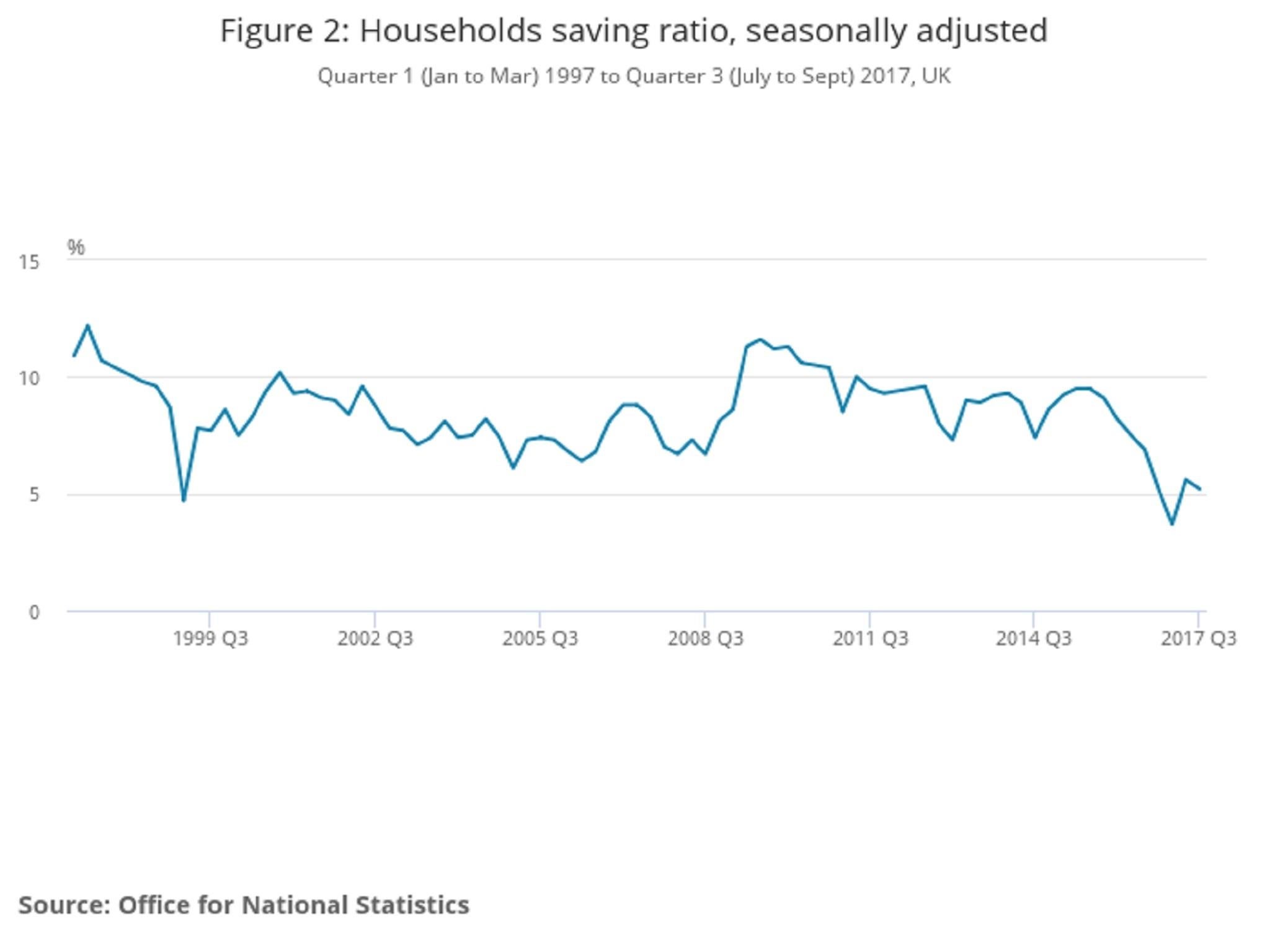

UK household savings contract as incomes fall short of spending

The aggregate UK household savings ratio fell from 5.6 per cent to 5.2 per cent, the second lowest level in 20 years

UK households spent more than their incomes in the third quarter of 2017, resulting in another fall in the saving ratio – and reinforcing doubts about the sustainability of the economy’s trajectory.

In its quarterly national accounts, the Office for National Statistics (ONS) reported that real household disposable income rose by only 0.2 per cent in the three months, while household spending picked up to 0.5 per cent.

This resulted in a fall in the aggregate UK household saving ratio from 5.6 per cent to 5.2 per cent – the second lowest level in 20 years.

The ONS also said that the household sector, after accounting for its investment, has been a net borrower for four successive quarters, the longest run since records began in 1987.

The overall economy grew by 0.4 per cent in the quarter, unrevised from previous estimates and up from 0.3 per cent in the three months to June.

Three-quarters of this GDP growth was delivered by household spending, while business investment, which expanded by 0.5 per cent, provided the rest.

Net trade made no contribution to the overall expansion in output, as increasing exports were cancelled out by a higher number of imports.

“The deterioration in consumers’ confidence in the second half of this year suggests that households won’t continue to throw caution to the wind,” said Samuel Tombs of Pantheon.

“With consumers set to struggle with a further fall in real wages, more austerity measures and rising borrowing costs, growth in household spending must slow over the coming quarters.”

Full-year GDP growth for 2017 is forecast by the Office for Budget Responsibility to come in at 1.5 per cent, which would be the worst annual performance for the UK economy since 2012.

Second lowest in 20 years

Higher inflation this year, stemming from the slump in the pound since the Brexit vote, has damaged real household incomes – and spending has been propped up by households running down their savings and increasing borrowing on credit cards and other personal loans.

Many economists expect no UK GDP growth pick-up in 2018, despite robust global growth.

“Growth should be helped by the squeeze on consumers easing as the year progresses. However, economic activity is likely to be hampered during much of the year by still significant Brexit uncertainties which will likely limit investment in particular,” said Howard Archer of the EY Item Club.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments