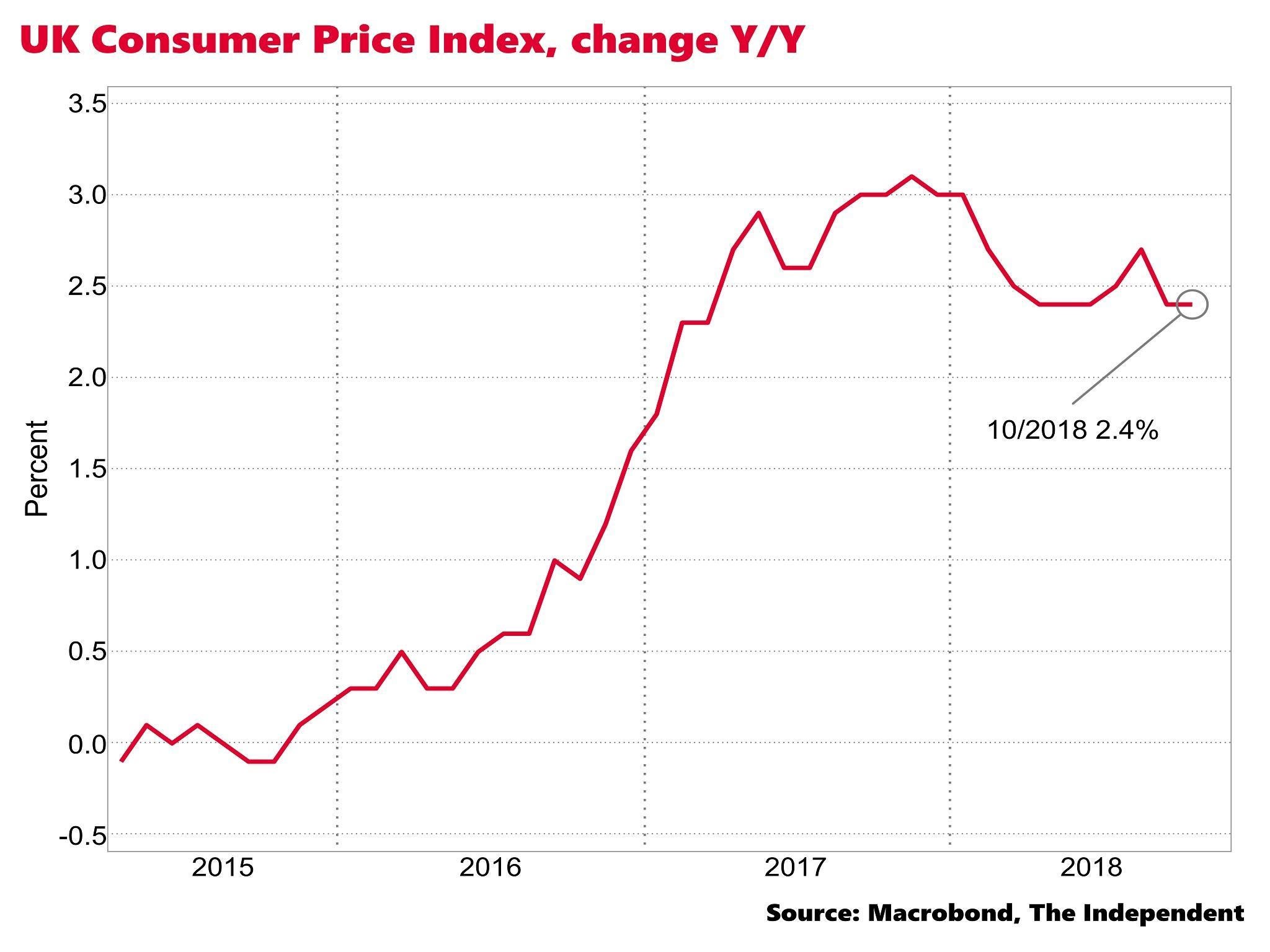

Inflation in October was stuck at 2.4 per cent in October, despite expectations that it would rise, official data showed on Wednesday.

City of London analysts had expected the rate to tick up to 2.5 per cent.

The Office for National Statistics (ONS) reported there were declines in food and clothing prices in the month, but that these were offset by rises in domestic fuel costs.

Core inflation, which strips out volatile energy and food prices, was also steady at 1.9 per cent.

The Bank of England signalled earlier this month that it is likely to raise interest rates again next year to curb inflationary pressure, and could accelerate the pace of hikes in the cost of borrowing if Brexit is smooth.

Steady on the month

UK inflation spiked in 2017, peaking above 3 per cent, mainly due to the slump in sterling in the wake of the 2016 Brexit vote, which pushed up import costs.

The Bank currently expects the rate to drift down to its 2 per cent target next year, before stronger wage growth pushes up costs throughout the economy.

“Much depends on Brexit,” said Ruth Gregory of Capital Economics.

“In the event of a no-deal Brexit, we would not be surprised if inflation were to surpass 3 per cent once more and remain persistently above the 2 per cent target over the next years. But if a no-deal Brexit is avoided, a further fall back in inflation and a rise in nominal wage growth should spur a sustained consumer recovery next year.”

“We still think that CPI inflation will return to the 2 per cent target in the first quarter and will average just 1.8 per cent in 2019,” said Samuel Tombs of Pantheon.

“Below-target inflation won’t rule out rate hikes but it will ensure that the [Bank of England] can calibrate the pace of tightening according to the strength of the economy.”

Separately, the ONS reported on Wednesday that annual factory gate prices rose 3.3 per cent in the month, up from 3.1 per cent in September and coming in ahead of City estimates.

The statistics body estimated that average UK house price growth picked up to 3.5 per cent year on year in September, up from 3.1 per cent in August.

Prices fell 0.3 per cent in London over the period.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments