Warrington starts its own bank in bid to beat austerity

The town hopes to use taxpayer money to generate market-beating returns while channelling credit into the economy

You smell Warrington before you see it – thanks to the huge Unilever plant that cranks out scented laundry detergent by the ton. And if you blink, you may not even see it at all.

But there’s a reason to pay attention. This commuter town midway between Liverpool and Manchester is conducting an experiment in banking that may provide a post-Brexit road map for cities struggling with twin declines in lending to small businesses and funding from the national government.

Elected officials in Warrington, a Labour stronghold, decided to put partisanship aside and invest in a start-up bank spearheaded by a major Conservative donor, David Rowland, and backed by two of America’s most successful financiers, TPG’s David Bonderman and Falcon Edge’s Rick Gerson. The hope is to use taxpayer money to generate market-beating returns while channelling credit into the economy. Critics of the plan say the town’s council is acting beyond its financial competency and creating possible conflicts of interest.

“This does probably look a bit off the wall,” said Russ Bowden, the councillor overseeing Warrington’s £30m ($39m) purchase of a third of Redwood Bank, which received its licence in April and plans to start operating in July. “But a good deal is a good deal, regardless of politics.”

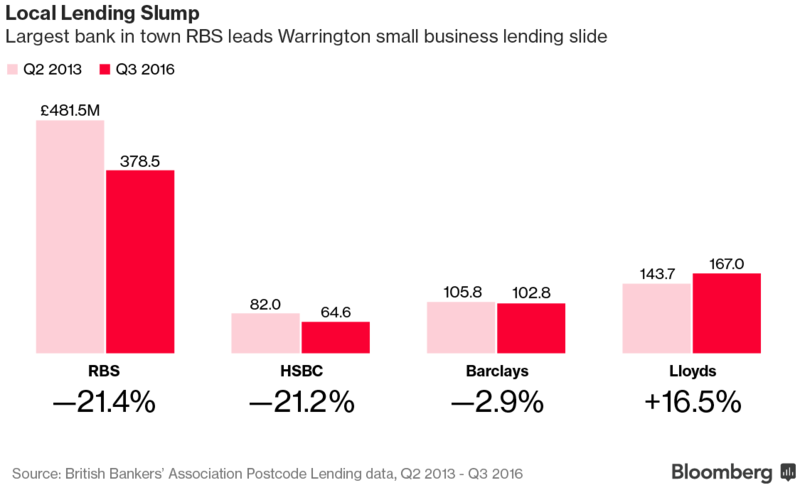

Mr Bowden, a nuclear physicist by day, said the big banks “quite clearly have less appetite for small-business lending,” even though the man his council chose as mayor last year is a senior loan adviser at NatWest, the Royal Bank of Scotland unit that dominates the regional market. The first Muslim to hold that ceremonial post, Faisal Rashid, cut his one-year term short to run on the Labour ticket in parliamentary elections on 8 June. He declined to comment.

Revenue Hunt

Cities across Britain are rushing to plug budget holes created by yearly cuts in outlays from the central government, turning many into property speculators to try to maintain spending on retirement homes, trash collection and other services. Councils – including Warrington’s – have invested billions of pounds in commercial real estate and residential developments that are often fully financed via a treasury programme that offers cheap rates for up to 45 years, prompting warnings of a credit bubble from several lawmakers in London.

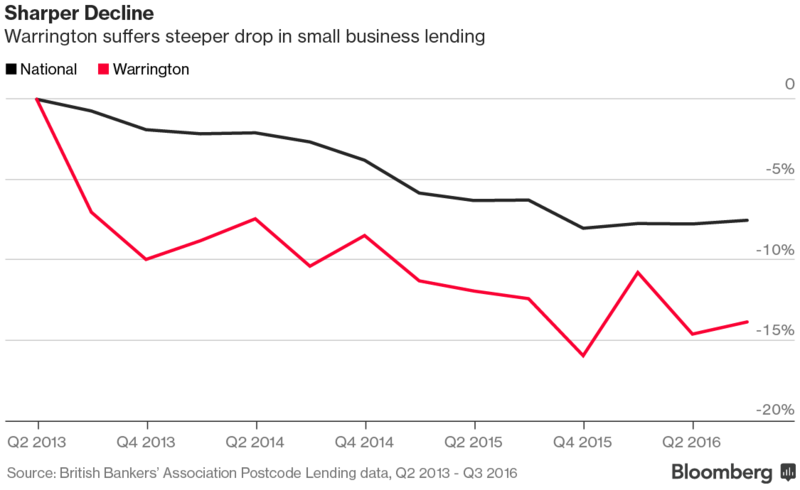

And while some councils like Manchester’s are setting aside money to lend directly to businesses, Warrington appears to be the first to try its hand at banking since Birmingham gave it a shot a century ago. This old Roman crossing on the Mersey River, which is campaigning to be the UK’s City of Culture for 2021, emerged from the deepest recession since World War II better than most, yet commercial lending here has fallen more than the national average, by as much as 15 per cent in the past three years, industry data shows.

Warrington is also one of seven UK municipalities with an investment-grade rating, which it got before selling £150m of 40-year bonds two years ago to help pay for a billion-pound capital-spending programme. Most of those outlays, including funds to redevelop the run-down central district, will be paid for with long-term credits via the treasury programme.

‘Being Suckered’

There are already warnings among the town’s 208,000 residents against doing business with such seasoned investors as Mr Rowland, a property tycoon and former tax exile, and his son Jonathan. The younger Rowland started Luxembourg-based Banque Havilland with assets acquired during the collapse of Kaupthing, one of the lenders in Iceland’s epic financial meltdown that tied up more than £1bn of local British government deposits for years.

“They’re in danger of being suckered by smart, savvy commercial actors with a lot more experience than a council,” said Joel Benjamin, a left-wing activist who blogs about municipal finances.

Les Styles, an accountant who owns his own practice in Warrington, said he’s more concerned about the whole concept of the council getting into banking.

“How can they somehow believe they can provide better service and make a profit compared to established banks?” Mr Styles said. “It seems reckless.”

‘Unique Opportunity’

These critics point out that while Redwood will have a branch in Warrington, the bank will be based about 200 miles south in Letchworth, the town in the London commuter belt where chief executive officer Gary Wilkinson lives. Nor will the council have a seat on the lender’s board because it said it does not have anyone competent enough and opted to save the cost of hiring a financial expert to represent its interests.

The town is counting on Bank of England Governor Mark Carney’s reforms to ensure it’s making a safe bet. Its 10-member executive committee decided to trust the regulator’s licencing process, which included vetting the Rowlands and the new lender’s other “clearly competent” owners, according to Mr Bowden.

Johnathan Rowland said investing in Redwood offers the council a chance to help stimulate the local economy while making a profit in the process.

“They’ve been with us all the way,” Mr Rowland said. “They get to benefit from the the unique opportunity of being able to start a bank in this day and age.”

Budget Gamble

Warrington’s commitment is equal to about a quarter of its annual budget and almost two-thirds of the projected deficit by 2020 if cuts are not made or new sources of income found. The investment is staggered over three years and contingent on performance. Auditing giant KPMG and law firm Addleshaw Goddard were hired as advisers.

Christopher Bovis, a professor of business law who studies municipal funding at the University of Hull, said the government in London does not set any rules on what local authorities can invest in, which he called the “elephant in the room” at times like this, when councils are on a spending spree.

“They once put their surpluses into Icelandic banks,” he said. “God forbid something like that happens again. The whole thing will go up in flames.”

Beyond that, local authorities simply don’t have the expertise needed to properly manage such a relatively large exposure to a single organisation, particularly one that’s focused on lending to small enterprises, which have a “pretty high” rate of failure, according to Ewen Fleming, head of financial services at the accountancy firm Grant Thornton in London.

Brexit Risk

“It’s highly risky,” Mr Fleming said. “It might be fine just now in the current economic phase, but no one knows quite what’s going to happen with Brexit.”

Even before Britons voted to leave the European Union last year, cities started expressing interest in investing in start-up banks to help offset a “retrenchment” by the major lenders, according to Mr Wilkinson, the Redwood CEO who was contacted by Warrington officials after his earlier success turning around a regional lender with the help of a local pension fund.

“There’s multiparty support for more competition in banking, strong cross-party support for regional banks,” Mr Wilkinson said by phone from Letchworth.

Since January 2016, when the Bank of England created its New Bank Start-Up Unit to ease the registration process, 11 lenders have received licences and 25 more are in the pipeline, according to the regulator.

‘Making Money’

Mr Wilkinson, 56, has had success in novel situations before. In 2010, the board of Pensions Bank, a small lender then controlled by Vladimir Antonov, former owner of Portsmouth football club, hired him to find new investors after the Russian magnate and a partner were indicted in Lithuania for allegedly stealing €490m ($550m) from Bankas Snoras, bankrupting the Baltic country’s third-largest lender.

He found buyers in Cambridge University’s Trinity Hall and a local pension fund who renamed what was left of the company Cambridge & Counties Bank. Since 2014, CCB’s loan book has more than doubled to £588m while pre-tax profit has jumped sevenfold to £18.1m.

Those are the kind of numbers that Mr Bowden, Warrington’s comptroller, is counting on Redwood achieving to quiet his project’s doubters.

“Hopefully, I’m doing a good service to the people of Warrington by finding ways to make money,” he said. “Nobody gets elected to cut services.”

Bloomberg

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments